Coke Investments: What are they? And how do I get involved?

Coke Investments, while not a formally defined or recognized investment product in the traditional financial sense, often refers to a slang term used within certain cryptocurrency circles to describe investments, particularly smaller, speculative altcoins, that have the potential for exponential growth – akin to the perceived widespread reach and popularity of Coca-Cola. The underlying idea is to find a cryptocurrency that is currently undervalued but possesses strong fundamentals, a dedicated community, and innovative technology, with the hope that it will “go viral” and experience a significant price surge, similar to how Coca-Cola became a globally recognized brand.

This concept isn’t necessarily about investing in projects directly affiliated with the Coca-Cola company itself. Instead, it's a metaphor representing the aspiration to identify and invest in the “next big thing” in the crypto space. It embodies the search for coins that have the potential to achieve massive adoption and generate substantial returns for early investors.

Getting involved in identifying and potentially profiting from these "Coke Investments" is a multifaceted process that demands rigorous research, a deep understanding of the cryptocurrency market, and a healthy dose of risk tolerance. This is not a passive investment strategy; it requires active participation and constant monitoring.

The first and perhaps most crucial step is to educate yourself thoroughly about the cryptocurrency ecosystem. This encompasses understanding blockchain technology, different types of cryptocurrencies (Bitcoin, Ethereum, Altcoins, stablecoins, etc.), decentralized finance (DeFi), non-fungible tokens (NFTs), and the various market forces that drive price fluctuations. Resources like academic papers, reputable news sources, industry publications, and online courses can be invaluable in building a strong foundation of knowledge.

Once you have a solid understanding of the fundamentals, the next step is to develop a research framework. This framework should include criteria for evaluating potential "Coke Investments." Some key considerations include:

- Team and Development: Analyze the team behind the project. Are they experienced, reputable, and transparent? Do they have a proven track record in blockchain development? Look for evidence of open-source code, active GitHub repositories, and regular project updates. A strong and committed team is essential for the long-term success of any cryptocurrency project.

- Technology and Innovation: Evaluate the technology underlying the cryptocurrency. Does it solve a real-world problem? Is it innovative and disruptive? Does it offer any advantages over existing solutions? A unique and valuable technology is more likely to attract users and investors.

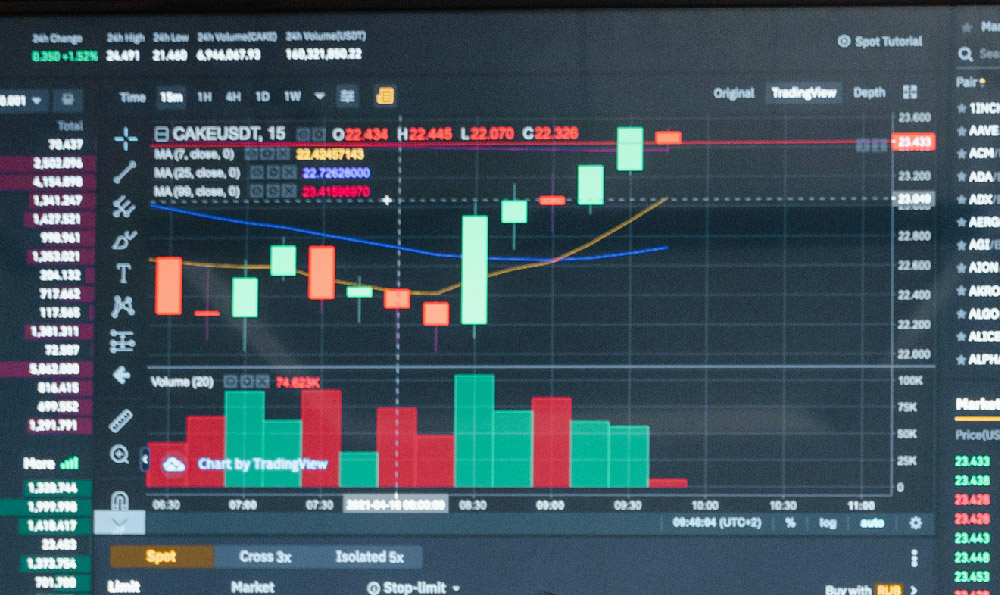

- Market Cap and Trading Volume: Consider the market capitalization and trading volume of the cryptocurrency. While low market cap coins have the potential for higher returns, they also carry a higher risk. Look for coins with sufficient liquidity to ensure that you can buy and sell them without significant price slippage.

- Community and Adoption: Assess the size and engagement of the cryptocurrency's community. A strong and active community can provide valuable support and contribute to the growth of the project. Look for active social media channels, forums, and developer communities.

- Tokenomics: Understand the tokenomics of the cryptocurrency. How many tokens are in circulation? What is the inflation rate? Are there any token burn mechanisms? A well-designed tokenomics model can incentivize long-term holding and contribute to price appreciation.

- Whitepaper and Roadmap: Thoroughly review the project's whitepaper and roadmap. The whitepaper should clearly outline the project's vision, goals, and technical specifications. The roadmap should provide a timeline for future development milestones.

After you have identified a few promising candidates, it's important to conduct a thorough risk assessment. Cryptocurrency investments are inherently volatile and speculative, and you should never invest more than you can afford to lose. Consider the following risks:

- Market Risk: Cryptocurrency prices can fluctuate wildly, and you could lose a significant portion of your investment.

- Regulatory Risk: The regulatory landscape for cryptocurrencies is constantly evolving, and changes in regulations could negatively impact the value of your investment.

- Technology Risk: Cryptocurrency projects are subject to technological risks, such as hacks, bugs, and protocol vulnerabilities.

- Fraud Risk: The cryptocurrency space is rife with scams and fraudulent projects. Be wary of promises of guaranteed returns and do your due diligence before investing in any project.

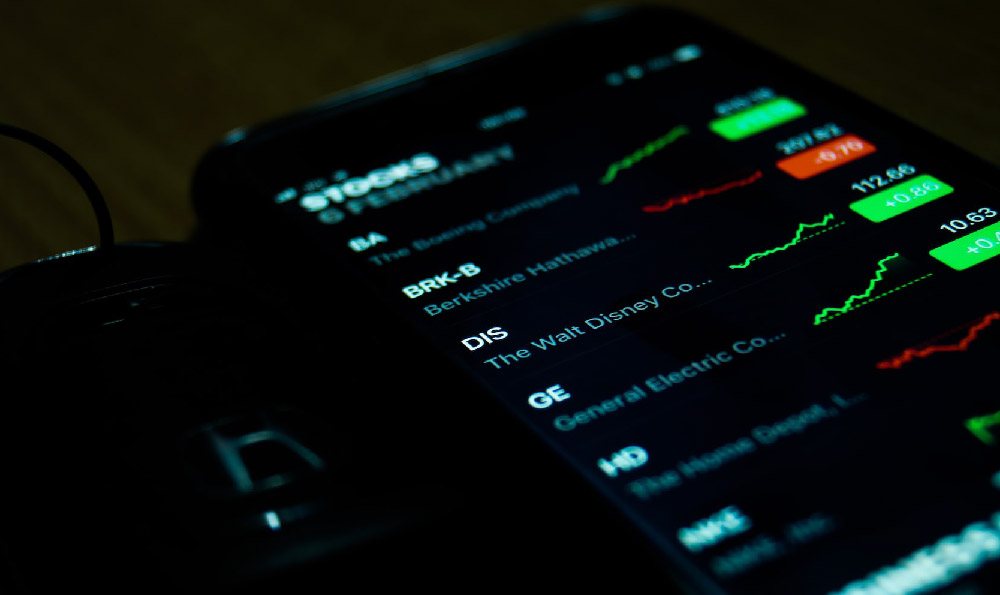

Once you are comfortable with the risks, you can begin to invest in the selected cryptocurrencies. Start with small amounts and gradually increase your position as you gain more confidence. Diversification is key to managing risk. Don't put all your eggs in one basket. Spread your investments across multiple cryptocurrencies.

Furthermore, it's crucial to use reputable cryptocurrency exchanges and wallets. Research the security measures implemented by each platform and choose those with a strong track record of protecting user funds. Enable two-factor authentication (2FA) for all your accounts and use strong, unique passwords. Consider using a hardware wallet for storing your cryptocurrency offline.

Finally, constantly monitor the market and your investments. Stay informed about the latest news and developments in the cryptocurrency space. Be prepared to adjust your investment strategy as market conditions change. Set realistic goals and don't let emotions drive your decisions. Consider setting stop-loss orders to limit potential losses.

Investing in potential "Coke Investments" requires a significant commitment of time, effort, and resources. It's not a get-rich-quick scheme and there are no guarantees of success. However, with thorough research, disciplined risk management, and a long-term perspective, it is possible to identify and profit from the next generation of successful cryptocurrencies. Remember to approach this with caution, and always prioritize protecting your capital. Consider consulting with a financial advisor before making any investment decisions.