How Does BlackRock Make Money Through Investment Fees and Asset Management

BlackRock's success in the investment world is built on a foundation of strategic financial management, diverse revenue streams, and a keen ability to navigate volatile markets. As one of the most prominent asset management firms globally, the company's approach to generating income through investment fees and asset management has evolved significantly, especially with the emergence of cryptocurrencies as a transformative asset class. By analyzing the intricate mechanisms of profitability and the nuances of risk management, it becomes evident how BlackRock maintains its competitive edge while adapting to the complexities of digital markets.

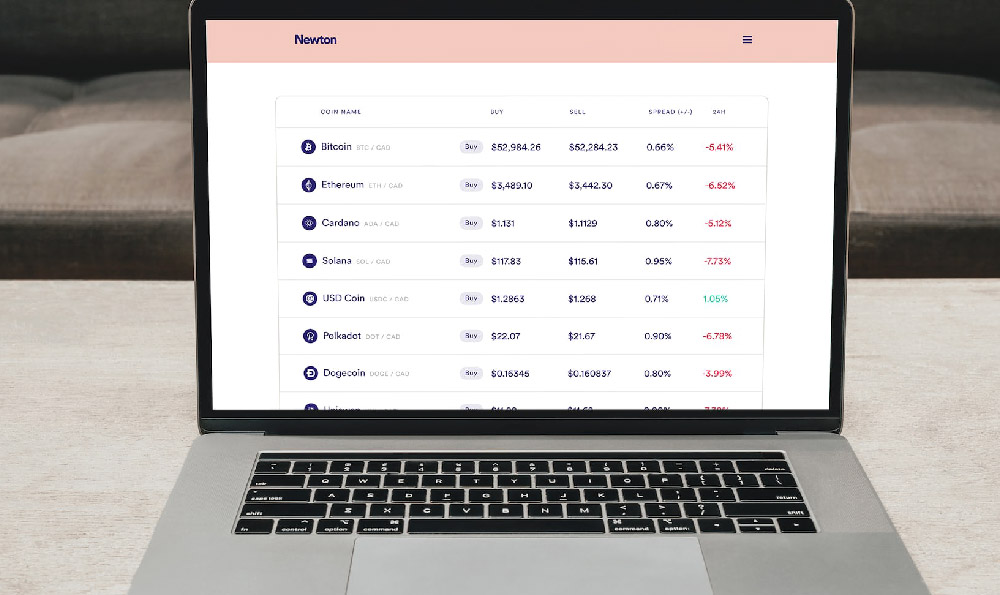

Understanding the intersection of traditional and digital assets is crucial to grasping BlackRock's revenue model. The firm generates income through a combination of management fees, performance-based compensation, and other ancillary services, which are particularly relevant in the context of decentralized finance (DeFi) and blockchain-based investments. In the cryptocurrency realm, BlackRock's entry via the iShares Bitcoin Trust highlights its ability to translate niche market opportunities into sustainable financial gains. This trust, which provides exposure to Bitcoin without direct ownership, operates on a fee structure that includes both asset management fees and transaction-related costs, underscoring the company's adaptability in a rapidly changing financial ecosystem.

A key component of BlackRock's revenue strategy lies in its asset management services, which are designed to cater to institutional investors seeking structured exposure to high-growth assets like cryptocurrencies. The firm leverages its extensive experience in managing portfolios to create products that balance innovation with risk mitigation. For instance, the iShares Bitcoin Trust not only allows investors to participate in Bitcoin's potential appreciation but also minimizes liquidity risks by pooling resources and facilitating institutional-grade trading. This approach aligns with BlackRock's broader philosophy of offering solutions that are both accessible and secure, ensuring that investors can benefit from market opportunities without exposing themselves to excessive volatility.

The profitability of BlackRock's asset management ventures is further amplified through its global footprint and diversified client base. By catering to a wide range of investors—ranging from individual traders to large corporations—the company ensures a steady inflow of capital, which in turn allows it to maintain low operating costs and maximize returns. In the case of cryptocurrencies, this diversification helps BlackRock mitigate the risks associated with speculative markets by spreading investments across different asset classes and market conditions. The firm's ability to generate consistent income through these services is a testament to its innovative strategies and deep understanding of investor behavior.

BlackRock's approach to investment fees also reflects a strategic emphasis on transparency and efficiency. For example, the management fees charged on cryptocurrency funds are often structured to be competitive while ensuring the firm's operational sustainability. These fees cover the costs of research, trading, compliance, and risk management, which are critical in maintaining the integrity of the investment process. Additionally, performance-based compensation, such as incentive fees, ensures that BlackRock's strategies are aligned with the interests of its clients, creating a win-win scenario for both parties.

In the context of internet-based digital assets, BlackRock's solutions are designed to address the unique challenges of the market. The firm's digital asset department, established in 2020, focuses on developing products that provide institutional investors with access to cryptocurrencies while maintaining a high standard of security and compliance. This includes offering structured products and custody solutions that are tailored to meet the demands of sophisticated investors. By doing so, BlackRock not only capitalizes on the growing interest in digital assets but also sets a benchmark for industry standards.

The long-term profitability of BlackRock's strategies is rooted in its ability to anticipate market trends and adapt to changing investor preferences. For example, the rise of Ethereum-based tokens and the development of DeFi platforms have created new opportunities for asset management, and BlackRock has been proactive in integrating these into its portfolio strategies. The firm's emphasis on risk-adjusted returns ensures that every investment decision is made with the goal of minimizing downside risk while maximizing upside potential. This holistic approach to portfolio management has made BlackRock a trusted name in the financial industry.

BlackRock's revenue model also includes the management of large-scale pension funds and endowment portfolios, where the firm applies its expertise in diversifying investments across traditional and digital assets. This not only enhances the performance of these funds but also ensures that investors are protected from market volatility through a combination of hedging strategies and diversification. By maintaining a robust asset management framework, BlackRock continues to attract a diverse clientele, including those seeking exposure to cryptocurrencies.

The firm's ability to generate income through these services is further enhanced by its strong brand reputation and extensive network of clients. By leveraging these relationships, BlackRock ensures that its investment strategies are continuously refined to meet the evolving needs of the market. This includes offering innovative products that allow investors to participate in the growth of digital assets while maintaining a stable and secure investment environment.

Ultimately, BlackRock's profitability in the investment arena is a result of its strategic approach to asset management, combined with its ability to adapt to new market realities. Whether through traditional investment vehicles or digital asset solutions, the company consistently delivers value to its clients while ensuring the long-term sustainability of its business model. This duality of innovation and risk management has solidified BlackRock's position as a leader in the financial industry, and its strategies serve as a blueprint for others seeking to balance profitability with prudent decision-making.