Currency Trading: What is it? How Can You Invest?

Currency Trading: A Deep Dive into the World of Forex

The foreign exchange market, often shortened to forex or FX, is a global decentralized marketplace where currencies are traded. Imagine a colossal, invisible bazaar operating 24 hours a day, five days a week, where trillions of dollars change hands, not in goods or services, but solely in the relative value of one nation's currency against another. This is the essence of currency trading, a dynamic and often volatile arena attracting individual investors, corporations, and institutions alike.

At its core, currency trading involves speculating on whether the value of one currency will rise or fall relative to another. Currencies are always traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). When you buy a currency pair, you are essentially buying the base currency (the first currency in the pair) and simultaneously selling the quote currency (the second currency in the pair). For example, if you believe the Euro will strengthen against the US Dollar, you would buy EUR/USD. Conversely, if you think the Euro will weaken, you would sell EUR/USD. Profit or loss is determined by the accuracy of your prediction and the magnitude of the currency movement.

The allure of forex trading lies in several factors. The sheer size of the market – averaging over $6 trillion in daily turnover – creates immense liquidity, meaning that it's relatively easy to enter and exit positions quickly, even with substantial sums of money. Furthermore, the 24/5 operation allows traders to participate at almost any time of day or night, fitting around their schedules. The potential for profit, driven by often rapid and significant currency fluctuations, is another major draw. However, this potential is intertwined with significant risk, as these fluctuations can also lead to substantial losses.

So, how can one actually participate in currency trading? The most common avenue for individual investors is through online forex brokers. These brokers provide platforms that allow traders to access the market, view real-time price quotes, and execute trades electronically. Selecting a reputable and regulated broker is paramount. Regulation ensures that the broker adheres to certain financial standards and provides a level of security for your funds. Look for brokers regulated by well-known financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, or the Australian Securities and Investments Commission (ASIC).

Before venturing into live trading, it's crucial to understand the mechanics of the platform and the intricacies of forex trading. Most brokers offer demo accounts, which allow you to trade with virtual money in a real-time market environment. This is an invaluable tool for practicing trading strategies, getting familiar with the platform's functionalities, and understanding the impact of leverage.

Leverage is a double-edged sword in forex trading. It allows you to control a large position with a relatively small amount of capital. For example, a leverage of 100:1 means that you can control $100,000 worth of currency with just $1,000 in your account. While this can amplify potential profits, it also magnifies potential losses. Using excessive leverage is a common mistake among novice traders and can quickly lead to devastating financial consequences. Prudent risk management involves using leverage sparingly and implementing stop-loss orders, which automatically close your position if the price moves against you beyond a predetermined level.

Developing a solid trading strategy is essential for success in forex trading. A well-defined strategy should outline your entry and exit points, risk management rules, and the rationale behind your trading decisions. There are two primary approaches to currency trading: technical analysis and fundamental analysis.

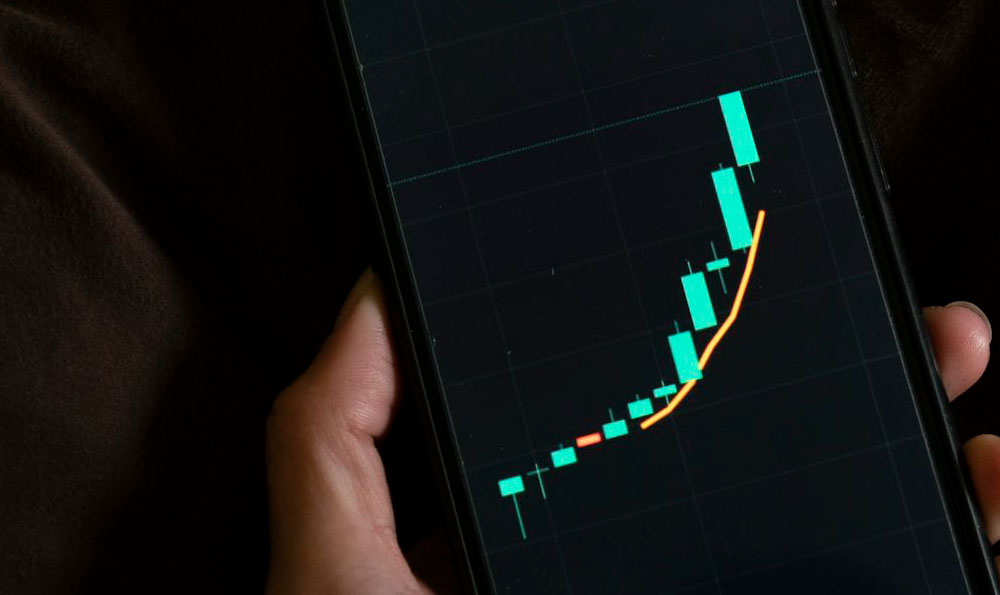

Technical analysis involves studying price charts and using various technical indicators to identify patterns and predict future price movements. This approach relies on the belief that historical price data can provide insights into future price behavior. Common technical indicators include moving averages, Relative Strength Index (RSI), and Fibonacci retracements.

Fundamental analysis, on the other hand, involves analyzing economic data, political events, and other factors that can influence currency values. This approach seeks to understand the underlying economic forces that drive currency movements. Factors such as interest rates, inflation, economic growth, and political stability can all have a significant impact on currency valuations. For instance, if a country's central bank raises interest rates, its currency may appreciate as it becomes more attractive to foreign investors seeking higher returns.

Successful forex traders often combine both technical and fundamental analysis to make informed trading decisions. They use fundamental analysis to identify long-term trends and then use technical analysis to pinpoint optimal entry and exit points.

Beyond the technical and strategic aspects, psychological discipline is paramount. The forex market can be highly emotional, and it's easy to get caught up in the excitement of potential profits or the fear of losses. Maintaining a cool head, sticking to your trading plan, and avoiding impulsive decisions are crucial for long-term success. It's also important to remember that losses are inevitable in trading, and it's how you manage those losses that ultimately determines your profitability.

Finally, continuous learning is essential in the ever-evolving world of forex trading. The market is constantly changing, and new trading strategies and technologies are emerging all the time. Staying informed about market trends, economic developments, and trading techniques is crucial for maintaining a competitive edge. Numerous resources are available online, including educational websites, webinars, and trading communities.

In conclusion, currency trading offers a potentially lucrative but also highly risky investment opportunity. It requires a thorough understanding of the market dynamics, a well-defined trading strategy, disciplined risk management, and a commitment to continuous learning. While the potential rewards can be substantial, it's crucial to approach forex trading with caution and a realistic understanding of the risks involved. It's not a get-rich-quick scheme, but rather a skill that requires dedication, patience, and a willingness to learn from both successes and failures. Before investing any real money, ensure you have thoroughly researched the market, practiced with a demo account, and developed a trading plan that aligns with your risk tolerance and financial goals.