Can You Really Lose More Than You Invest in Stocks? Is It Possible?

Okay, I understand. Here's an article addressing the question of whether it's possible to lose more than your initial investment in stocks.

The Stock Market Paradox: Can Your Losses Exceed Your Investment?

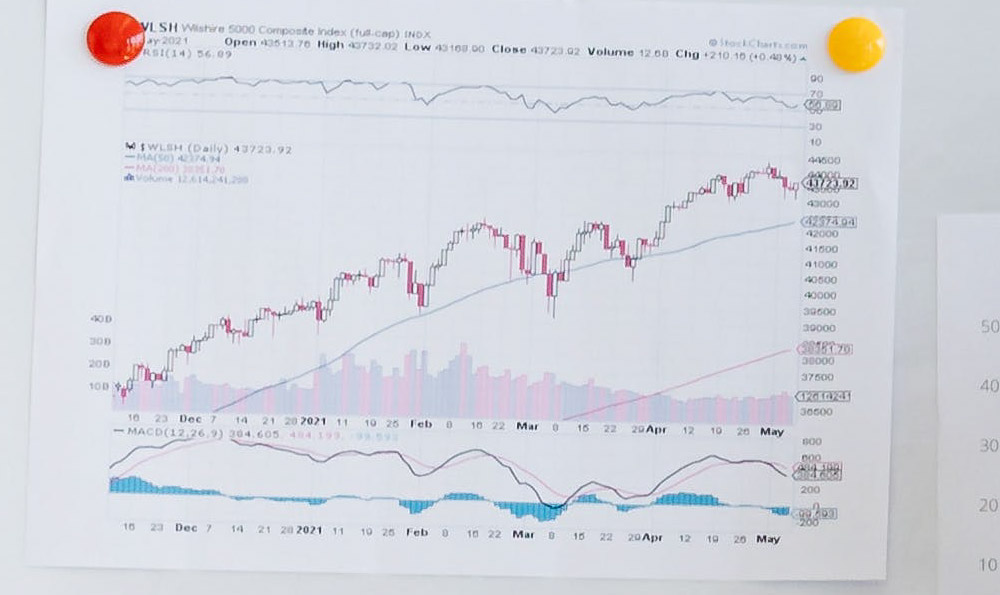

The allure of the stock market lies in its potential for substantial gains. We envision our portfolios blossoming, generating wealth that allows us to achieve financial freedom. However, the flip side of this coin is the inherent risk. While most investors intuitively understand that they can lose their entire investment in a stock, the unsettling question arises: is it actually possible to lose more than the initial amount put in? The answer, while nuanced, leans towards a conditional "yes." In most typical stock investing scenarios, particularly for retail investors, the risk is generally limited to the amount invested. However, specific situations and sophisticated financial instruments can expose investors to losses exceeding their original capital.

To understand this better, we need to dissect the different ways people engage with the stock market. The most common method involves directly purchasing shares of a company through a brokerage account. In this straightforward scenario, your potential loss is capped at the amount you spent buying the shares. If you invest $1,000 in a company and it goes bankrupt, the value of your shares drops to zero, and you lose your $1,000. That’s the absolute worst-case scenario. You won’t owe the company or anyone else any additional money. This is because as a shareholder, you have limited liability. Your liability extends only to the amount you invested.

However, the stock market offers a range of other investment instruments, and these are where the possibility of exceeding your initial investment loss emerges. The most prominent example is using margin.

Margin trading involves borrowing money from your broker to purchase more stock than you could afford with your own funds. This amplifies both potential gains and potential losses. Let's say you have $5,000 in your account and your broker offers a 2:1 margin. This means you can borrow an additional $5,000, giving you a total of $10,000 to invest. If the stocks you buy with this $10,000 increase in value by 10%, you've made a $1,000 profit on your initial $5,000 investment – a 20% return! However, if the stocks decline by 10%, you've lost $1,000. You still owe the broker the $5,000 you borrowed. If the stock continues to fall significantly, your broker can issue a "margin call." This is a demand for you to deposit more funds into your account to cover the losses. If you fail to meet the margin call, the broker can sell your stocks to recoup their loan. If the sale doesn't cover the loan and accrued interest, you'll be responsible for paying the remaining balance, meaning you could lose more than your initial $5,000 investment. The risk is magnified because you are essentially leveraging your investment, and leverage cuts both ways.

Another area where losses can exceed the initial investment lies in options trading. Options are contracts that give you the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a specific price on or before a specific date. Buying options generally limits your risk to the premium you paid for the option contract. However, selling certain types of options, particularly "naked" or "uncovered" options, can expose you to potentially unlimited losses.

For example, if you sell a call option on a stock you don't own (a naked call), you are obligated to sell that stock at the agreed-upon price if the option buyer exercises their right. If the stock price rises significantly above the strike price of the option, you'll have to buy the stock at the higher market price to deliver it to the option buyer at the lower strike price. The difference between these prices represents your loss. Theoretically, the stock price could rise infinitely, leading to potentially unlimited losses for the option seller. While brokers often require substantial collateral and have risk management systems in place to prevent such catastrophic losses, the potential for losses exceeding the initial investment is undeniably present with naked options trading.

Furthermore, certain complex financial instruments like leveraged ETFs (Exchange Traded Funds) can also amplify losses. These ETFs use leverage to magnify the returns of an underlying index or asset. While they might offer the potential for higher gains, they also carry a significantly higher risk of losses, particularly over longer periods. The daily rebalancing of these ETFs can lead to a phenomenon known as "volatility decay," which can erode your investment even if the underlying index eventually recovers. While not directly resulting in losses exceeding the initial investment in all cases, the complex mechanics and potential for rapid value depletion make them a risky proposition for inexperienced investors.

It's also important to consider situations involving fraudulent or illegal activities. If you invest in a company that turns out to be a Ponzi scheme or engages in other forms of financial fraud, you could potentially be held liable for some of the company's debts, although this is a very rare and complex legal scenario.

In conclusion, while the common perception of stock investing involves a risk limited to the initial investment, the reality is more complex. Using margin, trading uncovered options, investing in leveraged ETFs, and encountering fraudulent schemes can all potentially lead to losses exceeding your initial capital outlay. Therefore, a thorough understanding of the risks associated with different investment strategies and instruments is crucial for protecting your financial well-being. Before venturing into these more complex areas of the market, it's essential to seek professional financial advice and carefully assess your risk tolerance. The stock market offers opportunities for growth, but it also demands vigilance and a clear understanding of the potential pitfalls.