How Can Debt Be Leveraged, and How Does It Generate Profit?

Okay, I understand. Here's an article exploring the leveraging of debt for profit generation, written in English, exceeding 800 words, and structured to avoid excessive bullet points and numbered lists, while also omitting the provided title.

The judicious use of borrowed money, or debt, is a cornerstone of modern finance, allowing individuals and businesses to amplify their investment potential and accelerate wealth creation. While the concept of owing money can seem daunting, strategically employed debt can serve as a powerful lever, magnifying returns and unlocking opportunities that would otherwise remain out of reach. However, understanding the mechanics of debt leverage, its associated risks, and the optimal contexts for its application is crucial to harnessing its benefits without succumbing to its potential pitfalls.

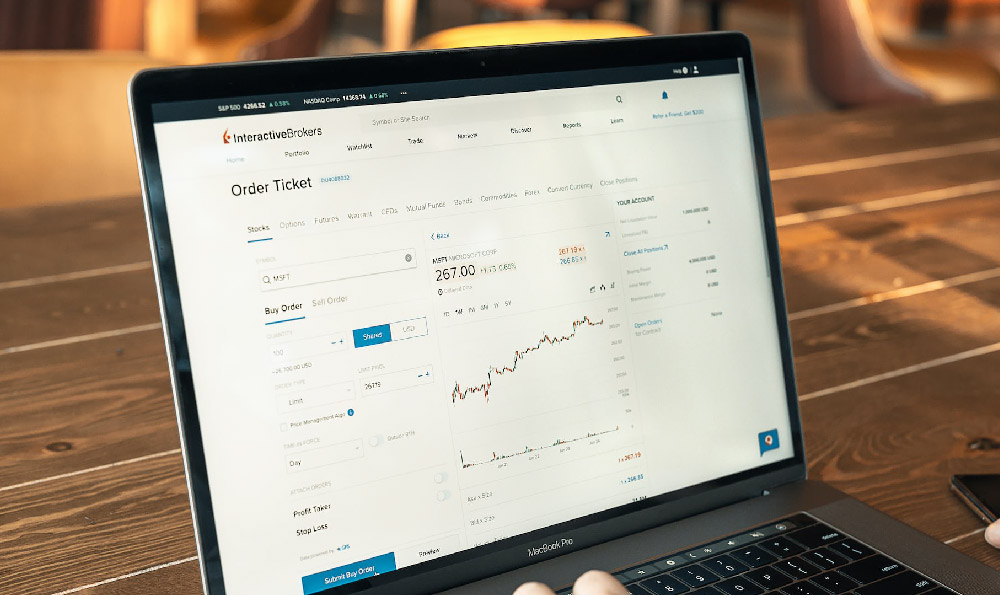

At its core, leveraging debt means utilizing borrowed funds to increase the scale of an investment. The hope is that the returns generated from the investment will significantly exceed the cost of borrowing, resulting in a net profit. This principle applies across a wide spectrum of asset classes, from real estate and stocks to business ventures and even personal skill development.

Consider the example of real estate. A prospective homeowner might secure a mortgage to purchase a property, contributing a smaller down payment and financing the remaining portion with borrowed funds. The potential for profit arises from several factors. First, the homeowner benefits from any appreciation in the property's value over time. If the property value increases, the homeowner gains the full benefit of that appreciation, even though they only financed a portion of the initial purchase price. Second, the homeowner can generate rental income from the property, which can be used to offset mortgage payments and potentially generate additional cash flow. Third, the mortgage interest paid can often be tax-deductible, further reducing the overall cost of borrowing. In this scenario, debt acts as a catalyst, allowing the homeowner to control an asset worth significantly more than their initial investment and potentially reap substantial financial rewards.

Businesses frequently employ debt to fuel expansion, invest in research and development, or acquire other companies. A company might issue bonds or secure loans to fund the construction of a new factory, the development of a groundbreaking product, or the acquisition of a competitor. If the investment proves successful, the resulting increase in revenue and profitability can far outweigh the cost of the debt. For example, a technology company might borrow money to develop a new software platform. If the platform gains widespread adoption and generates substantial revenue, the company can easily repay the loan and retain a significant portion of the profits. This is where the magic of leverage becomes evident: the company's growth trajectory is accelerated by access to capital it wouldn't have had otherwise.

Beyond traditional asset classes, debt can also be strategically utilized for personal development. Investing in education or acquiring specialized skills can significantly enhance an individual's earning potential. While these investments may require incurring student loans or other forms of debt, the long-term benefits in terms of increased salary and career opportunities can far outweigh the initial cost. The key is to carefully assess the potential return on investment and ensure that the chosen educational path or skill acquisition aligns with market demand and career goals.

However, the allure of leveraging debt must be tempered with a healthy dose of caution. The primary risk associated with debt leverage is the potential for magnified losses. If an investment performs poorly, the borrower is still obligated to repay the debt, regardless of whether the investment generates sufficient returns. This can lead to financial distress and even bankruptcy if the borrower is unable to meet their debt obligations. The higher the leverage ratio (the amount of debt relative to equity), the greater the potential for both gains and losses.

Interest rate fluctuations also pose a significant risk. If interest rates rise, the cost of borrowing increases, potentially eroding the profitability of the investment. This is particularly relevant for variable-rate loans, where the interest rate is tied to a benchmark rate that can fluctuate over time.

Furthermore, macroeconomic factors such as economic downturns, inflation, and changes in government policies can impact the performance of investments and the ability to repay debt. It is essential to carefully consider these factors and conduct thorough due diligence before taking on debt to finance an investment.

Therefore, responsible debt leverage requires a disciplined approach and a thorough understanding of the risks involved. Before taking on debt, it is crucial to assess your risk tolerance, evaluate the potential return on investment, and develop a realistic repayment plan. Diversifying investments can also help mitigate the risk of losses. It's also prudent to maintain an emergency fund to cover unexpected expenses and ensure that you can continue to meet your debt obligations even during challenging times.

In conclusion, debt can be a powerful tool for generating profit and accelerating wealth creation when used strategically. However, it is essential to approach debt leverage with caution and a clear understanding of the risks involved. By carefully assessing the potential benefits and drawbacks, developing a sound investment strategy, and managing risk effectively, individuals and businesses can harness the power of debt to achieve their financial goals. Ultimately, responsible debt management is the key to unlocking the transformative potential of leverage while avoiding the pitfalls of financial distress. Ignoring this balance is akin to playing with fire; the potential rewards are significant, but the consequences of mishandling it can be devastating.