how to become rich: 10 proven financial success strategies for wealth building

Financial success is a journey that requires a blend of discipline, knowledge, and strategic planning. Whether you’re looking to build wealth for retirement, secure a better future for your family, or achieve financial independence, there are key principles that consistently drive long-term prosperity. Let’s explore ten proven financial strategies that have helped countless individuals build lasting wealth, each offering a unique perspective on resource management and growth.

-

Curbing unnecessary expenses is foundational to creating financial freedom. Many people overlook the power of mindful spending by focusing solely on income rather than how money moves through their lives. By analyzing where your money goes, you can identify areas where you can reduce consumption without sacrificing quality of life. Prioritizing needs over wants, adopting budgeting habits, and using tools like expense tracking apps allow you to preserve capital for more impactful uses. The habit of living within your means is not just about saving—it's about cultivating a lifestyle that aligns with your financial goals, ensuring that smaller decisions compound into significant long-term results.

-

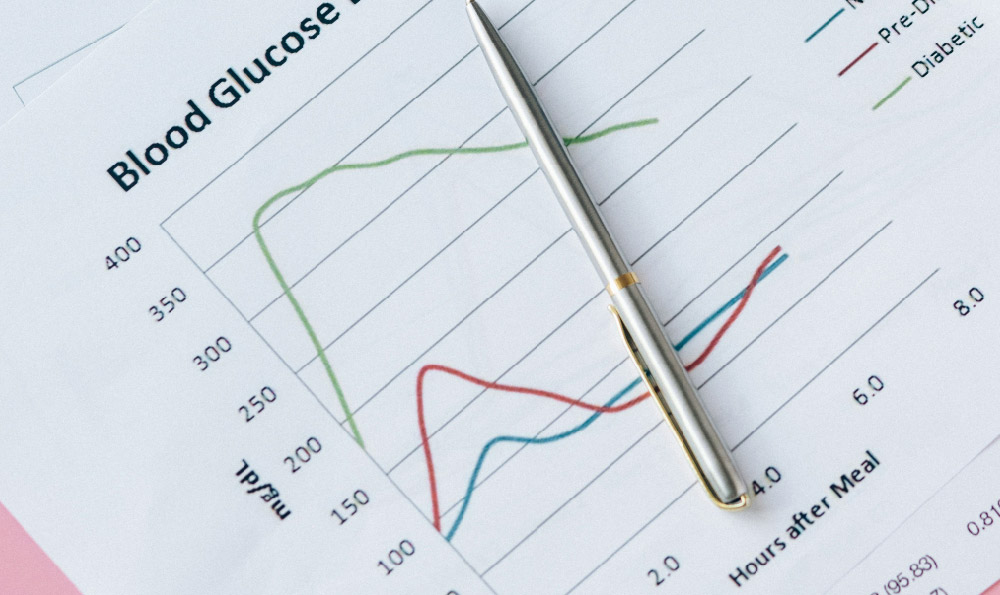

Understanding and leveraging compound interest is one of the most powerful tools for wealth accumulation. Unlike simple interest, which is calculated only on the initial principal, compound interest generates returns on both the original investment and the accumulated interest over time. This exponential growth is why experts recommend starting early and investing consistently, even with modest amounts. By choosing high-yield savings accounts, dividend-paying stocks, or long-term bonds, you can harness the compounding effect to amplify your wealth. The key is to avoid the urge to liquidate assets prematurely, as patience allows the time value of money to work in your favor.

-

Creating a diversified investment portfolio reduces risk while maximizing potential returns. Relying on a single asset class or market exposes you to significant volatility, which can lead to financial setbacks. By spreading investments across stocks, bonds, real estate, and alternative assets, you mitigate the impact of market downturns. Diversification doesn’t mean avoiding risk entirely, but rather balancing it with a strategic approach to growth. For example, a mix of low-risk and high-risk investments can provide stability during uncertain times, ensuring that your wealth continues to grow even when individual assets fluctuate.

-

Establishing a habit of financial literacy is critical for making informed decisions. Many people assume that wealth is built through luck or inheritance, but the reality is that knowledge is the cornerstone of sustainable growth. Taking time to learn about personal finance, investing, and tax strategies empowers you to make smarter choices. Whether through books, podcasts, or online courses, educating yourself on financial concepts helps you avoid common pitfalls and identify opportunities for growth. The more you understand about how money works, the better equipped you are to build lasting wealth.

-

Building emergency savings is a vital step in ensuring financial resilience. Unforeseen events like job loss, medical emergencies, or market corrections can disrupt even the most carefully laid plans. By setting aside 3-6 months of living expenses in a separate account, you create a financial buffer that protects your long-term goals. This safety net allows you to avoid debt during crises and maintain a consistent investment strategy. Emergency savings aren’t just a precaution—they’re an investment in your financial security and peace of mind.

-

Utilizing tax-advantaged accounts enhances wealth-building efficiency. Governments offer various tools to encourage savings and investment, such as retirement accounts, education funds, and health savings accounts. These accounts often provide tax deductions, deferrals, or exemptions, which can significantly boost your returns over time. By maximizing contributions to these accounts, you reduce your tax burden while growing your wealth. The strategic use of tax planning ensures that more money remains available for reinvestment, accelerating your path to financial success.

-

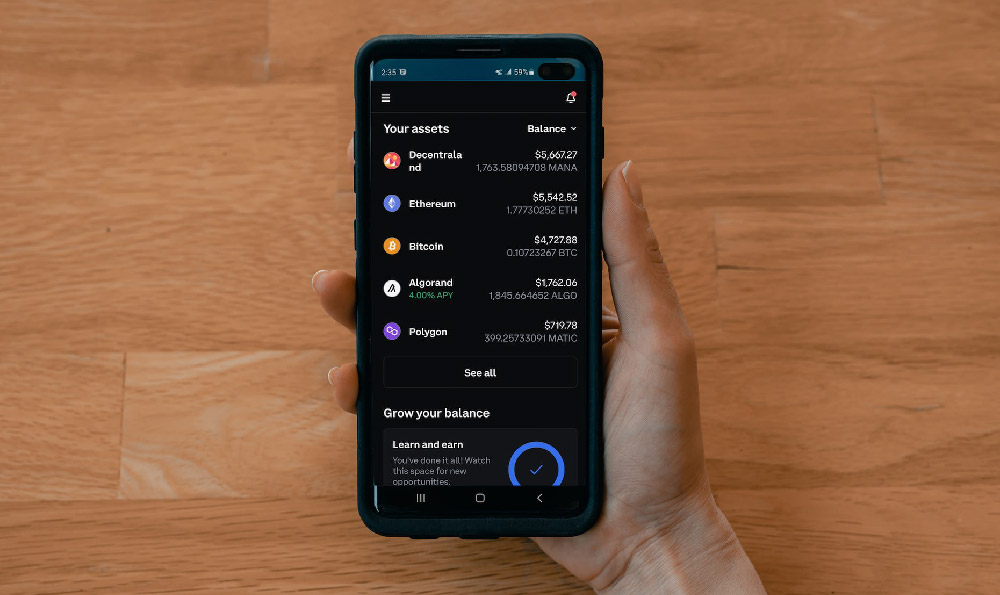

Embracing the concept of passive income is a shift from traditional earning models. While active income is earned through employment, passive income streams—such as rental properties, dividend stocks, or online businesses—provide consistent returns without active labor. Building multiple sources of passive income diversifies your financial foundation and reduces dependency on a single income stream. This approach allows you to generate wealth even when you’re not working, creating long-term stability. Passionate investing in areas like real estate or dividend stocks can lead to substantial income over time.

-

Practicing long-term financial planning counteracts short-term temptations. Many individuals struggle with impulsive spending or short-term investments, which can derail progress. A long-term mindset focuses on sustainability rather than quick gains. This includes setting clear financial goals, such as retirement savings or wealth preservation, and creating a roadmap to achieve them. Sticking to this plan even during economic downturns ensures that you stay on course for future success. Wealth is not built overnight—it’s a product of consistent, deliberate actions over time.

-

Reducing high-interest debt accelerates financial progress. Interest payments on credit cards, loans, or other obligations can erode your savings and delay wealth-building. By prioritizing debt repayment—especially for accounts with higher interest rates—you free up capital for more productive uses. Strategies like the debt snowball or avalanche method provide structured approaches to tackling debt. Eliminating financial burdens frees your money to invest, save, or spend wisely, aligning your resources with your goals.

-

Cultivating a mindset of abundance and resilience is essential for enduring success. Financial goals often require persistence, adaptability, and patience. Celebrating small victories, like saving a portion of your income or achieving a short-term investment milestone, keeps motivation alive. Resilience comes from understanding that setbacks are part of the journey and adapting strategies accordingly. A positive, forward-thinking attitude ensures that you remain committed to your path, even when challenges arise.

Each of these strategies is interconnected, forming a cohesive framework for building wealth. By combining discipline with opportunity, you create a pathway that balances risk and reward. Financial success is not about rapid accumulation but about structured, sustainable growth. Implementing these principles can transform your approach to wealth building, ensuring that your financial future is secure and prosperous.