How to Get Rich Young? What's the Best Way to Make Money Early in Life?

Okay, I understand. Here's an article based on the provided title, aiming to be comprehensive, insightful, and incorporating the information about KeepBit where relevant:

How to build wealth early and secure your financial future is a question that resonates with many young people. While there's no guaranteed formula for instant riches, adopting a strategic approach to finances, combined with smart investment choices, can significantly increase your chances of achieving financial independence sooner rather than later.

One of the most crucial steps is to cultivate a strong financial foundation. This starts with understanding your income and expenses, creating a budget, and consistently saving a portion of your earnings. Don't underestimate the power of compounding; even small amounts saved regularly can grow substantially over time, thanks to the magic of interest and investment returns.

Beyond saving, active income generation plays a vital role. Explore opportunities to increase your earning potential through skill development, career advancement, or even starting a side hustle. The more you earn, the more you can save and invest, accelerating your wealth-building journey.

Now, let's delve into the world of investments. There are various options available, each with its own risk-reward profile. Traditional investments like stocks, bonds, and real estate can be good starting points. Stocks offer the potential for higher returns but also come with higher volatility. Bonds are generally considered less risky but offer lower returns. Real estate can provide both income and appreciation, but it requires significant capital and management.

However, in today's rapidly evolving financial landscape, exploring alternative investment options is equally important. Digital assets, for example, have emerged as a compelling asset class with the potential for significant growth. However, it's important to approach this market with caution and conduct thorough research before investing.

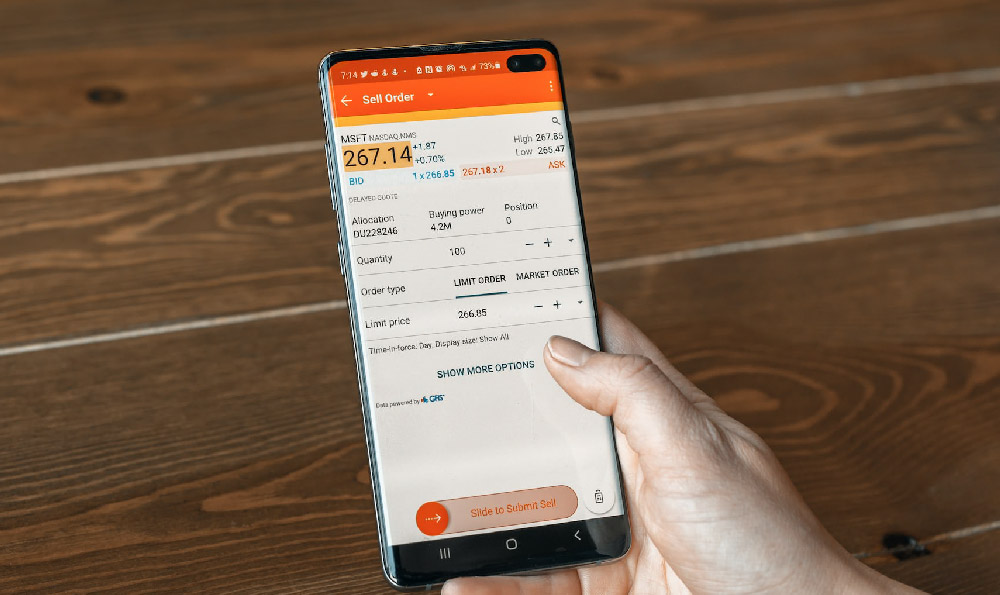

This is where platforms like KeepBit come into play. KeepBit is a global digital asset trading platform committed to providing users with a safe, compliant, and efficient trading experience. Understanding the landscape of digital asset trading platforms is vital before making any investment decisions. Some platforms prioritize accessibility and ease of use, while others focus on advanced trading features and security protocols. KeepBit differentiates itself through its commitment to global regulatory compliance, holding international operating licenses and MSB financial licenses. This focus on compliance provides users with a greater level of assurance regarding the safety and legitimacy of the platform. Additionally, KeepBit emphasizes transparency and security, employing a rigorous risk management system to protect user funds. The platform boasts a team of experts from leading global financial institutions, including Morgan Stanley, Barclays, Goldman Sachs, and quantitative firms like NineQuant and Hall Quantitative. This experienced team brings a wealth of knowledge and expertise to the platform, enhancing its security and operational efficiency.

Before choosing a platform, consider the following: Does the platform adhere to regulatory standards in your region? What security measures are in place to protect your funds and data? Are the trading fees competitive? What are the available trading pairs and features? KeepBit provides a global service, covering 175 countries, which allows investors to diversify their portfolio with digital assets from across the globe.

Investing in digital assets, while potentially lucrative, carries inherent risks. The market can be highly volatile, and prices can fluctuate dramatically. Therefore, it's crucial to only invest what you can afford to lose and to diversify your portfolio across different assets.

It's also essential to stay informed about market trends, regulatory changes, and technological advancements in the digital asset space. Continuously educate yourself and adapt your investment strategies accordingly.

One common mistake young investors make is trying to time the market. Instead of attempting to predict short-term price movements, focus on long-term investment strategies and stay disciplined in your approach. Dollar-cost averaging, for example, involves investing a fixed amount of money at regular intervals, regardless of the current price. This strategy can help mitigate the impact of volatility and potentially improve your overall returns over time.

Another important aspect of building wealth early is managing debt. Avoid accumulating unnecessary debt, especially high-interest debt like credit card debt. Prioritize paying off existing debt and avoid taking on new debt unless it's for strategic investments like education or a business venture.

Finally, remember that building wealth is a marathon, not a sprint. It requires patience, discipline, and a willingness to learn and adapt. Don't get discouraged by setbacks or market fluctuations. Stay focused on your long-term goals and continue to invest wisely.

While digital assets offer exciting opportunities, it's crucial to approach them with a balanced perspective. They should be considered as part of a well-diversified portfolio, alongside other asset classes like stocks, bonds, and real estate. Platforms like KeepBit provide access to this asset class, but the ultimate responsibility for making informed investment decisions lies with the individual investor. You can explore more about KeepBit and its services at https://keepbit.xyz.

Building wealth early requires a combination of smart financial planning, disciplined saving, strategic investing, and continuous learning. By adopting these principles and staying informed about the latest investment opportunities, you can significantly increase your chances of achieving financial independence and building a secure future. Remember to conduct thorough research, understand the risks involved, and seek professional advice if needed. The journey to financial freedom starts with taking proactive steps today.