Is Capital Markets Investment Banking: What Is It, and Is It Right for You?

Capital markets investment banking represents a critical nexus within the global financial system, serving as a bridge between companies seeking capital and investors eager to deploy it. Understanding its intricacies is essential for anyone considering a career within this field or for businesses contemplating utilizing its services. This exploration delves into the core functions, the diverse roles it encompasses, and the potential benefits and drawbacks it presents for both individuals and organizations.

Deciphering the Core Functions of Capital Markets Investment Banking

At its heart, capital markets investment banking facilitates the flow of capital. This primarily manifests through two key activities: underwriting and advisory services. Underwriting involves assisting companies in raising capital by issuing securities such as stocks (equity) and bonds (debt) in the primary market. The investment bank acts as an intermediary, purchasing these securities from the company and then reselling them to investors, assuming the risk of successfully placing the entire offering. Advisory services, on the other hand, provide strategic guidance to companies on mergers and acquisitions (M&A), restructurings, and other significant financial transactions. This involves valuing companies, structuring deals, negotiating terms, and navigating regulatory hurdles.

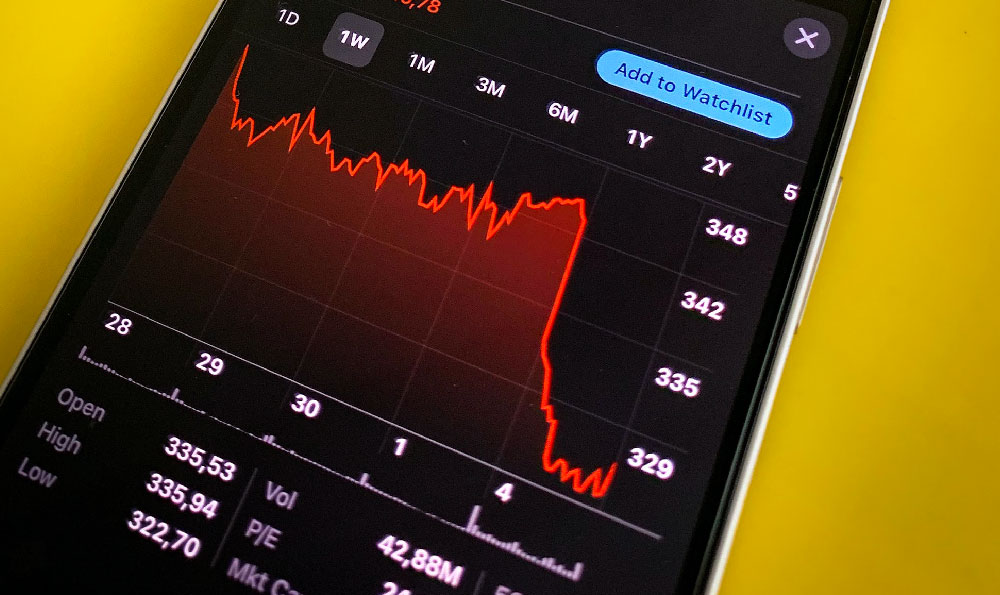

The underwriting process is a complex undertaking, involving meticulous due diligence, market research, and pricing strategies. Investment bankers must accurately assess the market demand for the securities and determine an appropriate price that attracts investors while still generating sufficient capital for the issuing company. A miscalculation can lead to a failed offering, resulting in significant financial losses for both the company and the investment bank.

Advisory services demand a deep understanding of industry dynamics, financial modeling, and strategic thinking. Investment bankers act as trusted advisors, guiding companies through complex transactions that can have a profound impact on their future. Their expertise helps companies make informed decisions that maximize shareholder value and achieve their strategic objectives.

Exploring the Diverse Roles Within Capital Markets Investment Banking

Capital markets investment banking offers a range of specialized roles, each requiring a unique skillset and expertise. Analysts typically form the entry-level ranks, responsible for conducting financial analysis, creating presentations, and supporting senior bankers in their day-to-day tasks. Associates, with a few years of experience, take on greater responsibilities, managing deal processes, interacting with clients, and supervising analysts. Vice Presidents lead deal teams, manage client relationships, and play a crucial role in originating new business. Directors and Managing Directors are senior executives responsible for overseeing entire divisions, developing strategic initiatives, and cultivating relationships with key clients.

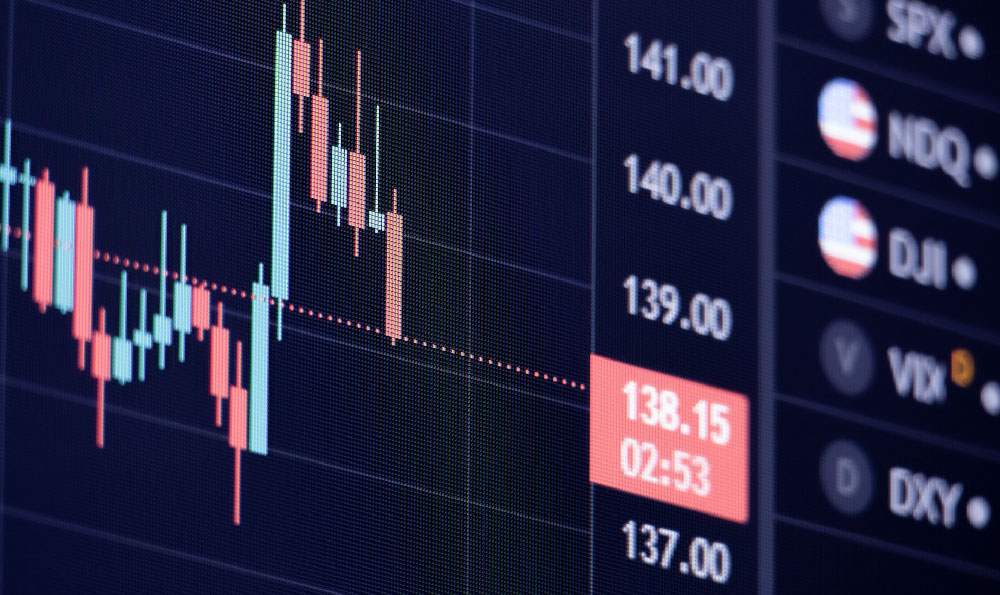

Beyond these traditional roles, specialized functions exist, such as sales and trading, research, and structuring. Sales and trading professionals connect investors with investment opportunities, executing trades and providing market insights. Research analysts provide in-depth analysis of companies and industries, offering investment recommendations to clients. Structuring professionals design complex financial instruments and transactions, tailoring solutions to meet the specific needs of clients.

The compensation structure in capital markets investment banking is typically performance-based, with a significant portion of compensation tied to bonuses. This can lead to substantial earnings for successful bankers, but it also creates a highly competitive and demanding work environment.

Weighing the Pros and Cons: Is It Right for You?

For individuals, a career in capital markets investment banking offers the potential for high compensation, intellectual stimulation, and rapid professional development. However, it also demands long hours, intense pressure, and a relentless focus on performance. Success requires strong analytical skills, exceptional communication abilities, and the ability to thrive in a fast-paced, demanding environment.

For companies, engaging with capital markets investment banks can unlock access to significant capital, enabling growth initiatives, strategic acquisitions, and other transformational transactions. However, it also involves substantial fees and the need to relinquish some control over the company's future. Choosing the right investment bank is crucial, requiring careful consideration of their expertise, track record, and cultural fit.

Navigating the Landscape: Essential Considerations for Success

Both individuals and companies navigating the world of capital markets investment banking must exercise caution and due diligence. For aspiring investment bankers, developing a strong foundation in finance, accounting, and economics is essential. Networking and building relationships with industry professionals can provide valuable insights and opportunities.

For companies seeking capital or advisory services, thoroughly researching potential investment banks is crucial. Evaluating their expertise in the relevant industry, their track record of successful transactions, and their cultural alignment with the company's values are key considerations. Seeking advice from independent financial advisors can also help companies make informed decisions and avoid potential pitfalls.

Furthermore, understanding the regulatory environment is paramount. Capital markets are subject to extensive regulations designed to protect investors and maintain market integrity. Adhering to these regulations is essential for both investment banks and companies engaging in capital markets transactions.

In conclusion, capital markets investment banking plays a vital role in the global financial ecosystem. While offering significant opportunities for both individuals and organizations, it also demands careful consideration, diligent planning, and a thorough understanding of the associated risks and rewards. By approaching this complex landscape with knowledge and prudence, individuals and companies can maximize their chances of success.