How Do ATM Machines Generate Profit and Earn Money

ATM machines have become an essential part of the global financial ecosystem, offering convenience for users while serving as a critical revenue stream for banking institutions. Beneath their sleek exteriors and automated functions lies a complex financial model that balances operational expenses with profit generation. Understanding this structure reveals how these cashless kiosks not only survive in a rapidly evolving market but also contribute significantly to the bottom line of financial service providers. The interplay between technology, infrastructure, and user behavior shapes the profitability of these machines, making them a strategic asset beyond their surface-level purpose of dispensing cash.

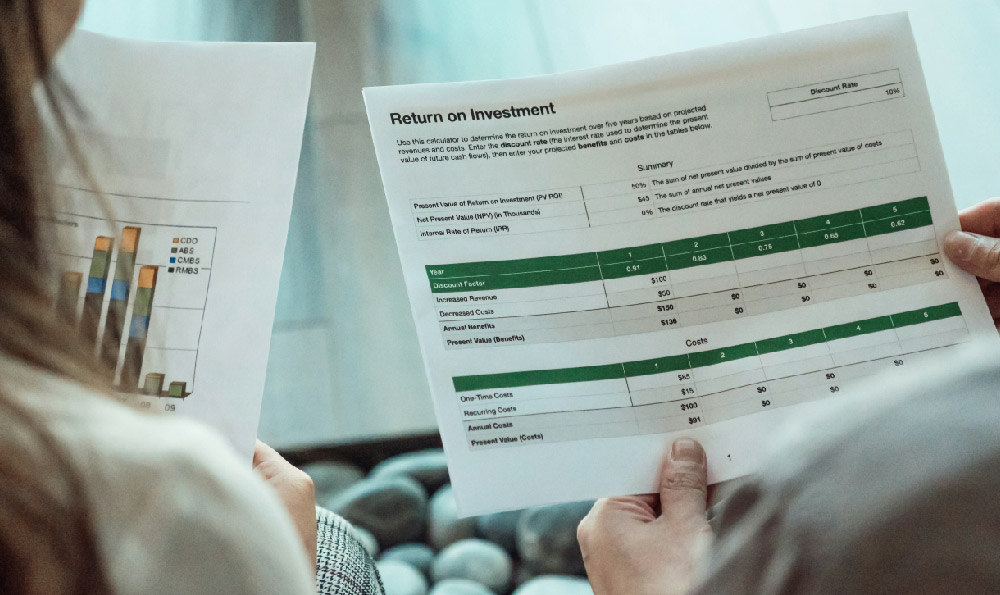

One of the most straightforward ways ATM machines generate profit is through transaction fees. Early in their development, banks adopted a model where each withdrawal, deposit, or balance inquiry carried a nominal charge. These fees, though often small, accumulate over millions of transactions annually, creating a steady revenue flow. For example, a single ATM might process hundreds of transactions daily, with each transaction averaging a few cents in fee income. In addition to basic fees, some machines charge extra for overnight cash deposits, currency exchange services, or cashback options. These ancillary charges allow banks to monetize the diverse services their ATMs offer, even as users increasingly expect them to be free.

Beyond direct user charges, the operational model of ATMs relies heavily on cost recovery. The initial investment in purchasing and deploying an ATM is substantial, requiring precise planning to ensure profitability. Manufacturers and banks collaborate to design machines with built-in cost structures, including maintenance and replenishment expenses. For instance, refilling an ATM with cash and managing the supply chain for bills and coins involves significant logistical costs, which are often offset through long-term contracts and volume-based pricing agreements. Moreover, the energy consumption, software updates, and hardware replacement schedules must be managed to minimize overhead, a challenge that drives continuous innovation in ATM technology.

The profitability of ATM machines is also influenced by location and usage patterns. High-traffic areas such as commercial districts, shopping malls, or airports yield more transactions per day than quieter suburbs or rural regions. Financial institutions leverage geospatial data to optimize ATM placement, ensuring maximum return on capital. Additionally, emerging technologies like biometric authentication or mobile integration enable personalized services, reducing the need for physical cash and increasing the reliance on digital transaction fees. These advancements allow banks to diversify their revenue sources while enhancing user experience.

Another crucial aspect of ATM profitability lies in the ecosystem of ancillary services they enable. The widespread adoption of ATMs has reduced the necessity for traditional bank branches, allowing institutions to allocate resources more efficiently. However, ATMs also serve as mini-branches in their own right, offering services like loan applications, account management, and customer support. This duality means that while ATMs lower operational costs in some areas, they simultaneously expand the range of services available for free or at a minimal cost. For example, a well-placed ATM might become a hub for digital financial services, indirectly increasing the value of the banking institution's broader offerings.

The financial model of ATMs extends into data analytics and user behavior tracking. Each interaction with an ATM generates valuable insights, from cardholder preferences to transaction frequencies. These data points enable banks to tailor their services, adjust pricing strategies, and even expand into related markets. For instance, if an ATM detects high demand for cross-border payments, the institution might invest in currency conversion tools or partner with fintech firms to offer such services. This proactive approach ensures that ATMs remain not just cash-dispensing devices but also dynamic revenue generators in the financial sector.

In addition to direct income, the profitability of ATM machines is tied to their role in fostering customer loyalty. Regular access to ATMs encourages users to maintain accounts with the institution, creating a stable customer base. Banks use this relationship to promote value-added services, such as investment options, insurance, or credit cards, which can generate additional revenue. For example, an ATM might serve as a gateway for users to access mobile banking apps, increasing their engagement with the institution's broader financial ecosystem. This strategy transforms ATMs into revenue multipliers, combining transactional fees with opportunities for cross-selling.

The financial viability of ATMs also depends on partnerships and shared infrastructure. Many banks operate under franchise models, where third-party companies handle the technical aspects of ATM maintenance and operations. These agreements allow financial institutions to reduce upfront costs while ensuring consistent service delivery. Furthermore, the integration of shared networks means that ATM machines can be used across multiple banks, expanding their utility and ensuring a broader revenue base. This collaborative approach not only lowers expenses but also enhances the profitability of the entire system.

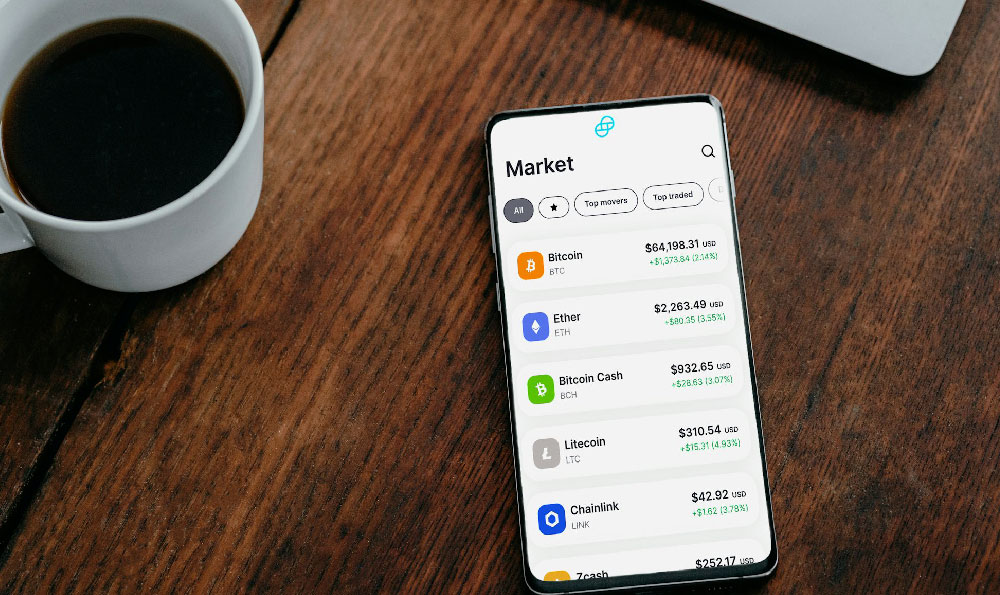

Looking ahead, the profitability of ATM machines is poised to evolve further as they adapt to digital trends. The rise of contactless payments, mobile wallets, and biometric verification is shifting user expectations, requiring banks to innovate their revenue models. For example, some institutions are experimenting with digital currency support, allowing ATMs to serve as conduits for blockchain transactions. These developments position ATMs as more than just physical devices—they become platforms for next-generation financial services, ensuring continued profitability in a competitive landscape.

Ultimately, the financial success of ATM machines reflects a broader strategy for banks to maximize value. While their primary function remains cash transactions, they have become integral to generating revenue through fees, data monetization, and integrated services. As technology advances and consumer behavior changes, the focus will shift toward creating sustainable models that align with both business objectives and user needs. This dynamic balance ensures that ATMs remain a profitable and evolving component of the global financial industry.