What's the best 401k investment, and where should my money go?

Navigating the complexities of a 401(k) plan can feel overwhelming. Deciding where to allocate your contributions is a critical step towards securing a comfortable retirement. There’s no single "best" 401(k) investment that suits everyone; the ideal choice depends heavily on your individual circumstances, including your age, risk tolerance, financial goals, and investment timeline. However, understanding the various investment options available and aligning them with your personal profile is key to maximizing your potential returns.

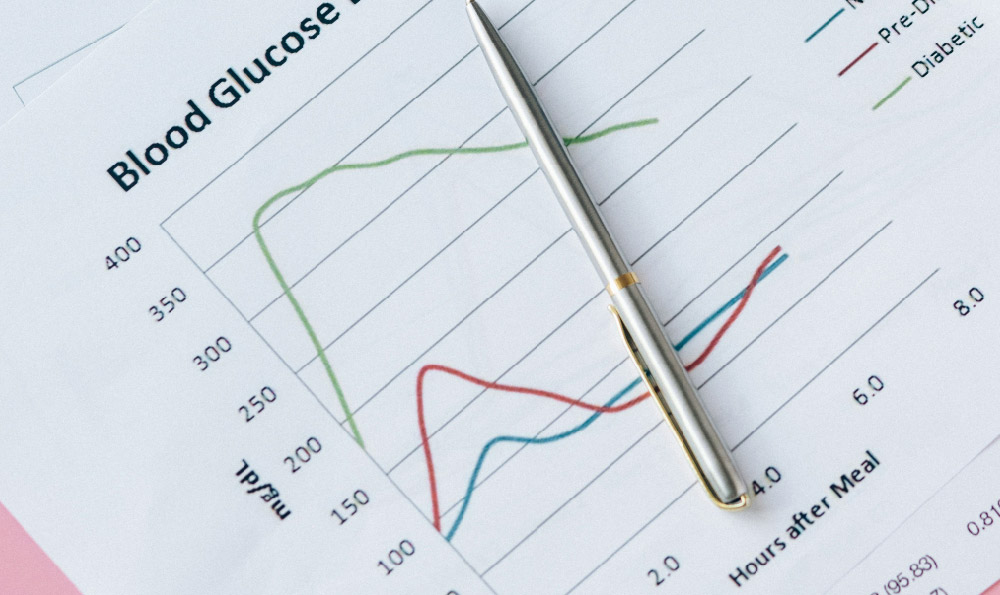

Before delving into specific investment choices, it's crucial to understand the fundamental principle of asset allocation. This involves diversifying your investments across different asset classes, such as stocks, bonds, and cash equivalents. Diversification helps to mitigate risk by ensuring that your entire portfolio isn't overly reliant on the performance of any single asset class. Stocks, historically, have offered higher potential returns but also come with greater volatility. Bonds, on the other hand, are generally considered less risky but offer lower potential returns. Cash equivalents provide stability but offer minimal growth potential.

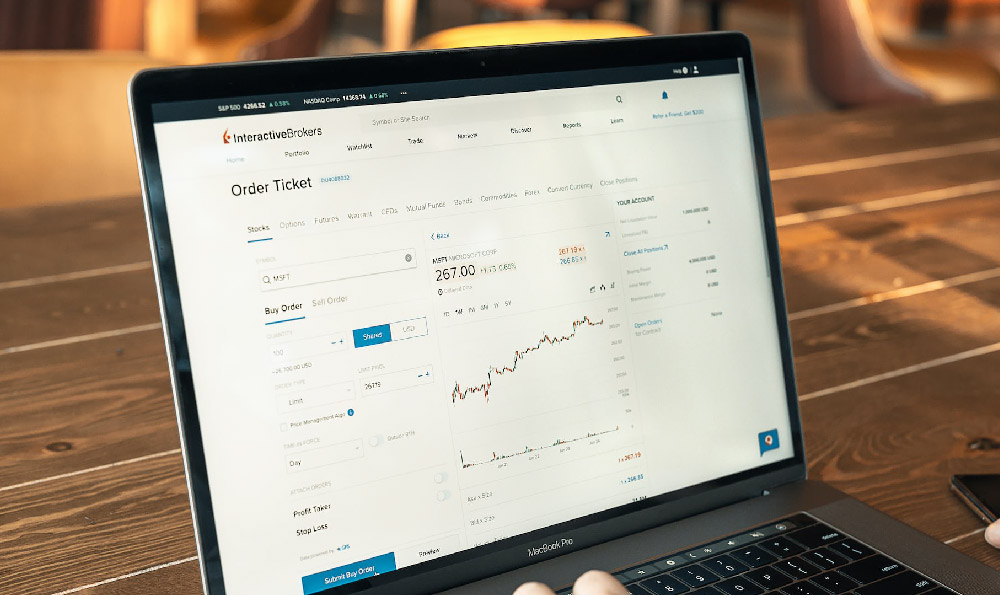

For younger investors with a longer time horizon, a more aggressive approach may be suitable. This could involve allocating a larger portion of your portfolio to stocks. The reasoning behind this is that younger investors have more time to recover from market downturns and can benefit from the higher potential growth offered by stocks over the long term. Within the stock allocation, consider diversifying across different sectors and market capitalization sizes (large-cap, mid-cap, and small-cap). A broad-market index fund or ETF (Exchange Traded Fund) can be an excellent way to achieve this diversification with low fees. These funds track a specific index, such as the S&P 500, and provide exposure to a wide range of companies. Investing in international stocks can also further diversify your portfolio and potentially capture growth opportunities in emerging markets.

As you approach retirement, a more conservative approach is generally recommended. This involves shifting a greater portion of your portfolio to bonds and cash equivalents. The goal here is to preserve capital and reduce the risk of significant losses as you get closer to needing the funds. Bonds provide a more stable income stream and can help to cushion your portfolio during market volatility. The specific allocation to bonds will depend on your individual risk tolerance and retirement income needs. Some investors may prefer to hold a mix of government bonds and corporate bonds, while others may opt for a bond fund or ETF.

Target-date funds (TDFs) are another popular option for 401(k) investors. These funds automatically adjust their asset allocation over time, becoming more conservative as you approach your target retirement date. TDFs are designed to simplify the investment process and are a good choice for investors who are not comfortable managing their own asset allocation. However, it's important to understand the underlying asset allocation of the TDF and ensure that it aligns with your individual risk tolerance and investment goals. TDFs with the same target date can have different underlying asset allocations, so it's essential to compare different TDFs before making a decision.

Beyond asset allocation, understanding the expenses associated with your investment options is crucial. High fees can significantly erode your returns over time. Pay close attention to the expense ratios of the mutual funds and ETFs offered in your 401(k) plan. An expense ratio is the annual fee charged by the fund to cover its operating expenses. Look for low-cost index funds or ETFs that track broad market indexes. Actively managed funds, which are managed by professional fund managers, typically have higher expense ratios than index funds. While actively managed funds may have the potential to outperform the market, they often fail to do so after accounting for fees.

Another key factor to consider is the availability of a company match in your 401(k) plan. Many employers offer a matching contribution, which means they will match a certain percentage of your contributions up to a certain limit. This is essentially free money and should be taken advantage of whenever possible. Contributing enough to receive the full company match is one of the most effective ways to boost your retirement savings. If your employer offers a Roth 401(k) option, consider whether this is a suitable choice for you. Roth 401(k) contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. This can be advantageous if you expect to be in a higher tax bracket in retirement than you are now.

Regularly review your 401(k) investments and make adjustments as needed. Your financial situation and goals may change over time, so it's important to ensure that your investment strategy remains aligned with your needs. Rebalancing your portfolio periodically is also important. This involves selling some of your investments that have performed well and buying more of those that have underperformed, in order to maintain your desired asset allocation.

Finally, don't hesitate to seek professional financial advice. A qualified financial advisor can help you assess your individual circumstances, develop a personalized investment strategy, and navigate the complexities of your 401(k) plan. While there's no magic bullet, thoughtful planning, diversification, and a disciplined approach are your best allies in achieving your retirement goals. Remember, the best investment is the one that aligns with your unique situation and helps you sleep soundly at night.