Is investing in Bitcoin profitable, and how can you make money doing it?

Okay, I understand. Here's an article exploring the potential profitability of Bitcoin investment and strategies for earning money with it:

Is investing in Bitcoin profitable, and how can you make money doing it?

Bitcoin, the pioneering cryptocurrency, has captivated the attention of investors worldwide with its volatile price swings and potential for substantial returns. The question of whether investing in Bitcoin is profitable is complex, with no guaranteed answer. It hinges on a variety of factors, including your risk tolerance, investment horizon, and understanding of the cryptocurrency market. Examining the historical performance of Bitcoin, exploring various avenues for earning money with it, and understanding the associated risks is crucial before making any investment decisions.

Historically, Bitcoin has demonstrated periods of explosive growth, significantly outperforming traditional asset classes like stocks and bonds. Early adopters who invested when Bitcoin was trading at fractions of a dollar reaped enormous profits as its value surged to tens of thousands of dollars. However, these periods of growth have been interspersed with sharp corrections and prolonged bear markets, during which Bitcoin's price has plummeted by significant percentages. This volatility is a defining characteristic of Bitcoin and a key consideration for any potential investor. Past performance is not indicative of future results, and even though Bitcoin has demonstrated profit potential, you can lose money with Bitcoin.

Several factors contribute to Bitcoin's inherent volatility. Its relative newness as an asset class means it lacks the established regulatory frameworks and institutional support that characterize traditional markets. News events, regulatory pronouncements, and macroeconomic trends can all trigger rapid price fluctuations. The market is also heavily influenced by sentiment, with social media and online forums playing a significant role in shaping investor perceptions. Furthermore, the limited supply of Bitcoin, capped at 21 million coins, can exacerbate price swings as demand fluctuates.

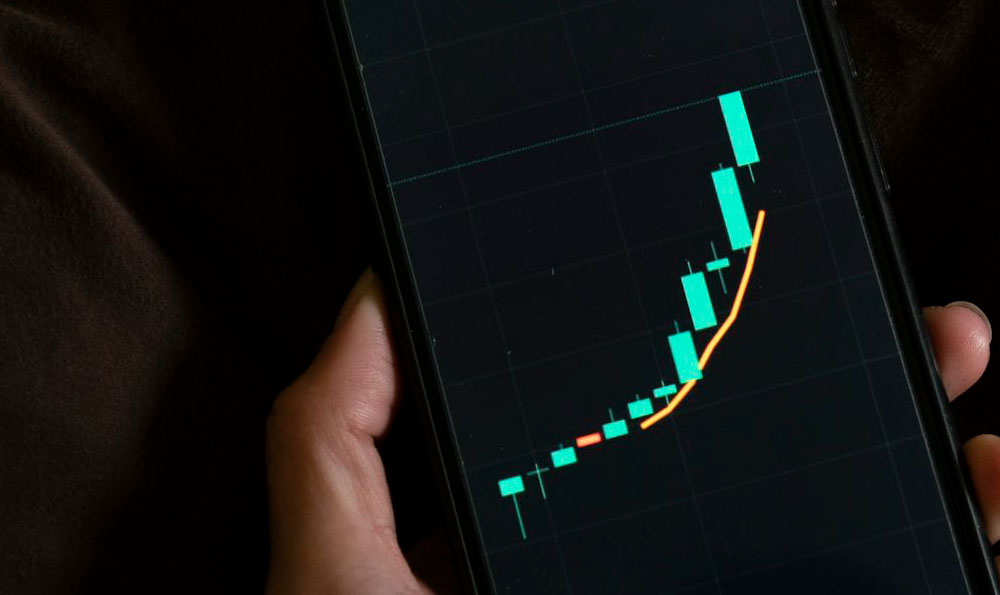

Despite its volatility, Bitcoin offers several avenues for earning money. The most straightforward approach is through direct investment, buying Bitcoin on a cryptocurrency exchange and holding it with the expectation that its value will appreciate over time. This strategy, often referred to as "hodling" (a deliberate misspelling of "holding"), requires patience and a strong belief in Bitcoin's long-term potential. The challenge lies in accurately predicting market trends and identifying optimal entry and exit points. Many investors employ technical analysis, studying price charts and trading volumes, to inform their decisions.

Beyond simply buying and holding, active trading strategies offer the potential for higher returns but also carry greater risks. Day trading involves making multiple trades within a single day, aiming to profit from small price fluctuations. Swing trading focuses on capturing short-term price swings over a period of days or weeks. These strategies require a deep understanding of market dynamics, technical analysis skills, and the ability to manage risk effectively.

Another way to generate income from Bitcoin is through staking. Staking involves holding certain cryptocurrencies in a digital wallet to support the operations of a blockchain network. In return for participating in the network's consensus mechanism, stakers earn rewards in the form of additional cryptocurrency. This provides a passive income stream while contributing to the security and stability of the network. However, staking options vary depending on the cryptocurrency and platform used, and it's essential to research the specific terms and conditions before participating.

Bitcoin mining, the process of verifying and adding new transactions to the Bitcoin blockchain, was initially a popular way to acquire Bitcoin. However, as the network has grown in complexity, mining has become increasingly competitive and requires specialized hardware and significant computational power. Individual miners are now largely priced out of the market, with mining dominated by large-scale operations. Cloud mining, where you rent computing power from a mining farm, is another option, but it often comes with high fees and limited profitability.

Providing liquidity on decentralized exchanges (DEXs) is another avenue, though a riskier one. Users deposit pairs of tokens, including Bitcoin or a wrapped version of Bitcoin (like WBTC), into liquidity pools, which are then used to facilitate trades on the exchange. In return, liquidity providers earn a share of the trading fees. However, they are also exposed to the risk of "impermanent loss," which occurs when the relative prices of the tokens in the pool diverge, potentially resulting in a decrease in the value of their holdings.

Before investing in Bitcoin, it's crucial to understand the associated risks. Price volatility is perhaps the most significant risk, as Bitcoin's value can fluctuate dramatically in a short period. Regulatory uncertainty also poses a threat, as governments around the world are still grappling with how to regulate cryptocurrencies. Security risks are another concern, as cryptocurrency exchanges and wallets can be vulnerable to hacking and theft. It is critical to secure your Bitcoin holdings using strong passwords, two-factor authentication, and cold storage solutions (offline wallets). Finally, the cryptocurrency market is still relatively immature, and there is a risk of fraud and scams. It's essential to do your own research, avoid investing in anything you don't understand, and be wary of promises of guaranteed returns.

Ultimately, whether investing in Bitcoin is profitable depends on individual circumstances, risk tolerance, and investment strategies. While Bitcoin has the potential to generate significant returns, it is also a highly volatile and risky asset. Diversifying your investment portfolio, investing only what you can afford to lose, and thoroughly researching the market are essential steps for mitigating risk and maximizing the potential for success. Always remember that informed decisions based on diligent research are the cornerstone of successful investing, regardless of the asset class.