AI Money Makers: What are the methods, and how do you get started?

The allure of AI in finance is undeniable, promising to revolutionize how we invest, manage, and grow our wealth. The term "AI Money Makers" encapsulates this exciting potential, suggesting a future where artificial intelligence tools actively participate in wealth creation. However, navigating this landscape requires understanding the diverse methods employed and a strategic approach to getting started.

At its core, AI in finance leverages sophisticated algorithms to analyze vast datasets, identify patterns, and make predictions. These algorithms, powered by machine learning and natural language processing, can process information far beyond human capabilities, uncovering opportunities that would otherwise remain hidden.

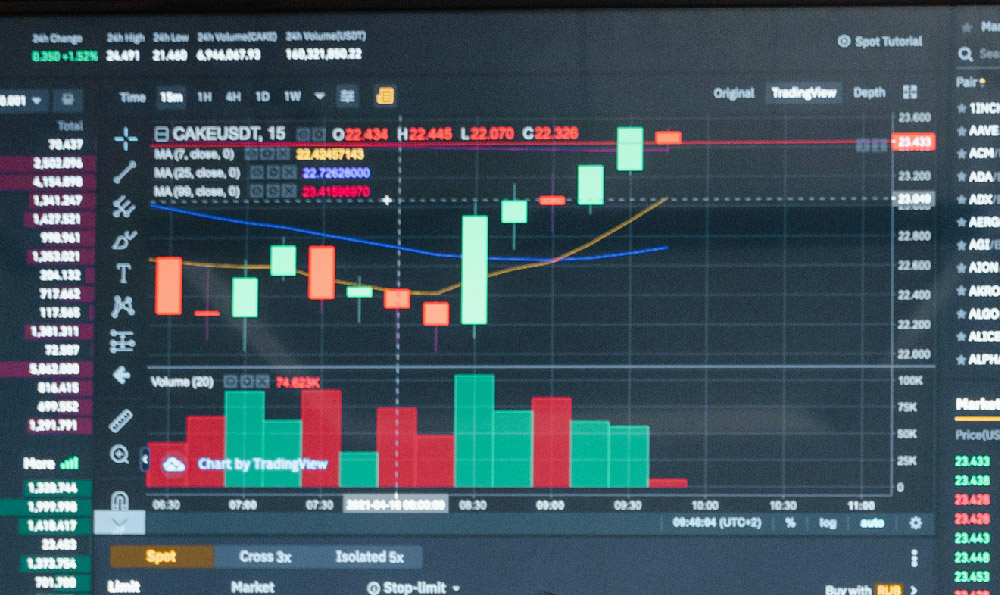

One prominent method is algorithmic trading. AI algorithms are programmed to execute trades based on pre-defined rules and parameters, reacting to market fluctuations with speed and precision. These algorithms can analyze market data, news sentiment, and economic indicators to identify profitable trading opportunities. High-frequency trading (HFT), a subset of algorithmic trading, uses AI to exploit minuscule price differences across exchanges, generating profits from tiny margins. While HFT is often associated with large institutions, advancements in technology are making algorithmic trading more accessible to individual investors through platforms that offer pre-built or customizable trading bots.

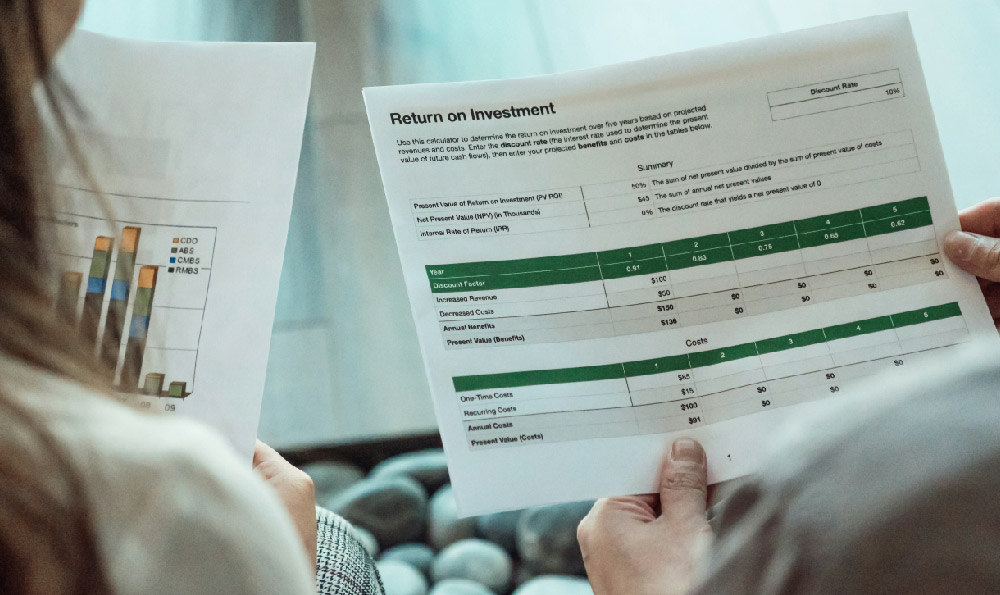

Another significant area is robo-advisory. Robo-advisors use AI to build and manage investment portfolios based on an individual's risk tolerance, financial goals, and investment horizon. These platforms typically employ a questionnaire to assess the client's needs and then recommend a diversified portfolio of exchange-traded funds (ETFs) or other investment vehicles. Robo-advisors offer a low-cost alternative to traditional financial advisors, making professional investment management accessible to a wider audience. The AI constantly monitors the portfolio's performance and automatically rebalances it to maintain the desired asset allocation. The key advantage here is the removal of emotional bias in investment decisions, relying instead on data-driven analysis.

Beyond trading and portfolio management, AI is also being used for fraud detection. Financial institutions are deploying AI-powered systems to analyze transaction data and identify suspicious patterns that may indicate fraudulent activity. These systems can learn from past fraud cases and adapt to new fraud schemes, providing a more robust defense against financial crimes. Similarly, AI assists in credit risk assessment by analyzing borrower data to predict the likelihood of default, enabling lenders to make more informed lending decisions. This process involves examining credit history, income, employment status, and other relevant factors to generate a risk score.

The use of AI in sentiment analysis is also gaining traction. AI algorithms can analyze news articles, social media posts, and other textual data to gauge market sentiment towards specific companies or industries. This information can then be used to inform investment decisions. For example, if an AI system detects a surge of negative sentiment towards a particular stock, an investor may choose to reduce their exposure to that stock.

So, how does one get started with AI-powered investing? The first step is self-education. Understanding the basics of AI, machine learning, and financial markets is crucial. Numerous online courses, books, and articles provide introductory material on these topics. Familiarizing yourself with different AI-powered investment tools and platforms is also essential. Research robo-advisors, algorithmic trading platforms, and other AI-driven investment solutions to determine which best suits your needs and risk tolerance.

Next, assess your risk tolerance and investment goals. Before investing in any AI-powered system, it's vital to understand your risk tolerance and determine your investment goals. Are you looking for long-term growth, income, or a combination of both? This will help you choose the appropriate AI-powered investment strategy. Robo-advisors typically offer various portfolio options based on different risk profiles, ranging from conservative to aggressive. Algorithmic trading platforms allow you to customize your trading strategies, but it's essential to understand the risks involved.

Start small and test the waters. Begin with a small investment and gradually increase your exposure as you gain experience and confidence. This allows you to learn how the AI-powered system works and assess its performance without risking a significant amount of capital. Backtesting is an important step. Many algorithmic trading platforms allow you to backtest your trading strategies using historical data. This helps you evaluate the potential profitability and risk of your strategy before deploying it in live markets.

Diversification remains key, even with AI. Don't put all your eggs in one basket. Diversify your investments across different asset classes, industries, and geographic regions. This can help mitigate risk and improve your overall portfolio performance. Even if you're using AI to manage a portion of your portfolio, it's still essential to maintain a diversified investment strategy.

Monitor your investments and re-evaluate your strategy regularly. AI-powered systems are not foolproof and require ongoing monitoring. Keep track of your portfolio's performance and re-evaluate your investment strategy periodically to ensure it still aligns with your goals and risk tolerance. Market conditions can change, and your AI-powered system may need to be adjusted accordingly.

Be aware of the limitations and risks. While AI offers significant advantages, it's important to recognize its limitations and potential risks. AI algorithms are only as good as the data they are trained on, and they can be susceptible to biases and errors. Market conditions can also change unpredictably, and even the most sophisticated AI algorithms can make mistakes. Furthermore, regulatory oversight of AI in finance is still evolving, and there is a risk that new regulations could impact the performance of AI-powered investment systems.

Consider the cost. While some AI-powered investment tools are relatively inexpensive, others can be quite costly. Robo-advisors typically charge a small percentage of assets under management, while algorithmic trading platforms may charge fees for access to data and trading tools. Carefully consider the costs associated with each AI-powered investment tool before making a decision.

Finally, remember that AI is a tool, not a magic bullet. While AI can enhance your investment process, it's not a guaranteed path to wealth. It's important to use AI wisely and in conjunction with your own knowledge and judgment. Successful investing requires a combination of human expertise and technological innovation. Embrace the opportunities offered by AI, but always approach it with a healthy dose of skepticism and a commitment to continuous learning.