How Do Bond Traders Profit? And What Strategies Do They Use?

Bond traders navigate the complex world of fixed income securities to generate profits. Their success hinges on a deep understanding of economic indicators, interest rate movements, and market sentiment. They employ a variety of strategies, some straightforward and others highly sophisticated, to capitalize on perceived mispricings and trends within the bond market. Let’s delve into how they do it.

At its core, bond trading profit generation relies on accurately predicting future price movements. This prediction, in turn, relies on assessing various factors that influence bond yields. Interest rate anticipation is paramount. Bond prices and interest rates have an inverse relationship: when interest rates rise, bond prices fall, and vice versa. Traders who anticipate a fall in interest rates (often called being "long" on bonds) will buy bonds, expecting their prices to appreciate. Conversely, anticipating rising rates prompts them to sell bonds ("shorting" bonds) before their prices decline.

One primary method of profiting from bonds is through directional trading. This involves taking a position based on a predicted movement of interest rates or a specific bond yield curve. For example, a trader might believe that the Federal Reserve will cut interest rates. They would then purchase bonds, expecting that the lower rates will drive up bond prices, leading to a profit when they sell. Or, they might anticipate an uptick in inflation, which usually prompts central banks to raise rates. They might then choose to "short" bonds or reduce their bond holdings, aiming to avoid losses as bond prices fall.

A more sophisticated strategy is yield curve trading. The yield curve plots the interest rates (or yields) of bonds with different maturities. Traders often analyze the shape of the yield curve (whether it's steep, flat, or inverted) to identify opportunities. A steepening yield curve (where long-term rates are rising faster than short-term rates) might signal economic growth, prompting traders to buy longer-term bonds expecting further appreciation. Conversely, a flattening or inverting yield curve (where short-term rates are higher than long-term rates) can indicate an impending recession, leading traders to reduce their exposure to longer-term bonds. Specific yield curve strategies include "butterfly trades," where traders bet on the relative performance of bonds with different maturities, aiming to profit from anticipated changes in the curve's shape.

Another important aspect of bond trading is relative value trading. This strategy involves identifying mispricings between similar bonds. For instance, a trader might compare a corporate bond to a government bond with a similar maturity and credit rating. If the corporate bond offers a higher yield than the government bond (after accounting for the credit risk), the trader might buy the corporate bond and sell the government bond, anticipating that the spread between the two yields will narrow. This type of trading relies on understanding credit risk assessment and the various factors that can influence the relative attractiveness of different bonds.

Credit spread trading focuses specifically on the difference in yield between bonds with different credit ratings. Traders analyze the creditworthiness of issuers and predict how credit spreads will evolve. If a trader believes that a company's credit rating will improve, they might buy that company's bonds, expecting the yield spread to narrow as the company's perceived risk decreases. Conversely, if they anticipate a downgrade, they might sell the company's bonds or short them, hoping to profit from the widening spread.

Carry trades are another common strategy, particularly in low-interest-rate environments. This involves borrowing money at a low interest rate and investing it in a bond with a higher yield. The profit comes from the difference between the borrowing cost and the bond's yield. However, carry trades are inherently risky, as they are sensitive to changes in interest rates and currency exchange rates (if the borrowing and investment are in different currencies).

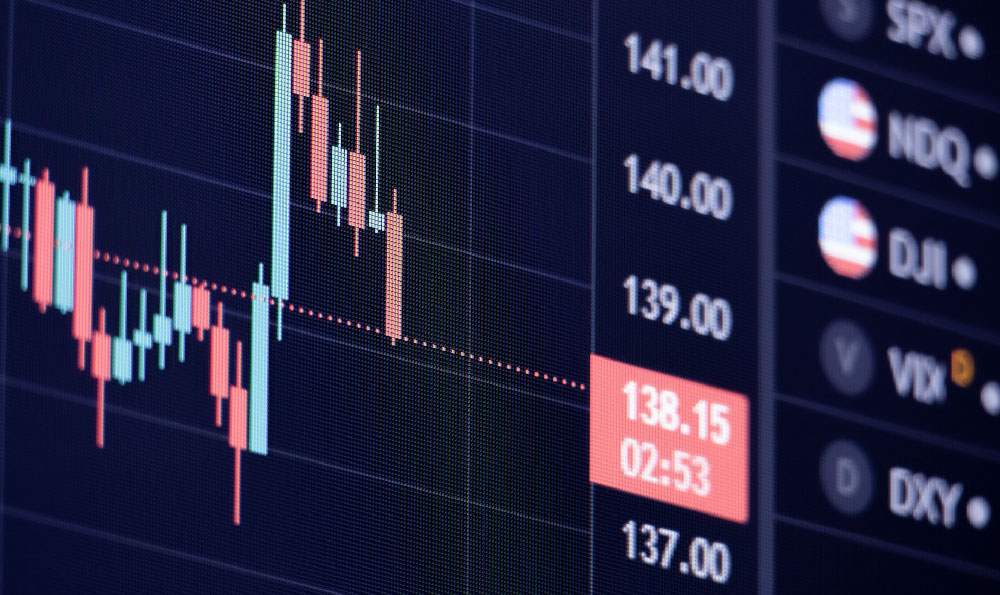

Beyond these strategies, bond traders also pay close attention to macroeconomic data and market sentiment. Economic indicators such as inflation, GDP growth, and employment figures can significantly influence interest rate expectations and bond yields. Market sentiment, which is often driven by news events and investor psychology, can also play a crucial role in bond price movements. Savvy traders combine their understanding of fundamental analysis with technical analysis, which involves studying price charts and trading patterns to identify potential buying and selling opportunities.

Liquidity is also a critical consideration for bond traders. Some bonds are more actively traded than others, making them easier to buy and sell without significantly impacting their price. Traders prefer to deal in liquid bonds because they can enter and exit positions more quickly and efficiently. Illiquid bonds, on the other hand, can be more difficult to trade and may require larger price concessions to attract buyers or sellers.

Moreover, understanding the nuances of bond auctions is essential for many traders. Governments and corporations often issue new bonds through auctions. Participating in these auctions can provide traders with an opportunity to acquire bonds at favorable prices. Traders carefully analyze the auction results to gauge market demand and identify potential trading opportunities.

Finally, risk management is paramount in bond trading. Traders use a variety of techniques to manage their risk, including setting stop-loss orders (which automatically sell a bond if its price falls below a certain level), diversifying their portfolios (holding a variety of different bonds), and hedging their positions (using financial instruments such as futures and options to protect against potential losses). The leverage inherent in bond trading amplifies both potential profits and potential losses, making prudent risk management essential for long-term success. In conclusion, bond traders profit by accurately predicting interest rate movements, identifying mispricings in the market, and managing risk effectively. Their strategies range from simple directional bets to complex relative value trades, all requiring a deep understanding of the fixed income market and the broader economic environment.