Can minors invest in crypto? How to buy cryptocurrency under 18?

The allure of cryptocurrency has captivated individuals of all ages, sparking questions about accessibility for younger investors. The question of whether minors can directly invest in crypto isn't a simple yes or no. Legally and practically, it's complex and varies significantly depending on jurisdiction and the specific platform in question.

Minors, generally defined as individuals under the age of 18 (though this can differ slightly in some regions), typically lack the legal capacity to enter into binding contracts. This fundamental limitation poses a significant hurdle when attempting to open accounts on most cryptocurrency exchanges. Exchanges, like traditional financial institutions, require users to agree to terms and conditions, which are legally considered contracts. A minor's ability to enter such contracts can be challenged, creating potential legal and regulatory complications for the exchange. Therefore, most reputable exchanges have explicit age restrictions, often requiring users to be at least 18 years old.

The rationale behind these restrictions extends beyond mere contractual limitations. Regulators are also concerned about the potential for minors to engage in high-risk activities without a full understanding of the implications. Crypto, known for its volatility and speculative nature, can be particularly dangerous for inexperienced investors. The potential for significant financial losses could have detrimental effects on a minor's well-being. Furthermore, concerns about financial crime, such as money laundering and tax evasion, further motivate the enforcement of age restrictions.

So, what are the alternatives for those under 18 who are interested in participating in the crypto market? While direct investment might be restricted, several indirect avenues offer possibilities, albeit with adult supervision and collaboration.

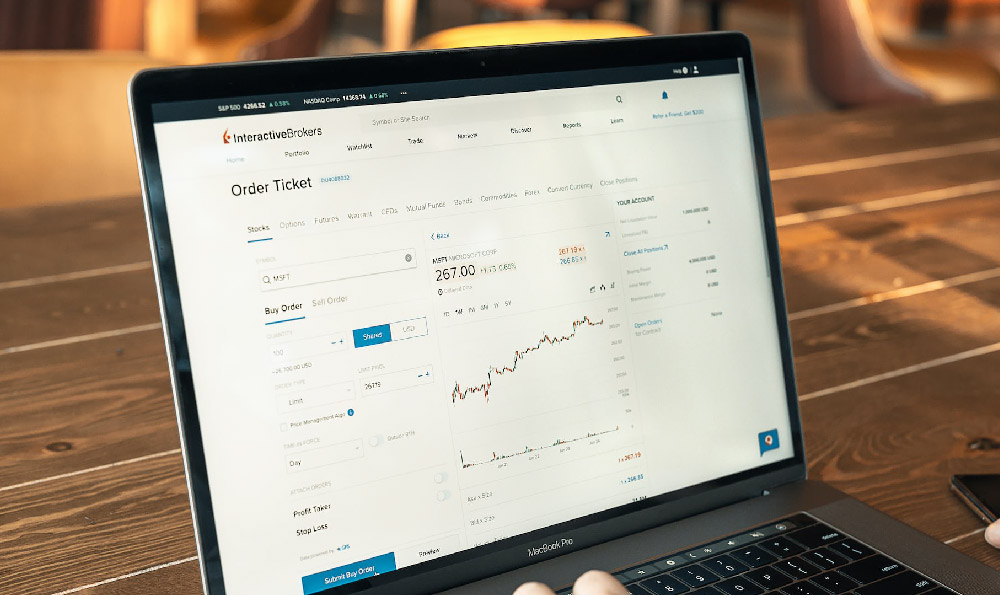

One prominent option involves investing through a custodial account. A parent or legal guardian can open a brokerage account or crypto platform account in their name and then manage the investments for the benefit of the minor. This approach allows the minor to indirectly participate in the market while the adult retains control and responsibility. It's crucial to carefully select a platform that aligns with the family's investment goals and risk tolerance. Furthermore, any profits generated from these investments will likely be subject to taxation based on the guardian's tax bracket, so careful tax planning is essential.

Another related strategy is to set up a trust fund specifically earmarked for crypto investments. This involves creating a legal trust, managed by a trustee (often a parent or guardian), who is responsible for managing the assets according to the terms of the trust document. Trust funds offer more flexibility in terms of structuring the investment strategy and planning for the long-term management of assets. However, setting up a trust can be more complex and involve legal and administrative fees.

Gifting cryptocurrency is also a viable option. An adult can purchase crypto and then gift it to the minor. The legal and tax implications of gifting crypto can vary significantly depending on the jurisdiction and the value of the gift. It is imperative to consult with a tax advisor to understand the potential tax consequences of such transactions.

Beyond these direct investment-related avenues, education remains a vital component. Instead of rushing into the market, minors can spend time learning about blockchain technology, cryptocurrency markets, and investment strategies. Numerous online resources, educational platforms, and even some engaging games can provide a solid foundation for understanding the fundamentals of crypto. Developing a strong understanding of market dynamics, risk management, and responsible investing practices is crucial for long-term success, regardless of age.

It's also important to consider the ethical implications. Cryptocurrency investments should be made with careful consideration of their potential impact on the environment and society. Engaging in responsible and ethical investing practices can help ensure that the minor's participation in the crypto market aligns with their values.

Finally, it's vital to address the risks associated with cryptocurrency investments honestly and transparently. Cryptocurrency markets are inherently volatile, and significant losses are possible. Furthermore, scams and fraudulent schemes are prevalent in the crypto space. Emphasizing the importance of due diligence, skepticism, and avoiding overly aggressive investment strategies is crucial for protecting a minor's financial well-being.

In conclusion, while direct cryptocurrency investment by minors is generally restricted due to legal and regulatory constraints, several indirect avenues exist that allow for participation under the supervision and guidance of an adult. These avenues, combined with education, responsible investing practices, and a clear understanding of the risks involved, can provide a valuable learning experience and potentially contribute to long-term financial growth, while safeguarding the interests of the minor. Before embarking on any crypto investment strategy involving a minor, it's essential to consult with legal and financial professionals to ensure compliance with applicable laws and regulations. The goal should always be to prioritize education, risk management, and responsible investing practices over the pursuit of quick profits.