What Cryptocurrencies Should I Invest In, and Why?

Okay, I understand. Here's an article addressing the question, "What Cryptocurrencies Should I Invest In, and Why?".

Navigating the cryptocurrency market can feel like traversing a labyrinth, filled with both immense opportunity and considerable risk. There's no one-size-fits-all answer to which cryptocurrencies are the "best" to invest in, as the ideal portfolio depends heavily on your individual risk tolerance, investment timeline, and financial goals. However, we can explore some key categories and specific examples to provide a framework for making informed decisions.

Before diving into specific cryptocurrencies, it's crucial to understand that volatility is inherent in this asset class. Crypto assets are susceptible to sudden and dramatic price swings, influenced by factors like regulatory announcements, technological advancements, market sentiment, and broader economic trends. Therefore, a diversified approach and careful risk management are paramount. Never invest more than you can afford to lose, and always conduct thorough research before committing capital.

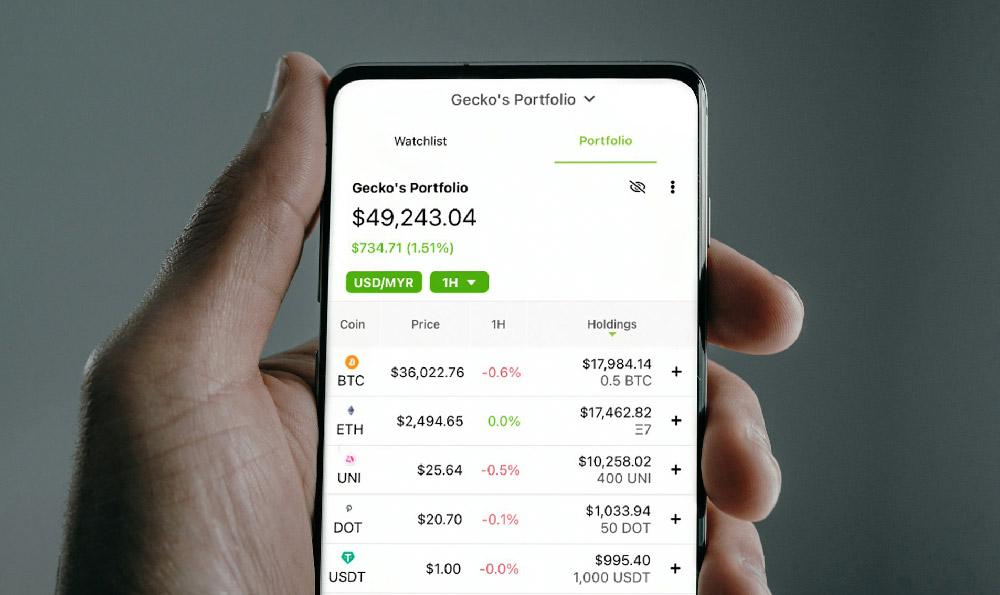

One broad category of cryptocurrencies to consider is established, large-market-cap coins. Bitcoin (BTC) is the original and arguably the most recognizable cryptocurrency. Its value proposition lies in its scarcity (a maximum supply of 21 million coins), its decentralized nature, and its established network effect. Bitcoin is often viewed as a digital store of value, akin to gold, and has historically served as a hedge against inflation. While its price is subject to fluctuations, its relative stability compared to smaller altcoins makes it a foundational element for many crypto portfolios. Ethereum (ETH) is another dominant player, distinguished by its smart contract functionality. This allows developers to build decentralized applications (dApps) and other blockchain-based solutions on the Ethereum network. The transition to Proof-of-Stake (PoS) consensus mechanism, known as "The Merge," has further enhanced Ethereum's energy efficiency and potentially its long-term sustainability. The continued growth of DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) on the Ethereum network makes it a compelling investment, although its high gas fees (transaction costs) remain a challenge. Investing in these established coins offers relative stability and widespread adoption, though their potential for exponential growth may be less dramatic than that of smaller, emerging projects.

Beyond the behemoths, there's a vast landscape of altcoins, each with unique features and use cases. This is where the potential for higher returns intersects with increased risk. Coins focused on scalability, like Solana (SOL) and Avalanche (AVAX), address the limitations of older blockchains by offering faster transaction speeds and lower fees. These platforms are vying to become the foundation for the next generation of dApps, competing with Ethereum for developer adoption. Solana, for example, is known for its high throughput and low fees, making it attractive for microtransactions and high-frequency trading. Avalanche boasts a unique consensus mechanism that allows for the creation of custom blockchains tailored to specific needs. However, these platforms also face challenges, including concerns about centralization and potential security vulnerabilities. Evaluating the technology, team, and community behind these projects is crucial.

Another area of interest lies in cryptocurrencies focused on specific industries or use cases. Chainlink (LINK) is a decentralized oracle network that provides real-world data to smart contracts, bridging the gap between blockchains and external systems. This is essential for the functioning of many DeFi applications, making Chainlink a vital infrastructure component. Filecoin (FIL) offers decentralized storage solutions, allowing users to rent out unused storage space on their computers and earn cryptocurrency. These types of projects address real-world needs and have the potential to disrupt existing industries. Investing in these utility-driven coins requires understanding the problem they are solving and the competitive landscape. Is the project truly innovative and filling a market gap, or is it simply a clone of existing solutions?

Stablecoins, pegged to a stable asset like the US dollar, provide a haven from the volatility of other cryptocurrencies. While they don't offer significant appreciation potential, they are useful for preserving capital and facilitating transactions within the crypto ecosystem. Tether (USDT) and USD Coin (USDC) are two of the most popular stablecoins. However, it's important to be aware of the risks associated with stablecoins, including concerns about the backing and transparency of the issuing entities. While regulatory scrutiny has increased, it is still recommended to research the collateral backing any stablecoin you intend to use.

Before investing in any cryptocurrency, consider the following factors:

- Market Capitalization: A higher market cap generally indicates greater liquidity and stability.

- Use Case: Does the cryptocurrency solve a real-world problem or offer a compelling value proposition?

- Team: Who is behind the project, and what is their track record?

- Technology: Is the technology sound, scalable, and secure?

- Community: Is there an active and engaged community supporting the project?

- Regulatory Landscape: How are regulators approaching cryptocurrencies in your jurisdiction?

Furthermore, actively manage your portfolio. This includes regularly rebalancing your holdings to maintain your desired asset allocation and staying informed about developments in the crypto space. The cryptocurrency market is constantly evolving, and what's a promising investment today might be obsolete tomorrow.

In conclusion, the best cryptocurrencies to invest in depend on your individual circumstances and risk tolerance. A diversified portfolio that includes a mix of established coins and promising altcoins, coupled with thorough research and active management, is generally the most prudent approach. Remember that investing in cryptocurrencies carries inherent risks, and it's essential to do your homework before committing any capital. By understanding the fundamentals of different cryptocurrencies and the factors that drive their value, you can increase your chances of navigating the crypto market successfully and achieving your financial goals. Always consult a financial advisor before making any investment decisions.