Can You Make Money? How To Make Money?

The question of whether one can make money is almost rhetorical in its inherent potential. The very existence of a financial system, markets, and economies hinges on the possibility of wealth creation. However, the more pertinent and challenging aspect lies in how one actually achieves this goal. Making money isn't simply a matter of passively waiting for it to materialize; it requires proactive effort, strategic planning, and a degree of risk-taking tempered with caution.

The path to financial success is rarely a straight line, and it rarely looks the same for any two individuals. Factors such as initial capital, risk tolerance, time horizon, and personal circumstances all play significant roles in shaping the optimal strategy. What works for a young, single professional with decades of career ahead of them will be vastly different from what suits a retiree with a fixed income. Therefore, a personalized approach is paramount.

One of the foundational pillars of wealth creation is understanding the difference between active and passive income. Active income is derived from direct labor or services rendered – your salary, freelance work, or profits from a business you actively manage. While essential for building a solid financial base, relying solely on active income can limit your earning potential and create vulnerability to job loss or health issues.

Passive income, on the other hand, is income generated with minimal ongoing effort. This could include rental income from real estate, dividends from stocks, interest from bonds, royalties from intellectual property, or profits from a business that operates relatively autonomously. Building streams of passive income is crucial for long-term financial security and eventually achieving financial independence. The key is to reinvest initial earnings and build up assets that generate income over time.

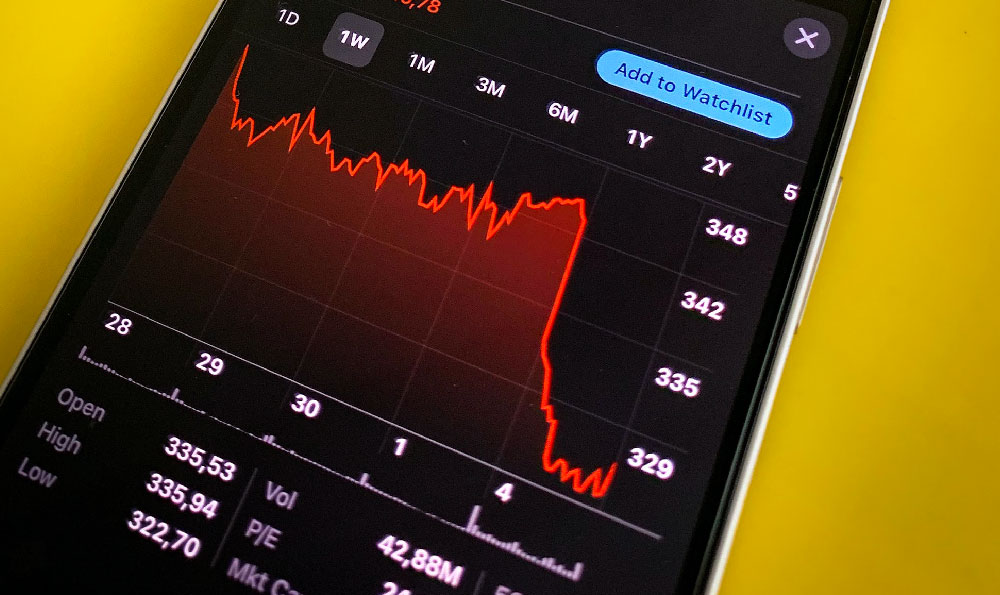

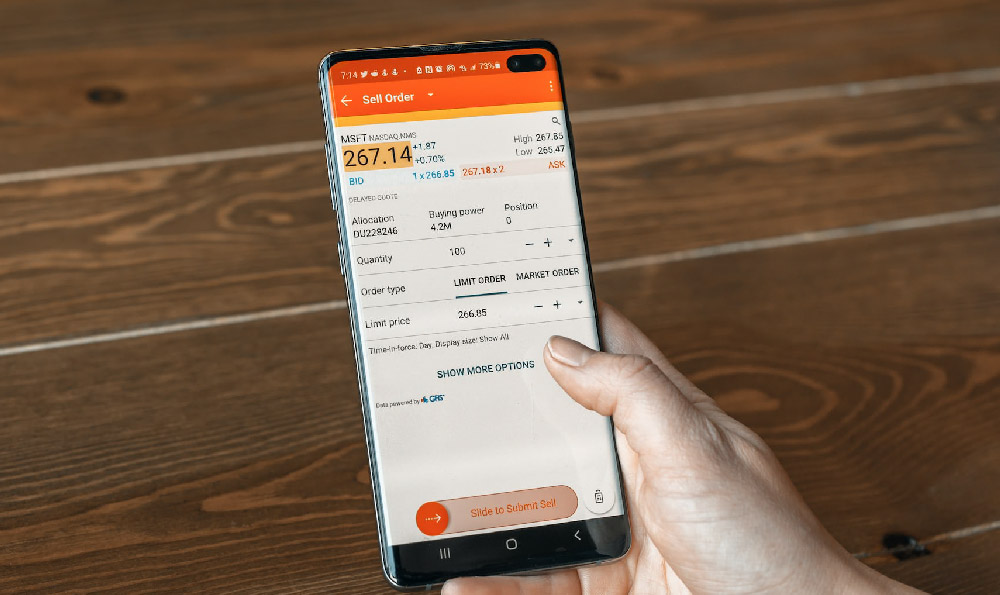

Investing is a cornerstone of wealth accumulation, but it’s vital to approach it with knowledge and discipline. The stock market, for instance, offers the potential for significant returns, but it also carries inherent risks. Diversification is a key strategy to mitigate these risks. Spreading your investments across different asset classes – stocks, bonds, real estate, commodities – and within each asset class, across different industries and geographies, reduces the impact of any single investment performing poorly.

Before diving into any investment, thorough research is essential. Understanding the underlying business model, financial health, and competitive landscape of a company before investing in its stock is crucial. Similarly, understanding the risks and yields associated with different types of bonds, or the intricacies of the real estate market, is paramount. Relying solely on tips or hearsay can be a recipe for disaster.

Beyond traditional investments, entrepreneurship offers another avenue for wealth creation. Starting a business, whether it’s a side hustle or a full-time venture, can provide significant financial rewards, but it also demands a substantial commitment of time, energy, and resources. A well-thought-out business plan, a clear understanding of the target market, and a willingness to adapt to changing circumstances are essential for success. Many successful entrepreneurs start small, reinvesting profits back into the business to fuel growth and expansion.

Furthermore, managing debt effectively is critical. High-interest debt, such as credit card debt, can quickly erode wealth and hinder financial progress. Prioritizing the repayment of high-interest debt and avoiding unnecessary borrowing are essential steps toward financial freedom. In contrast, strategically utilizing low-interest debt, such as a mortgage, can be a tool for wealth creation, particularly when investing in appreciating assets like real estate.

Developing sound financial habits is just as important as generating income. Budgeting, tracking expenses, and saving regularly are fundamental to building wealth. Creating a budget helps you understand where your money is going and identify areas where you can cut back. Saving consistently, even small amounts, allows you to accumulate capital for future investments and unexpected expenses. The power of compounding, where earnings generate further earnings, can significantly accelerate wealth accumulation over time.

Another often overlooked aspect is continuous learning. The financial landscape is constantly evolving, with new investment opportunities and challenges emerging regularly. Staying informed about market trends, economic developments, and changes in financial regulations is crucial for making informed investment decisions. Reading financial news, attending seminars, and consulting with financial professionals can help you stay ahead of the curve.

Finally, patience and discipline are essential virtues in the pursuit of wealth creation. The stock market, for example, can experience periods of volatility and downturns. Resisting the urge to panic sell during market corrections and sticking to your long-term investment strategy is crucial for achieving long-term success. Similarly, avoiding impulsive purchases and maintaining a disciplined approach to saving and investing will significantly increase your chances of achieving your financial goals. Building wealth is a marathon, not a sprint, and requires a long-term perspective and a commitment to continuous improvement.