What is investing, and why does it matter?

Investing is essentially the act of allocating resources, typically money, with the expectation of generating an income or profit in the future. This can take many forms, from purchasing stocks and bonds to investing in real estate, businesses, or even intangible assets like intellectual property. The fundamental principle underlying all investment decisions is the hope that the invested capital will appreciate in value or generate a consistent stream of income, ultimately increasing the initial investment. It's about deploying capital today to reap financial rewards later.

Why does investing matter? The answer is multifaceted, touching upon individual financial well-being, economic growth, and societal progress. On a personal level, investing is crucial for achieving long-term financial goals that are often unattainable through solely relying on earned income. Think about retirement, purchasing a home, funding education for your children, or simply achieving financial independence. These aspirations typically require substantial capital accumulation, and investing provides a mechanism to amplify savings over time through the power of compounding. Compounding, often referred to as the eighth wonder of the world, is the process by which earnings from an investment generate further earnings. Over time, this exponential growth can significantly accelerate wealth creation.

Beyond individual benefits, investing plays a vital role in the broader economy. When individuals and institutions invest in businesses, they provide capital that fuels innovation, expansion, and job creation. Companies use this capital to research and develop new products and services, expand their operations, and hire more employees. This, in turn, leads to increased economic activity, higher productivity, and improved standards of living. The stock market, for instance, serves as a vital conduit for channeling capital to publicly traded companies, enabling them to access funds needed for growth.

Furthermore, investment in infrastructure, such as roads, bridges, and energy systems, is essential for supporting economic development and improving the quality of life. Government investments in these areas can create jobs, stimulate economic growth, and enhance the overall competitiveness of a nation. Similarly, investments in education and healthcare contribute to a more skilled and healthy workforce, further boosting productivity and economic potential.

However, it's important to acknowledge that investing inherently involves risk. The value of investments can fluctuate due to various factors, including market volatility, economic downturns, and company-specific issues. There's no guarantee that an investment will generate a positive return, and it's possible to lose money. Therefore, it's crucial to approach investing with a well-informed and disciplined approach, understanding the risks involved and taking steps to mitigate them.

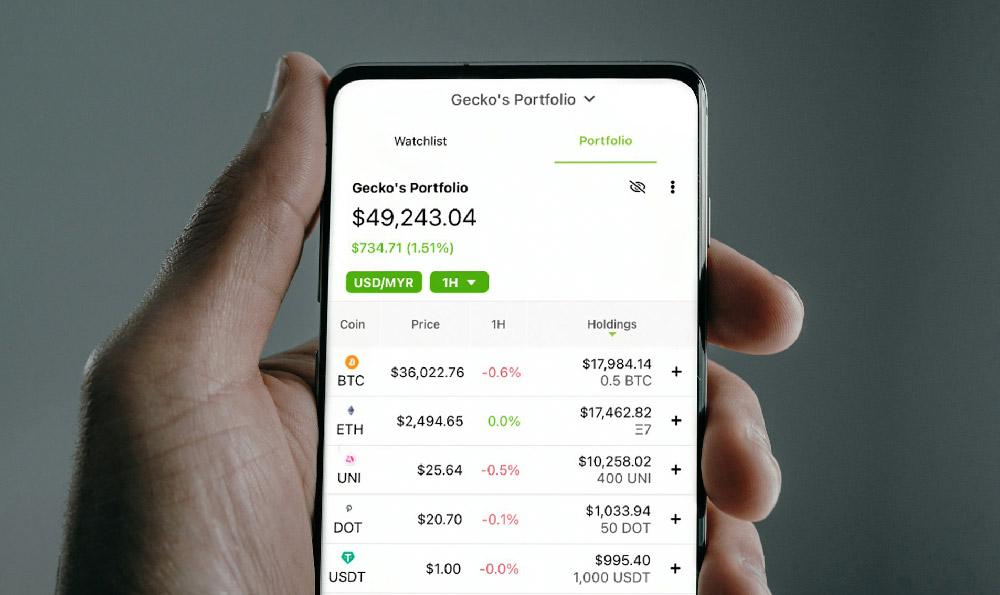

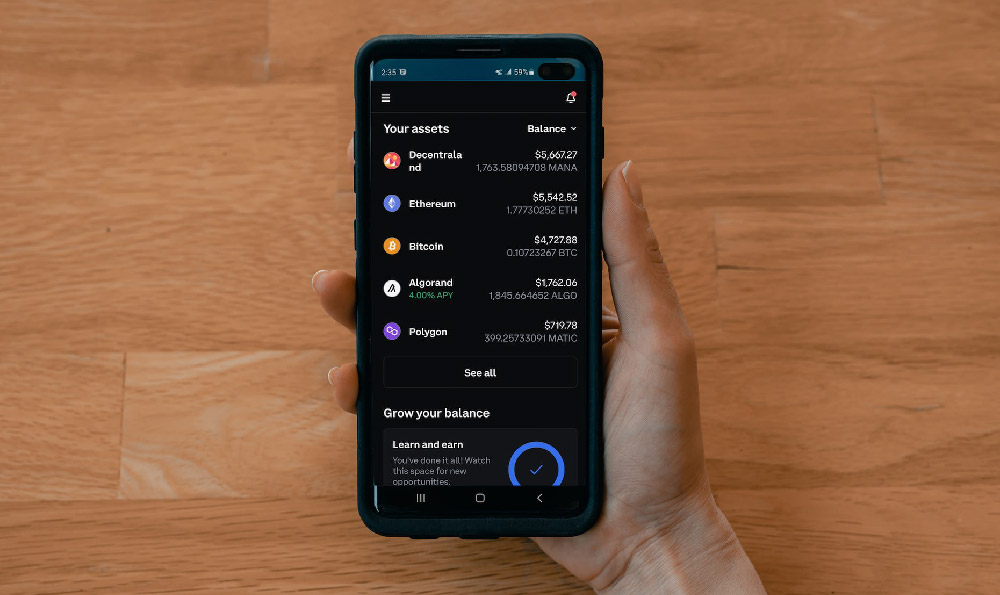

A key element of successful investing is diversification, which involves spreading investments across different asset classes, industries, and geographic regions. By diversifying, investors can reduce the impact of any single investment on their overall portfolio, thereby lowering the overall risk. For example, instead of investing solely in stocks of technology companies, an investor might also allocate capital to bonds, real estate, and international equities.

Another critical aspect of investing is conducting thorough research and due diligence. Before investing in any asset, it's essential to understand its fundamentals, its potential risks and rewards, and its alignment with your overall investment goals. This may involve analyzing financial statements, reading industry reports, and consulting with financial advisors. It's also important to stay informed about market trends and economic developments that could affect your investments.

Developing a long-term investment strategy is also crucial. This involves setting clear financial goals, determining your risk tolerance, and creating a plan for how you will allocate your capital and manage your investments over time. A well-defined strategy can help you stay focused and avoid making impulsive decisions based on short-term market fluctuations. Patience and discipline are key virtues in the world of investing.

Moreover, it's crucial to understand the impact of inflation on your investment returns. Inflation erodes the purchasing power of money over time, so it's essential to consider the real return on investment, which is the return after accounting for inflation. Investing in assets that have the potential to outpace inflation is crucial for preserving and growing wealth over the long term.

In the context of virtual currencies, investing involves even greater considerations. The virtual currency market is notoriously volatile and subject to rapid fluctuations. While the potential for high returns exists, so does the risk of significant losses. Thorough research, understanding the underlying technology, and assessing the project's viability are paramount before investing in any virtual currency. Diversifying across different cryptocurrencies and allocating only a small portion of your portfolio to this asset class are prudent risk management strategies. Never invest more than you can afford to lose.

In conclusion, investing is a vital activity for individuals, businesses, and economies alike. It provides a means to achieve financial goals, fuels economic growth, and improves standards of living. While investing involves risk, a well-informed and disciplined approach can help mitigate those risks and maximize the potential for long-term financial success. The importance of investing lies not just in accumulating wealth, but also in securing a more stable and prosperous future. Investing responsibly and intelligently is an investment in your future and the future of society.