What Percentage of Americans Invest in Stocks, and Why?

Okay, here's an article exploring the prevalence of stock market investment among Americans and the multifaceted reasons behind their decisions.

The landscape of American investing is complex, shaped by economic conditions, generational attitudes, access to resources, and individual risk tolerance. Determining the exact percentage of Americans invested in stocks is challenging due to varying methodologies and data sources, but available research paints a fairly clear picture. While numbers fluctuate, a commonly cited figure suggests that around half of American households invest in the stock market, either directly through individual stocks or indirectly through mutual funds, retirement accounts like 401(k)s, or other investment vehicles. This figure encompasses a significant portion of the population, but it also highlights that a substantial number of Americans remain on the sidelines.

Understanding why this is the case requires delving into the complex web of factors that influence investment decisions. Financial security, or rather the lack thereof, is a primary reason preventing many from participating in the stock market. For a large segment of the population, simply covering daily expenses, paying off debt, and building an emergency fund takes precedence over investing for the future. When immediate needs outweigh long-term financial goals, the stock market can seem like a luxury or an unnecessary risk. Income inequality plays a significant role here. Those with higher disposable incomes are naturally more likely to have the surplus capital required to invest, perpetuating a cycle of wealth accumulation.

Beyond basic affordability, knowledge and understanding of the stock market also play a crucial role. Investing can seem daunting, especially to those without a background in finance. The perceived complexity of analyzing market trends, understanding financial statements, and choosing the right investments can be intimidating, leading to hesitation or outright avoidance. Financial literacy rates in the United States are not uniformly high, and many people lack the confidence or resources to navigate the intricacies of the stock market. This knowledge gap is further exacerbated by the proliferation of misleading or overly complex financial products and investment strategies, which can create confusion and distrust.

Risk aversion is another key determinant of investment decisions. The stock market is inherently volatile, and the possibility of losing money is a real concern for many. Individuals approaching retirement, for example, may be more conservative in their investment choices, preferring lower-risk options like bonds or fixed-income securities to protect their accumulated savings. Younger investors with a longer time horizon may be more willing to tolerate risk in pursuit of higher potential returns, but even among this group, risk tolerance varies widely based on personality, financial circumstances, and past experiences. Events like market crashes or economic recessions can significantly impact investor sentiment, leading to increased risk aversion and a shift away from stocks.

Age is undeniably linked to investment behavior. Younger individuals are often at the beginning of their careers and may prioritize paying off student loans or purchasing a home over investing in the stock market. As people progress through their careers and accumulate wealth, they are more likely to begin investing, especially as they start thinking about retirement. However, generational differences in attitudes toward risk and investing also come into play. Millennials and Gen Z, for example, have grown up in a world of economic uncertainty and technological disruption, which may influence their investment strategies and preferences.

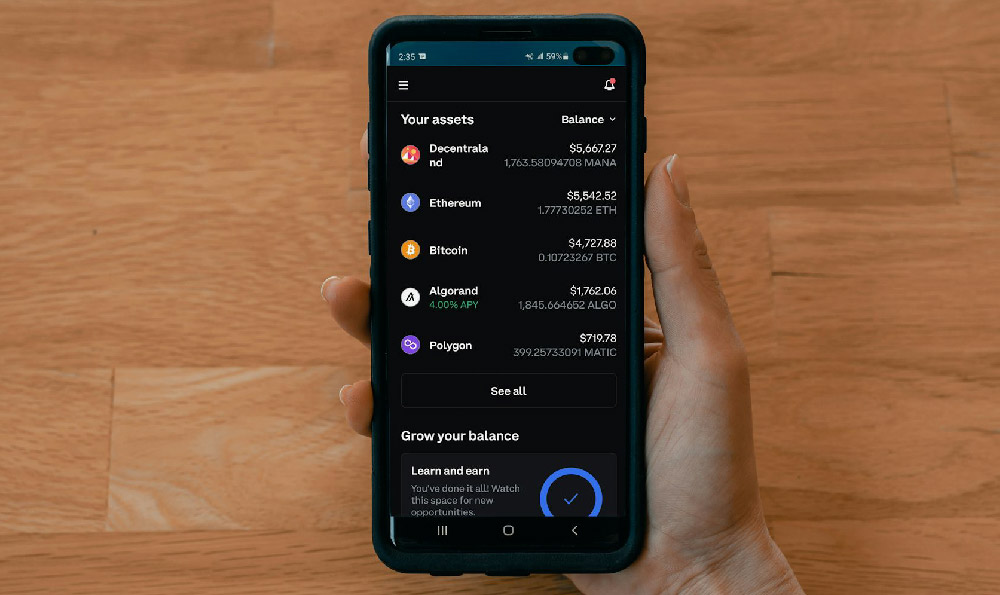

Access to investment opportunities also plays a role. While online brokerage platforms have made investing more accessible than ever before, not everyone has equal access to these resources. Factors like internet access, access to financial advisors, and employer-sponsored retirement plans can all influence an individual's ability to invest in the stock market. The rise of commission-free trading and fractional shares has lowered the barriers to entry for many, but further efforts are needed to ensure that everyone has the opportunity to participate in the market.

Furthermore, trust in financial institutions and the stock market itself is a crucial element. Past scandals and financial crises have eroded public trust in the financial system, leading some people to avoid investing altogether. Rebuilding this trust requires greater transparency, stronger regulation, and ethical conduct from financial professionals.

Cultural and social factors can also shape investment decisions. Some cultures place a greater emphasis on saving and investing than others, while social networks and peer influence can also play a role in shaping investment behavior. If friends and family members are actively investing in the stock market, individuals may be more likely to do the same.

In conclusion, the percentage of Americans invested in stocks is influenced by a complex interplay of economic, social, demographic, and psychological factors. While a significant portion of the population participates in the stock market, a substantial number remain on the sidelines due to factors such as financial insecurity, lack of knowledge, risk aversion, and lack of trust. Addressing these barriers requires a multi-pronged approach that includes improving financial literacy, promoting access to affordable investment opportunities, and restoring trust in the financial system. By empowering individuals with the knowledge, resources, and confidence to invest, we can create a more inclusive and equitable financial future for all Americans. Understanding these multifaceted reasons is crucial for policymakers, financial institutions, and individuals alike to foster greater financial inclusion and empower more Americans to participate in the potential wealth creation opportunities offered by the stock market.