Gala Games Investment: Where to Start & Is It Worth It?

Gala Games has undeniably carved out a significant niche within the burgeoning landscape of blockchain gaming and NFTs. Its decentralized approach, player-owned assets, and promise of revolutionizing the gaming industry have attracted considerable attention from both gamers and investors alike. However, before diving headfirst into investing in Gala Games, a comprehensive understanding of its ecosystem, associated risks, and potential rewards is crucial. This exploration will guide potential investors through the initial steps and considerations necessary to determine whether Gala Games aligns with their investment objectives.

Understanding the Gala Games Ecosystem: More Than Just Games

Gala Games isn't just a platform hosting a few games; it's a complex ecosystem powered by its native token, GALA. This token serves multiple purposes: it's used for purchasing in-game items, participating in governance decisions (through voting), and rewarding node operators who support the network's infrastructure. Several factors contribute to the value and utility of GALA.

Firstly, the games themselves play a crucial role. The more popular and engaging the games on the Gala platform become, the higher the demand for GALA tokens, as players use them to enhance their gaming experience. Gala Games boasts a diverse portfolio of games, ranging from strategy and farming simulations to role-playing games and arena brawlers. The variety aims to cater to a broad audience and ensure sustained user engagement. Secondly, the Gala Games network relies heavily on its node operators. These individuals run software on their computers to validate transactions and maintain the network's integrity. In return for their services, they receive GALA tokens as rewards. The number of active nodes and the efficiency of the network directly impact the performance and security of the Gala Games platform. Thirdly, governance is a key aspect of the Gala Games ecosystem. GALA token holders have the opportunity to participate in voting on important decisions related to the platform's development and future direction. This decentralized governance model empowers the community and allows them to shape the platform's evolution.

Exploring Investment Opportunities Within Gala Games

Investing in Gala Games extends beyond simply buying GALA tokens. Several avenues exist for participating in the Gala Games ecosystem:

- Purchasing GALA Tokens: This is the most straightforward way to invest. GALA tokens are available on various cryptocurrency exchanges. The price of GALA is subject to market volatility and is influenced by factors such as platform adoption, game popularity, and overall market sentiment.

- Becoming a Node Operator: Running a Gala Games node requires purchasing a license and dedicating computing resources. While it involves a higher initial investment, it offers the potential for earning GALA tokens as rewards. The profitability of running a node depends on factors such as the number of active nodes, the reward structure, and the price of GALA.

- Investing in NFTs: Each game within the Gala Games ecosystem features unique NFTs, such as characters, weapons, and land plots. These NFTs are often limited in supply and can be traded on the Gala Games marketplace or other NFT platforms. Investing in NFTs requires careful evaluation of their rarity, utility, and potential demand.

- Supporting Specific Games: Certain games within the Gala Games ecosystem may offer opportunities to invest directly in their development or acquire in-game assets early on. This can involve purchasing early access passes, participating in crowdfunding campaigns, or acquiring rare NFTs associated with the game.

Assessing the Risks Associated with Gala Games Investment

Investing in Gala Games, like any investment, carries inherent risks that potential investors should carefully consider:

- Market Volatility: Cryptocurrency markets are notoriously volatile, and the price of GALA can fluctuate significantly in short periods. This volatility can be influenced by factors such as market sentiment, regulatory changes, and competition from other blockchain gaming platforms.

- Platform Risk: The success of Gala Games depends on its ability to attract and retain users, develop engaging games, and maintain a stable and secure network. Any technical issues, security breaches, or failures to meet user expectations could negatively impact the value of GALA and other assets within the ecosystem.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies and NFTs is constantly evolving. Changes in regulations could potentially impact the legality, taxation, and overall viability of Gala Games and its associated assets.

- Competition: The blockchain gaming industry is highly competitive, with numerous platforms vying for users and developers. Gala Games faces competition from established gaming companies, as well as emerging blockchain gaming platforms.

- NFT Valuation Risk: The value of NFTs is subjective and can be influenced by factors such as rarity, utility, and community sentiment. There is no guarantee that an NFT purchased within the Gala Games ecosystem will retain its value or appreciate over time. Demand for certain NFTs can dwindle, leaving investors holding assets that are difficult to sell.

Starting Your Gala Games Investment Journey: A Step-by-Step Guide

If you've carefully considered the risks and believe that Gala Games aligns with your investment objectives, here's a step-by-step guide to get you started:

- Conduct Thorough Research: Before investing any money, dedicate time to researching Gala Games. Read their whitepaper, explore their website, and follow their social media channels. Understand the ecosystem, the games, the GALA token, and the node network.

- Set a Budget and Risk Tolerance: Determine how much capital you're willing to invest and your level of risk tolerance. Never invest more than you can afford to lose. Diversification is key to mitigating risk.

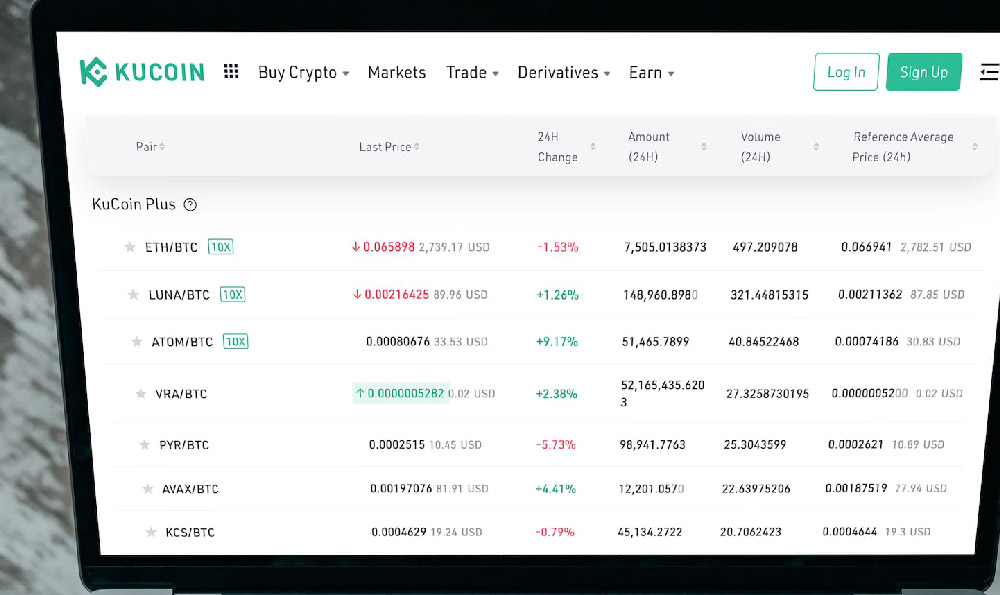

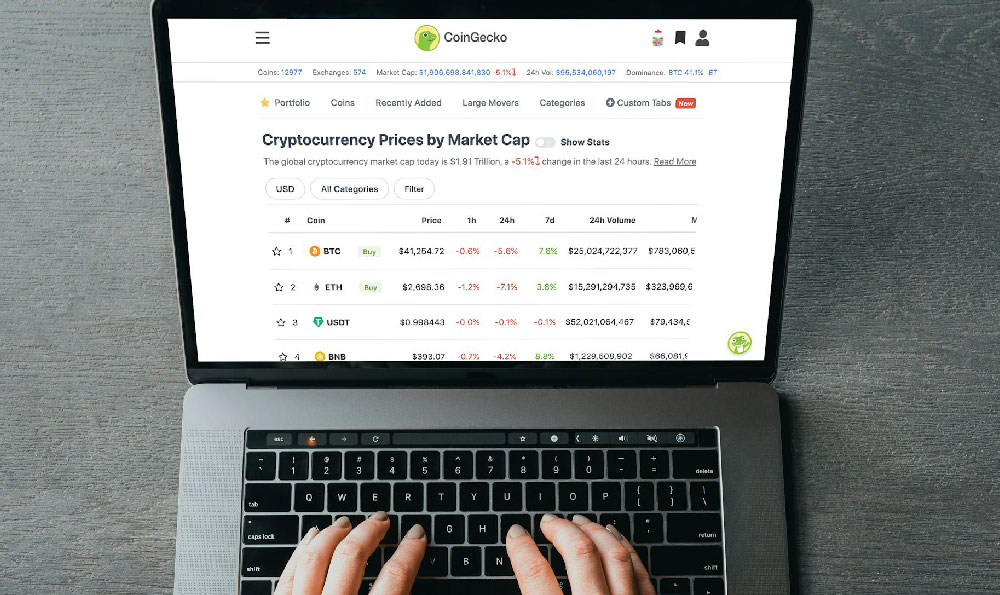

- Choose a Reputable Exchange: Select a reputable cryptocurrency exchange that lists GALA tokens. Ensure the exchange has robust security measures and complies with relevant regulations.

- Secure Your Wallet: Store your GALA tokens and NFTs in a secure wallet. Consider using a hardware wallet for maximum security. Always enable two-factor authentication (2FA) on your exchange account and wallet.

- Start Small: Begin with a small investment to familiarize yourself with the platform and the dynamics of the GALA token and NFT markets.

- Stay Informed: Continuously monitor the Gala Games ecosystem, news, and market trends. Stay updated on any announcements, partnerships, or developments that could impact the value of your investment.

- Engage with the Community: Participate in the Gala Games community forums and social media channels. This can provide valuable insights and help you stay informed about the latest developments.

Is Gala Games Worth Investing In? A Balancing Act

Ultimately, the decision of whether or not to invest in Gala Games is a personal one that depends on your individual circumstances, risk tolerance, and investment objectives. Gala Games presents a compelling vision for the future of blockchain gaming, with its focus on player ownership, decentralized governance, and engaging gameplay. However, it's crucial to acknowledge the inherent risks associated with cryptocurrency and NFT investments.

A cautious and informed approach is paramount. By conducting thorough research, understanding the ecosystem, assessing the risks, and starting small, potential investors can make a well-informed decision about whether Gala Games aligns with their financial goals. The future of blockchain gaming is uncertain, but Gala Games has positioned itself as a significant player in this emerging industry, offering both potential rewards and inherent risks to those willing to explore its ecosystem. Due diligence is the cornerstone of any successful investment strategy.