How Much Can You Earn with DoorDash? 2023 Driver Income Guide

As of 2023, the income potential for DoorDash drivers has become a focal point for many individuals seeking supplemental or flexible earnings. The platform, which operates within the gig economy, presents a unique opportunity for drivers to monetize their time and transportation resources, yet its profitability hinges on a complex interplay of factors such as geographic location, personal driving habits, and external market conditions. To fully grasp the financial landscape of DoorDash, it's essential to analyze its income structure, evaluate the variables that influence earnings, and consider strategies that can maximize the returns from this role.

The average hourly wage for DoorDash drivers typically ranges between $15 to $25, though this figure is not universal. In metropolitan areas such as New York City, Los Angeles, or Chicago, where competition is high and delivery demands are more consistent, drivers may earn closer to the upper end of this spectrum. Conversely, in smaller towns or rural regions, where delivery requests are less frequent, the hourly rate might be lower. This variation underscores the importance of location as a critical determinant of income. Moreover, the income is not fixed; it fluctuates based on the number of active restaurants, the efficiency with which drivers complete orders, and the ability to maintain a high rating within the app. Drivers who consistently receive positive feedback from customers often see increased earnings and better access to high-value orders, creating a positive feedback loop that reinforces their financial incentive.

Another dimension influencing DoorDash income is the balance between time investment and financial gain. For instance, a driver who works 20 hours per week in a bustling urban area might generate around $3,000 to $5,000 in monthly earnings, while someone working 10 hours in a less populated region could earn half that amount. This disparity highlights the need for drivers to assess their time availability and prioritize areas where their efforts yield the highest return. Additionally, the income is subject to fluctuations caused by seasonal variations, such as holidays when demand for food delivery surges, or economic downturns that may reduce consumer spending. During peak times, drivers often experience a temporary increase in earnings, but this can be offset by the associated challenges, including longer wait times between orders and increased competition for delivery slots.

The financial viability of DoorDash also depends on the type of vehicle used, the cost of fuel, and the expenses related to maintaining a delivery service. Drivers who opt for a personal vehicle face the burden of mileage expenses, maintenance costs, and insurance premiums, which can significantly impact the net profit. In contrast, those who use a company-provided vehicle may have these costs partially covered, but they might also face additional restrictions on vehicle usage or performance. The affordability of fuel is another variable; for example, in regions where gas prices are soaring, the operational cost of delivering orders may eat into the potential earnings, making it crucial for drivers to plan their routes and schedules accordingly.

To optimize their earnings, drivers should adopt a strategic approach that includes route optimization, order batching, and maintaining a high driver score. Utilizing advanced navigation tools can help drivers select the most efficient paths, reducing time spent on each delivery and increasing the number of orders completed in a given period. Similarly, grouping multiple orders on the same route can minimize travel costs and make use of the time between deliveries more effectively. Maintaining a high rating is equally important; it not only improves visibility in the app but also attracts higher-value orders, potentially increasing both the quantity and quality of work.

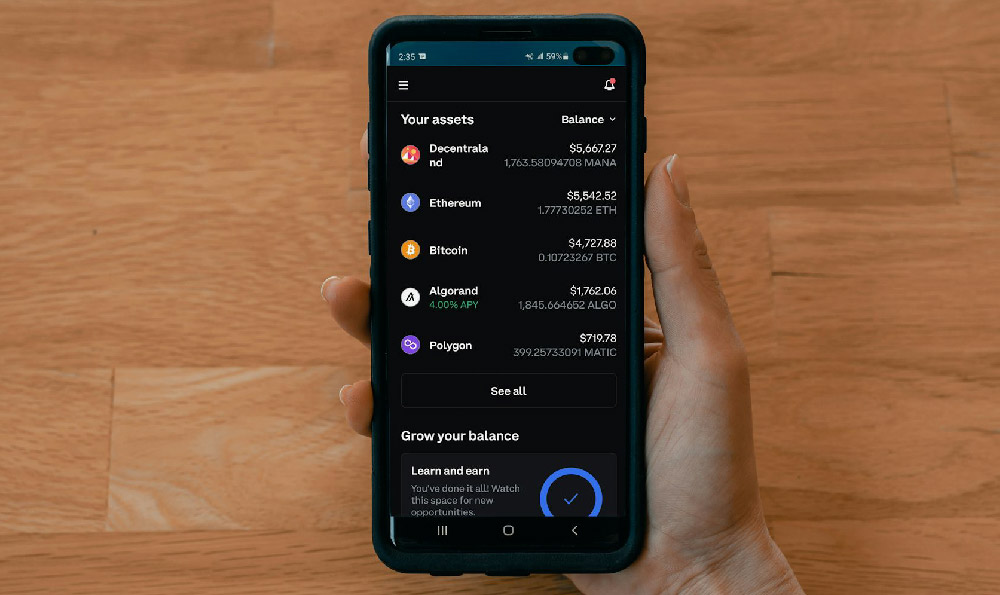

Moreover, drivers can explore ways to complement their income by leveraging the flexibility of the gig economy. For example, combining DoorDash work with other part-time jobs or side hustles can provide a diversified income stream, mitigating the risks associated with reliance on a single platform. Additionally, the income generated through DoorDash can be allocated to various investment opportunities, such as high-yield savings accounts, index funds, or even fractional investing in real estate, thereby fostering long-term financial growth.

In conclusion, while DoorDash offers a lucrative opportunity for drivers to earn money, the actual income depends on a multitude of factors. By understanding the nuances of the platform, drivers can make informed decisions that enhance their earning potential. It's also imperative to approach this work with realistic expectations, recognizing that the income is subject to fluctuations and that success requires a balance of time, effort, and strategic resource management. Ultimately, DoorDash can serve as a valuable tool in the broader context of financial planning, providing drivers with the flexibility to generate income while also exploring avenues for wealth creation.