How Can I Earn a Fortune? What's the Best Way to Make a Lot of Money?

Earning a fortune is a goal many aspire to, and while there's no magic formula, a combination of strategic planning, informed decision-making, and a healthy dose of risk management can significantly increase your chances of success. The path to wealth creation is rarely linear and requires discipline, adaptability, and a willingness to learn continuously. Instead of looking for a get-rich-quick scheme, focus on building a sustainable foundation for long-term financial growth.

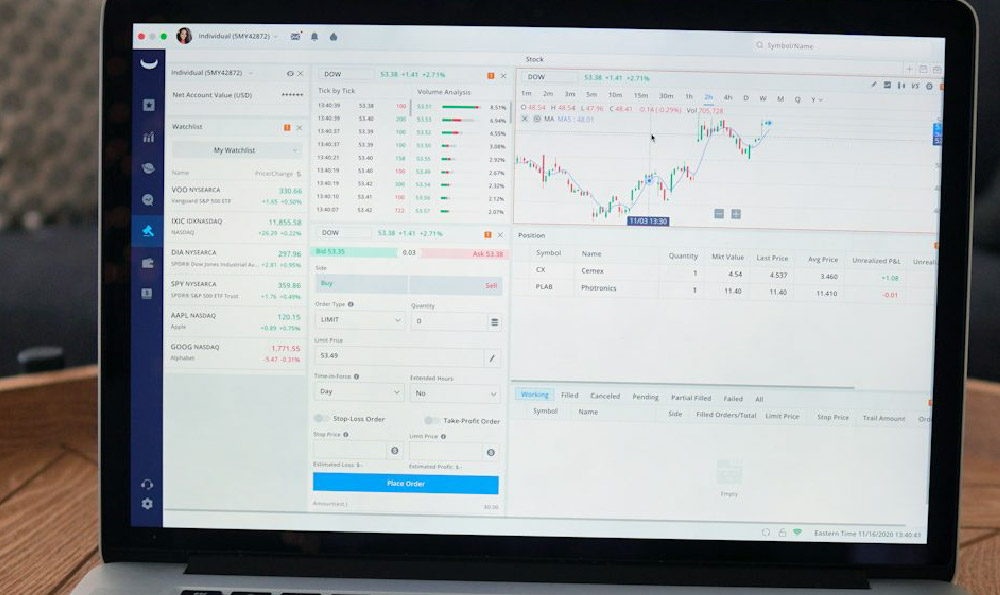

One crucial aspect of building wealth lies in understanding the power of compounding. Starting early and investing consistently, even with small amounts, can lead to substantial returns over time. Consider various investment vehicles like stocks, bonds, real estate, and, more recently, cryptocurrencies. Each asset class carries its own risk profile and potential rewards. Diversification is key to mitigating risk. Spreading your investments across different asset classes and sectors reduces the impact of any single investment performing poorly. A well-diversified portfolio can weather market fluctuations and still generate positive returns.

Diving deeper into the world of cryptocurrencies, one finds a landscape teeming with opportunities, but also fraught with volatility and uncertainty. Bitcoin, as the pioneer and most well-known cryptocurrency, has demonstrated significant growth over the years, but its price can fluctuate dramatically. Ethereum, with its smart contract capabilities, opens up possibilities for decentralized applications (dApps) and decentralized finance (DeFi). Beyond these established players, countless altcoins exist, each with its own unique value proposition and associated risks.

Investing in cryptocurrencies requires a thorough understanding of the underlying technology, market dynamics, and regulatory landscape. Researching specific projects, analyzing their whitepapers, and understanding their tokenomics are crucial steps. Technical analysis, which involves studying price charts and trading volume, can help identify potential entry and exit points. However, it's essential to remember that past performance is not indicative of future results. Fundamental analysis, which involves evaluating the underlying fundamentals of a cryptocurrency project, such as its team, technology, and market adoption, is equally important.

The DeFi space, in particular, offers various avenues for earning passive income through activities like staking, yield farming, and lending. Staking involves holding cryptocurrency in a wallet to support the operations of a blockchain network and earning rewards in return. Yield farming involves providing liquidity to decentralized exchanges and earning transaction fees. Lending involves lending out your cryptocurrency to borrowers and earning interest. While these activities can be lucrative, they also come with risks such as smart contract vulnerabilities, impermanent loss, and regulatory uncertainty.

Protecting your investments from scams and fraud is paramount in the cryptocurrency world. Be wary of projects that promise unrealistic returns or lack transparency. Do your own research and avoid blindly following the advice of influencers or online communities. Use reputable cryptocurrency exchanges and wallets with strong security measures, such as two-factor authentication and cold storage. Never share your private keys with anyone, and be cautious of phishing scams that attempt to steal your login credentials.

Beyond investing, increasing your income through active sources is equally important. Developing valuable skills and pursuing career opportunities that offer higher earning potential can significantly boost your financial resources. Starting a side hustle or business can also provide an additional stream of income and accelerate your wealth-building journey. Continuous learning and staying up-to-date with industry trends are essential for maintaining a competitive edge.

Managing your expenses effectively is another crucial aspect of wealth creation. Creating a budget, tracking your spending, and identifying areas where you can cut back can free up more money for investing. Avoiding unnecessary debt, such as high-interest credit card debt, is also essential. Living below your means allows you to save and invest a larger portion of your income, accelerating your progress towards financial independence.

Financial planning is not a one-time event but an ongoing process. Regularly reviewing your investment portfolio, adjusting your asset allocation as needed, and seeking professional financial advice can help you stay on track towards your financial goals. Understanding your risk tolerance and aligning your investment strategy accordingly is crucial. Market fluctuations are inevitable, and having a long-term perspective can help you avoid making impulsive decisions based on short-term market movements.

Earning a fortune requires a combination of strategic investing, income maximization, expense management, and risk mitigation. While cryptocurrencies offer exciting opportunities for wealth creation, they also come with significant risks. Thorough research, careful planning, and a disciplined approach are essential for navigating this complex landscape. Remember that building wealth is a marathon, not a sprint. Patience, perseverance, and a commitment to continuous learning are key to achieving your financial goals. Finally, consider seeking advice from qualified financial advisors who can provide personalized guidance tailored to your specific circumstances and risk tolerance.