how to earn money from home easily

Earning money from home through virtual currency investments has become a popular strategy in the digital age, driven by the rapid evolution of blockchain technology and decentralized financial systems. While the idea of passive income may seem tempting, it requires careful planning, a deep understanding of market dynamics, and a disciplined approach to avoid the pitfalls that often plague inexperienced investors. The key lies in distinguishing between opportunities that align with long-term value creation and those that lure individuals into high-risk speculation. Here’s a comprehensive guide tailored for those seeking to harness the potential of virtual currency while maintaining financial stability and intellectual rigor.

One of the most compelling reasons to explore virtual currency investments is the global accessibility of digital markets. Unlike traditional financial systems, which often impose geographical and institutional barriers, blockchain-based assets operate 24/7 across the world. This allows individuals to participate in market movements without the need for physical presence, making it an ideal avenue for those with time constraints or geographical limitations. However, the market’s volatility necessitates a strategic mindset. For instance, the rise of decentralized finance (DeFi) platforms has introduced new avenues for passive income, such as liquidity mining and yield farming. These mechanisms enable users to earn returns by providing capital to decentralized protocols, but they also require a thorough evaluation of risks, including smart contract vulnerabilities and impermanent loss.

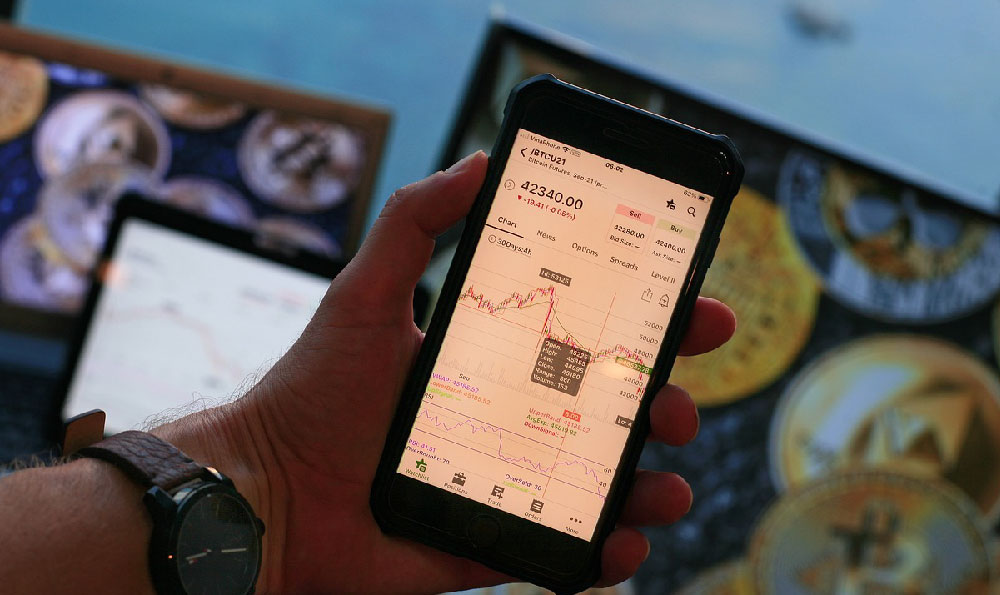

A crucial aspect of successful virtual currency investment is the ability to analyze both macroeconomic trends and micro-level technical indicators. For example, the correlation between Bitcoin’s price and global interest rates or inflationary pressures can offer insights into its long-term trajectory. Meanwhile, technical analysis tools like moving averages, relative strength index (RSI), and volume-weighted average price (VWAP) can help identify short-term entry and exit points. However, it’s essential to avoid overreliance on any single metric. The most astute investors combine fundamental research—such as assessing a project’s utility, team credibility, and tokenomics—with technical analysis to build a well-rounded decision-making framework.

Another strategy that aligns with the goal of earning money from home is the construction of a diversified portfolio. Virtual currency markets are highly fragmented, with thousands of tokens catering to different sectors such as DeFi, non-fungible tokens (NFTs), and tokenized real estate. Diversification across these categories can mitigate the impact of market downturns in any single sector. For example, allocating a portion of capital to stablecoins for liquidity preservation, while investing in high-growth projects like Ethereum-based dApps or emerging tokens in the Web3 space, creates a balanced approach. However, diversification must be paired with thorough due diligence. Many projects in the crypto space lack transparency, and some operate as Ponzi schemes, offering unsustainable returns. Investors must scrutinize whitepapers, community engagement, and real-world applications before committing funds.

The concept of passive income is often misunderstood in the context of virtual currency. While some investors believe in the "set it and forget it" approach, the reality is that even the most established assets require periodic monitoring. For instance, staking cryptocurrencies like Cardano or Cosmos allows users to earn interest by locking up their holdings, but this process is not entirely passive. The user must ensure their wallet remains secure, monitor network updates, and be aware of potential slashing risks. Additionally, the emergence of automatic market makers (AMMs) has enabled algorithm-driven trading strategies that can generate consistent returns, but these tools are not foolproof. They require customization to align with an investor’s risk tolerance and financial goals, and they should never be used as a substitute for critical thinking.

Avoiding investment traps is a cornerstone of sustainable growth in this arena. The crypto market is rife with scams, from phishing attacks targeting user funds to fraudulent Initial Coin Offerings (ICOs) that vanish after raising capital. A cautious investor will prioritize projects with verified teams, audited smart contracts, and a clear roadmap. For example, a token with a robust treasury system and active community governance is often more resilient than one with vague promises. Moreover, the psychological challenge of "FOMO" (fear of missing out) can lead to impulsive decisions, such as buying at market peaks or investing in unproven projects. A disciplined investor must resist these urges and instead focus on long-term fundamentals.

The infrastructure of virtual currency investments is another area that demands attention. Custodial services, such as hardware wallets and custodial exchanges, play a critical role in securing digital assets. While custodial solutions offer convenience, they also introduce counterparty risk, as the user’s funds are entrusted to a third party. A more secure approach involves non-custodial wallets, which give the investor full control over private keys. However, this requires a basic understanding of cybersecurity principles, such as multi-signature setups and regular software updates. The balance between accessibility and security is a recurring theme in this field, and investors must navigate it with expertise.

The legal and regulatory landscape surrounding virtual currency is continually evolving. In some jurisdictions, investing in crypto is tax-free, while others impose stringent reporting requirements. A savvy investor must stay informed about local regulations and maintain accurate records of transactions to avoid legal complications. Furthermore, the rise of institutional investors has led to increased scrutiny of the market, with regulatory bodies issuing guidelines to protect consumers. Staying ahead of these developments can help investors adapt their strategies to changing rules, ensuring long-term compliance.

In conclusion, earning money from home through virtual currency investments is not a get-rich-quick scheme but a multifaceted approach that requires knowledge, patience, and vigilance. The market offers opportunities for passive income through DeFi, staking, and automating trades, but these must be pursued with a thorough understanding of risks and a strategic mindset. By combining macroeconomic insights, technical analysis, and careful due diligence, individuals can navigate this complex landscape and build a resilient portfolio. The greatest challenge is not the market itself, but the investor’s ability to resist short-term temptations and focus on long-term value creation.