How to Get Rich Fast: Wealth Building Strategies and Tips for Financial Freedom

Getting rich fast is a common aspiration, but the path to financial freedom requires more than just quick fixes. While the allure of overnight wealth can be tempting, sustainable strategies often focus on long-term growth, discipline, and smart decision-making. Whether you're looking to build a substantial portfolio or achieve a balance between ambition and prudence, the following insights offer a framework for progressing toward your goals without compromising ethical or legal boundaries.

Financial freedom is rarely achieved through a single method; it emerges from a combination of consistent habits, strategic investments, and a mindset aligned with wealth creation. One of the most overlooked yet fundamental principles is the power of compound interest. By reinvesting returns over time, even modest contributions can grow significantly. For example, investing $100 monthly at an average annual return of 7% for 30 years could result in over $120,000, a number that reflects the exponential nature of growth rather than immediate gains. This approach emphasizes patience and the importance of starting early, as the compounding effect accelerates with time.

Diversification is another critical factor that separates informed investors from those who chase quick wins. Spreading capital across multiple asset classes—such as stocks, bonds, real estate, or alternative investments—helps mitigate risks and stabilize returns. A well-structured portfolio might allocate 60% to equities, 30% to fixed income, and 10% to tangible assets, but these percentages depend on individual risk tolerance and financial goals. While diversification doesn't guarantee profitability, it reduces the likelihood of catastrophic losses, allowing wealth to grow more steadily. This strategy also aligns with the principle of not putting all eggs in one basket, which is essential for long-term security.

In contrast to short-term speculation, the focus on value investing can offer a more reliable pathway to wealth. Value investors analyze companies, markets, and economic trends to identify undervalued opportunities with strong fundamentals. By purchasing assets at a discount and holding them until their intrinsic value is realized, this approach prioritizes quality over speed. Historical data from successful value investors like Warren Buffett demonstrates that consistent, long-term decision-making often outperforms impulsive trading, even in volatile markets. However, value investing requires research, analysis, and the ability to resist market noise, which can be challenging for newcomers.

Another overlooked strategy is the importance of financial literacy and continuous learning. Understanding how to manage expenses, save effectively, and make informed investment decisions is foundational to wealth building. For instance, creating a budget that prioritizes essential spending while allocating a percentage to savings and investments can create a foundation for future growth. Additionally, staying informed about market trends, economic indicators, and financial tools enables better decision-making. This includes educating oneself on topics like tax optimization, retirement planning, and asset allocation, which are crucial for maintaining financial stability.

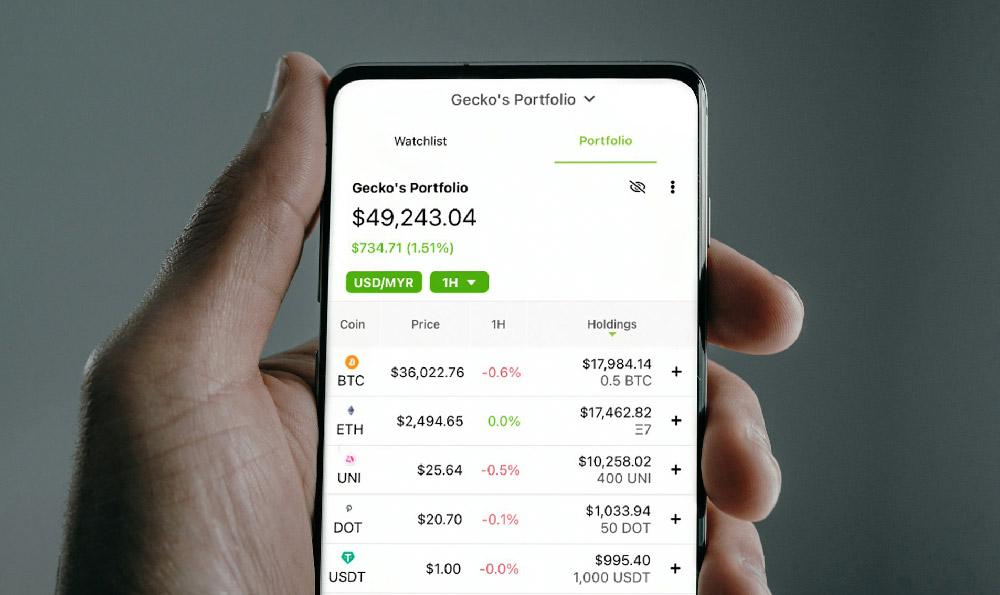

While some individuals might pursue high-risk ventures like cryptocurrency or speculative trading, these paths often come with significant volatility and uncertainty. The cryptocurrency market, for instance, has seen rapid growth and sharp declines, making it a double-edged sword. While some investors have achieved substantial returns, others have faced severe losses due to market fluctuations and lack of understanding. Similarly, speculative trading in stocks or commodities can offer quick profits but requires expertise and a deep understanding of market dynamics. These methods are not inherently unethical, but they demand caution and a clear awareness of the risks involved.

Traditional avenues like real estate, stocks, and retirement accounts remain cornerstones of wealth building for many. Real estate investments, for example, can offer both rental income and appreciation, but they require capital, time, and a thorough understanding of the market. In contrast, stocks allow individuals to participate in corporate growth and innovation, but they also require an analysis of company performance and market conditions. Retirement accounts, on the other hand, provide a structured way to save and invest over time, with tax advantages that can amplify long-term returns. While these options may not generate immediate wealth, they are generally more stable and accessible for most investors.

In conclusion, achieving financial freedom is a multifaceted process that combines strategic planning, disciplined habits, and continuous learning. While the pursuit of quick wealth is appealing, it often leads to short-term gains with long-term risks. By focusing on long-term goals, diversifying investments, and leveraging compound growth, individuals can create a foundation for sustainable wealth. This requires patience, vigilance, and a commitment to financial education, which are essential for navigating the complexities of the financial world. Ultimately, the journey to wealth is not about getting rich fast, but about building a path that leads to lasting financial security.