CoinPro Dynamic Take Profit Tool: Does it Really Work? Is it Worth the Investment?

Let's delve into the world of automated trading tools, specifically the "CoinPro Dynamic Take Profit Tool," and dissect its potential effectiveness and value as an investment. The allure of such tools is undeniable: the promise of hands-off profit generation in the volatile cryptocurrency market. However, the reality is often more nuanced, requiring careful consideration before committing your capital.

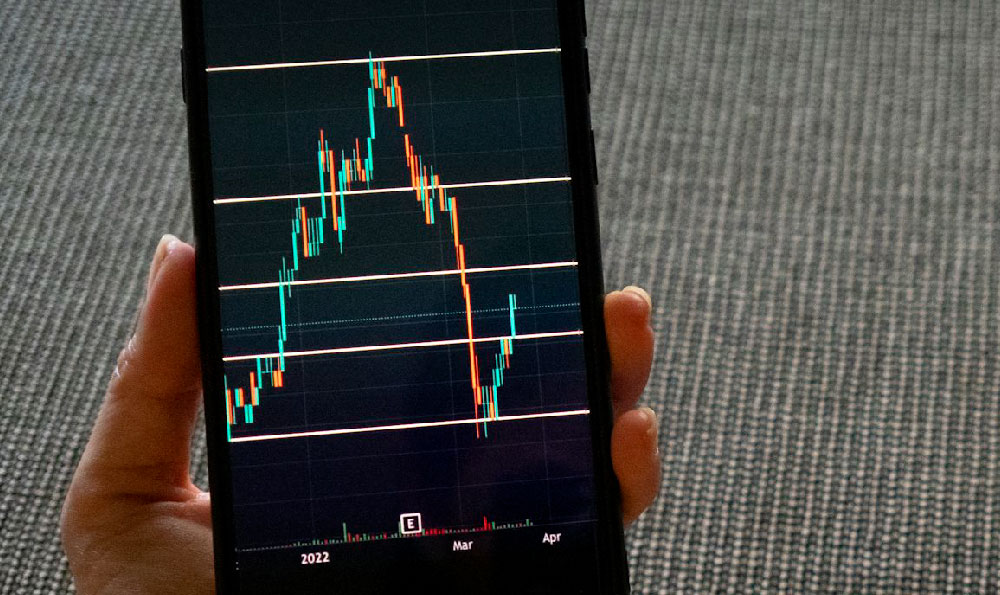

First and foremost, understanding the underlying mechanism of a "Dynamic Take Profit" tool is crucial. These tools, in essence, are designed to automatically close out a winning trade based on pre-defined parameters and market conditions. Unlike a static take profit order, which triggers at a fixed price target, a dynamic take profit aims to capture more upside potential by trailing the price as it rises (or falls, in the case of short positions). The "dynamic" aspect typically involves algorithms that adjust the take profit level based on indicators like volatility, moving averages, or Fibonacci retracement levels.

The core argument for using such a tool revolves around optimizing profit capture. A static take profit order can leave potential gains on the table if the price continues to climb after hitting the target. Conversely, manually adjusting the take profit can be time-consuming and emotionally taxing, especially during rapid price swings. A dynamic take profit theoretically solves both these problems by automating the adjustment process, allowing traders to ride winning trends for longer.

However, the devil lies in the details. The effectiveness of any dynamic take profit tool hinges on the sophistication of its algorithm and its adaptability to different market conditions. A poorly designed algorithm might trigger premature take profit orders, cutting short potentially lucrative trades. Or, it might fail to adjust quickly enough to sudden price reversals, resulting in missed profit targets and even losses.

Therefore, evaluating the "CoinPro Dynamic Take Profit Tool" requires a deep dive into its specifics. What indicators does it use to determine the take profit level? How frequently does it adjust the level? Does it offer customizable settings to cater to different trading styles and risk tolerances? Understanding these factors is essential to assessing its potential performance.

Furthermore, it's vital to scrutinize the historical performance data of the tool. Has it been backtested on a range of market conditions, including bull markets, bear markets, and periods of high volatility? Does the backtesting data demonstrate a consistent track record of profitability? Be wary of overly optimistic claims or cherry-picked data that presents an unrealistic picture of the tool's capabilities. Independent reviews and testimonials from other users can also provide valuable insights, although it's important to treat them with a degree of skepticism, as they can be subject to bias.

Consider also the cost of the tool. Is it a one-time purchase or a recurring subscription? How does the cost compare to the potential benefits it offers? Factor in the opportunity cost of using the tool – could you achieve similar results by manually managing your trades with the same amount of time and effort? It's crucial to conduct a thorough cost-benefit analysis to determine if the investment is justified.

The claim that the tool "really works" is subjective and depends entirely on your individual trading goals and risk tolerance. If you're looking for a completely hands-off solution that guarantees consistent profits, the "CoinPro Dynamic Take Profit Tool," or any automated trading tool for that matter, is unlikely to live up to your expectations. The cryptocurrency market is inherently unpredictable, and no algorithm can perfectly predict future price movements.

However, if you're willing to actively manage the tool, adjust its settings based on market conditions, and accept the inherent risks, it could potentially be a valuable addition to your trading arsenal. Think of it as a tool to augment your existing trading strategy, rather than a replacement for it.

Regarding whether it's "worth the investment," the answer depends on your individual circumstances. If you're a novice trader with limited experience, it might be prudent to focus on learning the fundamentals of technical analysis and risk management before investing in automated trading tools. A strong understanding of market dynamics is essential for effectively using and troubleshooting such tools.

On the other hand, if you're an experienced trader looking to automate certain aspects of your trading strategy and free up your time, the "CoinPro Dynamic Take Profit Tool" could potentially be a worthwhile investment, provided you've done your due diligence and are comfortable with the risks involved.

Ultimately, the decision to invest in the "CoinPro Dynamic Take Profit Tool" should be based on a thorough assessment of its features, performance, cost, and your own trading goals and risk tolerance. Don't be swayed by hype or unrealistic promises. Approach it with a critical eye, and remember that no tool can guarantee profits in the unpredictable world of cryptocurrency trading. Responsible risk management and a sound understanding of market principles remain paramount, regardless of the tools you choose to employ. Consider starting with a demo account or paper trading to test the tool's performance in a simulated environment before committing real capital. This allows you to familiarize yourself with its features and evaluate its effectiveness without risking your own funds.