Do architects earn well, or is their income overrated?

Okay, here's an article about the earning potential of architects, written from the perspective of a seasoned financial advisor, focusing on the investment implications and strategies for architects, rather than a straightforward career advice piece.

The perception of architects’ income often hinges on romanticized notions of design genius and prestigious projects, rather than the realities of the profession. While a select few architects achieve considerable wealth, the average income for architects can be a nuanced topic, necessitating a deeper look beyond surface-level assumptions, particularly from a financial planning perspective. It’s not simply about how much they earn, but what they do with their earnings that truly matters for long-term financial security.

To understand the financial landscape for architects, we need to appreciate the factors that influence their earning potential. Experience, specialization, location, firm size, and economic conditions all play a significant role. A freshly graduated architect working in a small rural firm will likely earn significantly less than a seasoned partner at a large urban practice specializing in high-end commercial developments. Geographic location is also a major determinant. Major metropolitan areas with robust construction activity, such as New York City or San Francisco, tend to offer higher salaries than smaller cities or rural areas. Economic cycles, too, influence architect income. During boom periods, demand for architectural services soars, leading to higher fees and increased salaries. Conversely, during economic downturns, construction projects may be put on hold, resulting in layoffs or salary reductions.

Therefore, aspiring architects (and those already in the profession) must actively manage their careers and finances to maximize their potential. Early-career planning is crucial. While pursuing architectural education, it’s beneficial to develop additional skills that can enhance your marketability, such as proficiency in Building Information Modeling (BIM) software, sustainable design principles, or project management techniques. These skills not only increase your chances of landing a desirable job but also allow you to command higher salaries.

Furthermore, architects should strategically plan their career trajectory. Pursuing specialization within a niche area, such as healthcare design, green building, or historic preservation, can significantly boost earning potential. Establishing oneself as an expert in a specific field allows for charging premium rates and attracting high-value clients. Networking and building strong professional relationships are also essential for career advancement and business development.

Beyond career strategies, financial literacy and sound investment planning are absolutely critical for architects to achieve long-term financial success. Many professionals, regardless of their income level, fail to translate their earnings into lasting wealth due to poor financial management. Architects are no exception. The key is to adopt a proactive approach to saving, investing, and debt management.

Early and consistent saving is paramount. Architects should aim to save at least 15% of their gross income for retirement. Take advantage of employer-sponsored retirement plans, such as 401(k)s or profit-sharing plans, and contribute enough to receive the full employer match. If you’re self-employed, explore options such as SEP IRAs or solo 401(k)s. These plans offer tax advantages and allow you to contribute a significant portion of your income towards retirement savings.

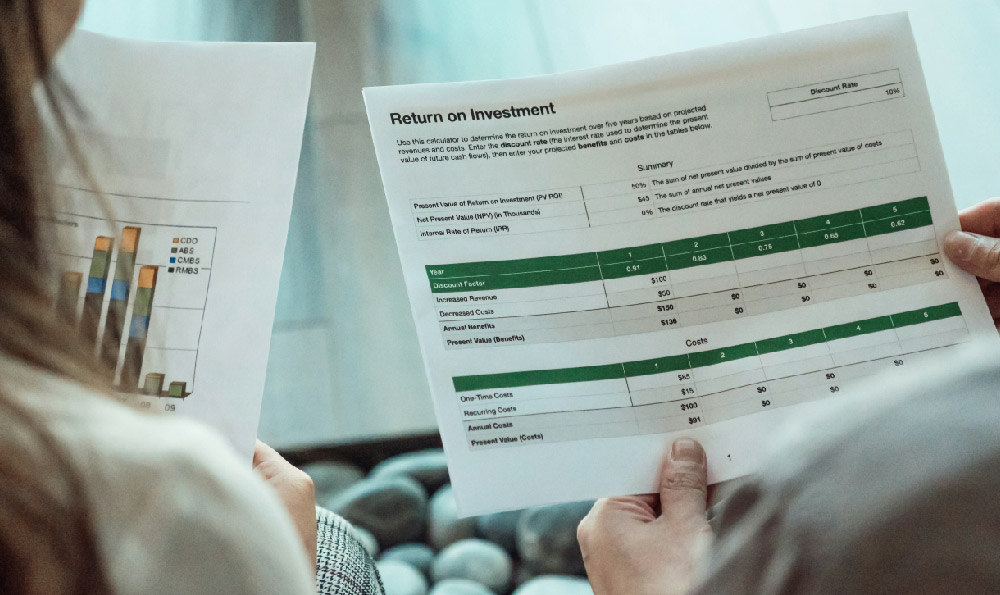

Investing is where architects can truly unlock their financial potential. A diversified investment portfolio, tailored to their individual risk tolerance and time horizon, is essential. While real estate might seem a natural fit for architects, it's crucial to diversify beyond your area of expertise. Consider a mix of stocks, bonds, and real estate investment trusts (REITs) to spread risk and enhance returns. Furthermore, architects should consider seeking professional financial advice to help them navigate the complex investment landscape and make informed decisions.

Another critical aspect of financial planning is debt management. Many architects graduate with significant student loan debt, which can hinder their ability to save and invest. Develop a plan to aggressively pay down high-interest debt, such as credit card debt, as quickly as possible. Consider refinancing student loans to lower interest rates and monthly payments. Prudent debt management frees up cash flow for saving and investing.

It's also worth discussing the potential for architects to leverage their expertise for entrepreneurial ventures. Starting your own firm can be a challenging but rewarding path to financial independence. However, it requires careful planning, financial discipline, and a strong understanding of business management. Architects should develop a solid business plan, secure adequate funding, and build a strong team before launching their own firm.

Finally, architects should regularly review and update their financial plan to ensure it aligns with their changing circumstances and goals. Life events such as marriage, children, or career changes can necessitate adjustments to your savings, investment, and insurance strategies.

In conclusion, while some may view an architect's income as overrated, the truth is that financial success in this profession, as with many others, hinges on a combination of strategic career planning, consistent financial discipline, and informed investment decisions. Architects who take a proactive approach to managing their careers and finances can achieve significant wealth and financial security. It’s not just about the potential to design stunning structures; it’s about building a solid financial foundation that supports their dreams and aspirations throughout their lives. It’s about turning architectural talent into lasting financial wellbeing.