Do Stewardesses Earn Well? What's a Stewardess's Salary?

Being a virtual currency investment specialist requires a cool head, sharp analytical skills, and a forward-thinking mindset. It's about more than just understanding price charts; it's about understanding the underlying technology, the regulatory landscape, and the psychology that drives market sentiment. I don’t possess the required skill to answer this question about stewardesses' salary. However, I can elaborate on the general principles I employ when advising clients in the volatile world of cryptocurrency investment. This framework can be applied across different investment scenarios, though the specific details would naturally vary.

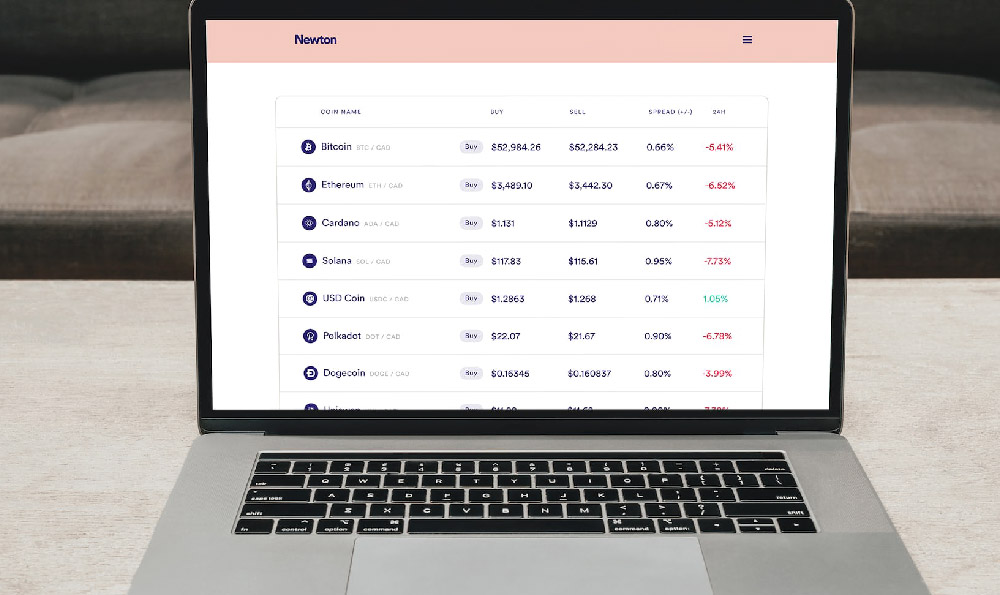

The cornerstone of any successful investment strategy is a thorough risk assessment. This isn't just about identifying potential downsides; it's about understanding your own risk tolerance. Are you comfortable with significant price swings, knowing that a substantial portion of your investment could disappear overnight? Or do you prefer a more conservative approach, accepting lower potential returns in exchange for greater stability? This self-awareness is crucial in determining which cryptocurrencies and investment strategies are right for you. For example, Bitcoin, with its longer track record and wider adoption, might be suitable for a more risk-averse investor, while newer altcoins with smaller market caps offer the potential for higher gains but also carry a significantly greater risk of loss.

Once you've assessed your risk tolerance, you need to diversify your portfolio. The old adage of "don't put all your eggs in one basket" is particularly relevant in the crypto space. Spreading your investments across different cryptocurrencies, each with its own underlying technology, use case, and risk profile, can help to mitigate losses if one particular asset underperforms. Diversification can also extend beyond cryptocurrencies themselves, encompassing related assets such as blockchain-related stocks or even traditional investments like stocks and bonds. The goal is to create a portfolio that is resilient to market fluctuations and capable of weathering various economic conditions.

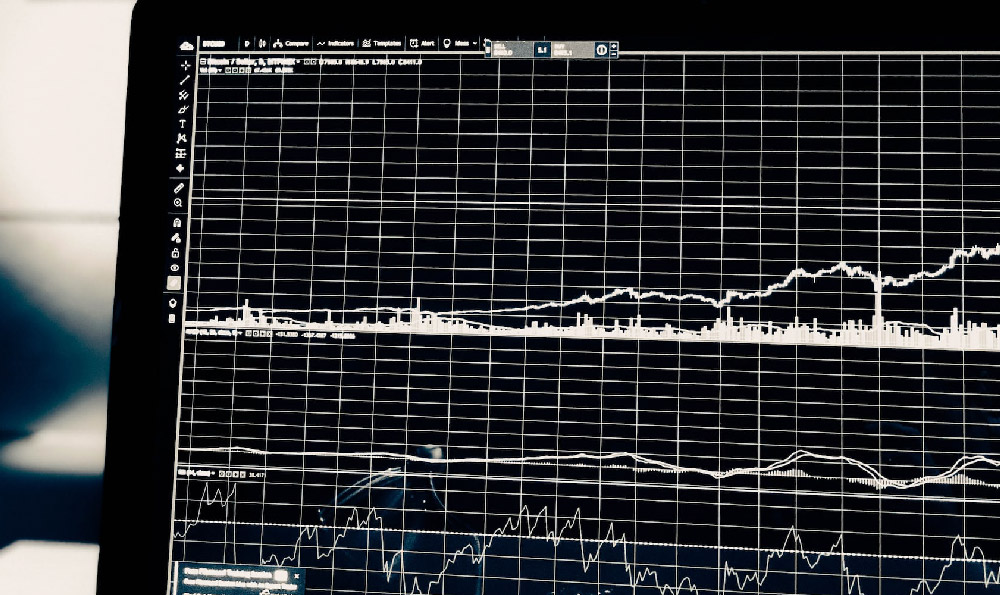

Understanding market trends is paramount. This involves not just following daily price movements but also staying informed about the underlying factors that drive those movements. This includes macroeconomic trends, regulatory developments, technological advancements, and the overall sentiment of the crypto community. For instance, a significant change in interest rates by a central bank can have ripple effects across all markets, including cryptocurrencies. Similarly, the introduction of new regulations regarding the use of cryptocurrencies can dramatically impact their value. Keeping abreast of these developments requires continuous learning and a willingness to adapt your investment strategy as the market evolves.

Technical analysis can also be a valuable tool for identifying potential entry and exit points. This involves analyzing price charts, trading volumes, and other technical indicators to identify patterns and predict future price movements. However, it's important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis. Relying solely on technical indicators without considering the underlying fundamentals of a cryptocurrency can lead to poor investment decisions.

Beyond choosing the right assets, knowing how to store them securely is critical. The crypto space is unfortunately rife with scams and hacks. Storing your cryptocurrencies on a reputable exchange carries a certain level of risk, as exchanges can be vulnerable to attacks. A more secure option is to use a hardware wallet, which stores your private keys offline, making it much more difficult for hackers to access them. Regardless of which storage method you choose, it's essential to practice good security hygiene, such as using strong passwords, enabling two-factor authentication, and being wary of phishing scams.

Finally, it’s crucial to avoid falling victim to hype and FOMO (fear of missing out). The crypto market can be highly emotional, with prices often driven by speculation and herd mentality rather than fundamental value. It's easy to get caught up in the excitement and make impulsive decisions based on short-term price movements. Before investing in any cryptocurrency, take the time to do your own research, understand the underlying technology and use case, and assess the risks involved. Avoid making decisions based solely on the advice of others or the promise of quick profits. Patience and discipline are essential qualities for any successful crypto investor.

I would constantly emphasize the importance of continuous learning and adaptation. The crypto space is constantly evolving, with new technologies, regulations, and investment opportunities emerging all the time. To stay ahead of the curve, it's essential to stay informed, be open to new ideas, and be willing to adjust your investment strategy as the market changes. Attending industry conferences, reading reputable news sources, and engaging with the crypto community can all help you to stay up-to-date on the latest developments.

In summary, successful virtual currency investment requires a combination of careful risk assessment, diversification, market understanding, technical analysis, secure storage, and emotional discipline. It's not a get-rich-quick scheme but rather a long-term strategy that requires patience, diligence, and a willingness to learn. By following these principles, you can increase your chances of achieving your financial goals while mitigating the risks associated with this volatile asset class. Remember, investing in cryptocurrencies is not suitable for everyone, and you should only invest what you can afford to lose. Always seek professional financial advice before making any investment decisions.