How Much MORE Money DOES an E-2 Make? Or, How Much MORE Money Does an E-2 Make?

Alright, let's delve into the financial realities facing an E-2 service member and try to quantify the "more money" question. It's not a simple calculation because it depends heavily on comparing apples to apples. Are we comparing an E-2's total compensation package to an entry-level civilian job with similar educational requirements? Or are we comparing their potential earning trajectory over a longer period?

First, let’s break down the components of an E-2’s compensation. It’s far more than just base pay. An E-2 (Private in the Army and Marine Corps, Airman Basic in the Air Force, Seaman Recruit in the Navy and Coast Guard) receives a base pay that, frankly, is modest. However, that's just the starting point. The military offers a comprehensive benefits package that significantly augments the take-home pay. These benefits include:

- Housing Allowance (Basic Allowance for Housing - BAH): This is a significant component, and its value depends entirely on the duty station. BAH is designed to cover the cost of housing, whether you choose to live on base (which may or may not entirely offset the allowance) or off-base. In high-cost areas, BAH can be substantial, sometimes exceeding an E-2’s base pay. Therefore, where the service member is stationed drastically affects their overall financial picture.

- Food Allowance (Basic Allowance for Subsistence - BAS): This is a monthly allowance intended to cover the cost of food. While the amount isn't enormous, it's a consistent benefit that helps offset living expenses. BAS is generally not taxable.

- Healthcare: Military members receive comprehensive healthcare coverage through TRICARE. This is a tremendous benefit, as it covers medical, dental, and vision care, often with minimal out-of-pocket expenses. Considering the high cost of healthcare in the civilian sector, this is a significant value.

- Educational Opportunities: The military provides access to various educational programs, including tuition assistance for college courses and the Post-9/11 GI Bill. The GI Bill is a particularly valuable benefit, offering substantial financial assistance for higher education after honorable service. This can translate to significantly higher earning potential in the long run.

- Retirement Benefits: Although an E-2 might not be thinking about retirement, starting early contributes to a strong foundation. The military's retirement system, coupled with the Thrift Savings Plan (TSP), offers excellent opportunities for long-term savings. The TSP, in particular, is a 401(k)-style retirement savings plan with potentially matching contributions from the government, essentially free money towards retirement.

- Tax Advantages: Certain military pay is tax-free, such as BAH and BAS. Additionally, service members stationed in combat zones receive tax-free pay, further increasing their disposable income.

- Other Benefits: These include life insurance, access to base facilities (gyms, libraries, recreational activities), travel opportunities, and discounts at military exchanges (PX/BX) and commissaries (grocery stores). These benefits, while seemingly small individually, add up to a significant overall value.

Now, let’s compare this to a civilian job. A similarly situated young person without specific training or education might find entry-level jobs in retail, food service, or manual labor. These jobs often pay minimum wage or slightly above, and they typically lack the comprehensive benefits package offered by the military. Healthcare, if offered, can be expensive, and retirement plans are often non-existent or require employee contributions. Job security can also be less stable.

Therefore, an E-2 might not make significantly "more" in terms of raw base pay compared to some entry-level civilian jobs. However, when considering the total compensation package – the housing allowance, food allowance, healthcare, educational opportunities, retirement benefits, and tax advantages – the financial picture becomes much more favorable for the E-2. The "more money" comes in the form of reduced living expenses, access to benefits that would otherwise cost a considerable amount, and the potential for long-term financial security.

But the real "more money" comes into play later. The skills and experience gained in the military, coupled with the educational opportunities provided, can translate to significantly higher earning potential in the civilian sector after leaving the service. Leadership skills, discipline, teamwork, and technical expertise are all highly valued by employers. Add to that a college degree earned through the GI Bill, and a veteran can command a much higher salary than their civilian counterparts who started working in entry-level jobs straight out of high school.

It's crucial to acknowledge the downsides. Military service involves significant sacrifices. Deployments, long hours, and the inherent risks of military operations are not to be taken lightly. Financial compensation is only one factor to consider.

Finally, let's talk about avoiding investment pitfalls. As an E-2, financial literacy is paramount. Here's what they need to consider:

- Create a Budget: Track income and expenses to understand where the money is going.

- Pay Down Debt: High-interest debt, especially credit card debt, can quickly erode financial stability.

- Build an Emergency Fund: An emergency fund of 3-6 months' worth of living expenses can provide a safety net for unexpected expenses.

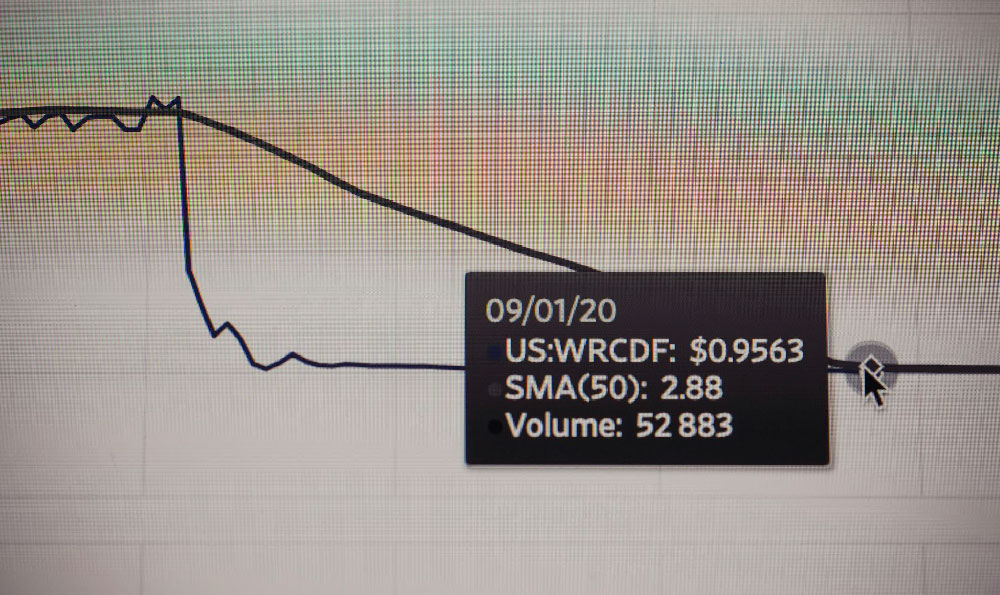

- Invest Wisely: Start investing early in low-cost index funds or exchange-traded funds (ETFs) through the TSP. Avoid high-fee investments and get-rich-quick schemes. Be wary of anyone promising guaranteed returns.

- Seek Financial Counseling: Military bases offer free financial counseling services to help service members manage their finances.

- Avoid Lifestyle Inflation: As pay increases, resist the temptation to increase spending proportionally. Instead, focus on saving and investing for the future.

- Beware of Scams: Service members are often targeted by scams, so be cautious of unsolicited offers and opportunities that seem too good to be true.

- Understand Your TSP: Learn about the different investment options within the TSP and choose a portfolio that aligns with your risk tolerance and time horizon.

In conclusion, while an E-2's base pay may not be dramatically higher than some entry-level civilian jobs, the overall compensation package, coupled with the long-term opportunities for growth and financial security, often translates to significantly "more money" over the course of a career. The key is to manage finances wisely, take advantage of the benefits offered, and plan for the future. The "more money" is not just about the immediate paycheck, it’s about the potential for a more secure and prosperous future.