Do Nonprofits Generate Revenue? Can They Profit?

Nonprofit organizations, by their very nature, operate under a unique financial model. While often perceived as entities solely reliant on donations and grants, the reality is more nuanced. The question of whether nonprofits generate revenue and, more controversially, whether they can profit, deserves a thorough exploration.

The primary goal of a nonprofit is to fulfill its mission – whether it's alleviating poverty, promoting education, supporting the arts, or advocating for environmental protection. To achieve this mission, nonprofits require financial resources. While donations and grants are crucial, they often constitute only part of the funding equation. A significant portion of a nonprofit's income can be generated through various revenue-generating activities.

One common source of revenue for nonprofits is earned income. This encompasses income derived from the sale of goods or services directly related to the organization's mission. For example, a museum might generate revenue through ticket sales, a bookstore selling related merchandise, or educational programs offered to the public. Similarly, a social enterprise nonprofit focused on job training might generate revenue by operating a cafe or retail store that employs and trains individuals. An environmental conservation nonprofit might charge fees for guided tours or workshops on sustainable living. The key here is that the activity must align with and further the organization's core mission.

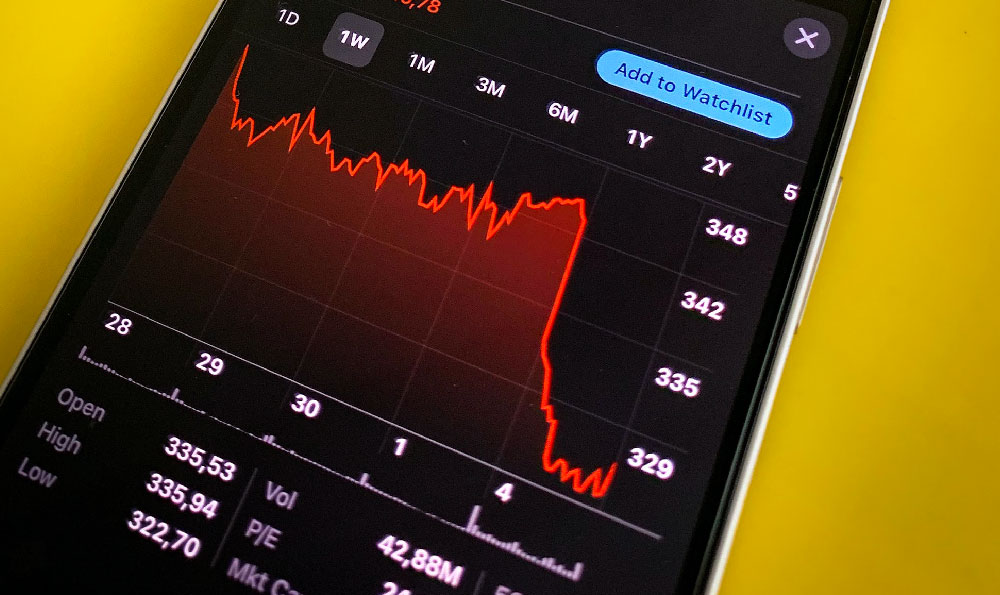

Beyond earned income, nonprofits can also generate revenue through investment income. Many nonprofits maintain endowments or reserve funds, which are invested to generate returns. These returns, in the form of dividends, interest, and capital gains, can provide a significant source of revenue to support the organization's operations. However, nonprofits must carefully manage their investments, balancing the need for generating returns with the ethical considerations of their mission. Investing in companies whose practices conflict with the organization's values, for instance, would be a significant misstep.

Another avenue for revenue generation involves sponsorships and partnerships. Nonprofits can partner with corporations or other organizations to receive financial support in exchange for promoting the sponsor's brand or values. This can take the form of event sponsorships, corporate social responsibility initiatives, or cause-related marketing campaigns. However, nonprofits must carefully vet potential sponsors to ensure that their values align and that the partnership doesn't compromise the organization's integrity or mission.

The concept of "profit" within the context of nonprofits is where things get more complicated. While nonprofits are not designed to distribute profits to shareholders or owners (as for-profit businesses do), they are certainly allowed, and often encouraged, to generate a surplus of revenue over expenses. This surplus, often referred to as "net revenue" or "retained earnings," is not distributed as profit but rather reinvested back into the organization to further its mission.

The ability to generate a surplus is crucial for the long-term sustainability and effectiveness of a nonprofit. A healthy surplus allows the organization to build reserves for unforeseen expenses, expand its programs and services, invest in infrastructure and technology, and attract and retain talented staff. It also provides a cushion against economic downturns or fluctuations in funding sources.

However, the perception of "profit" can be a sensitive issue for nonprofits. Potential donors and grantmakers may be wary of contributing to an organization that appears to be accumulating excessive wealth. Therefore, nonprofits must be transparent about their financial performance and clearly articulate how any surplus is being used to further their mission. They need to demonstrate that they are operating efficiently and effectively, and that any revenue generated is being directed towards achieving their goals, not enriching individuals or building unnecessary reserves.

It's also important to note that there are legal and regulatory constraints on how nonprofits can use their funds. Nonprofit organizations are typically exempt from certain taxes, such as income tax, but they must adhere to specific rules and regulations to maintain their tax-exempt status. These regulations often restrict the use of funds for purposes other than the organization's mission and prohibit private benefit, meaning that the organization's assets cannot be used to enrich individuals or for purposes unrelated to its mission.

Navigating the financial landscape of a nonprofit requires a delicate balance. Organizations must be innovative and resourceful in generating revenue while remaining true to their mission and adhering to ethical principles. They must be transparent and accountable in their financial management, ensuring that all revenue is used effectively and efficiently to achieve their goals. The ability to generate a surplus is not inherently problematic; in fact, it is often essential for the long-term sustainability and impact of a nonprofit. The key is to manage that surplus responsibly and transparently, ensuring that it is used to further the organization's mission and benefit the community it serves. Furthermore, investing in financial literacy programs for staff and board members can greatly enhance a nonprofit’s ability to make sound financial decisions and ensure long-term financial health. By embracing a strategic approach to revenue generation and financial management, nonprofits can maximize their impact and make a lasting difference in the world.