How to Get Instant Wealth Fast – Quick Tips for Overnight Success

The allure of instant wealth has long captivated human imagination, promising a shortcut to financial freedom through luck, quick decisions, or unconventional strategies. However, the reality of wealth creation is far more nuanced, rooted in disciplined planning, risk management, and a deep understanding of market dynamics. While it is true that exceptional circumstances can yield rapid financial gains—such as overnight market shifts or serendipitous opportunities—these are rare, highly volatile, and often accompanied by significant risks. For the vast majority of individuals, the pursuit of wealth should be grounded in a long-term perspective that prioritizes sustainable growth over fleeting profits.

One of the most critical misconceptions about fast wealth is the belief that luck alone can guarantee success. Historically, individuals who achieve sudden financial breakthroughs often do so through a combination of timing, knowledge, and strategic risk-taking, rather than mere chance. For example, the rise of early-stage tech startups or the discovery of valuable assets in emerging markets may create opportunities for exponential returns, but such scenarios require extensive research, capital, and a willingness to tolerate uncertainty. These instances are not replicable by the average investor, who lacks the resources, expertise, and risk tolerance to navigate such high-stakes environments. Moreover, the probability of encountering a one-time windfall diminishes as markets become more efficient, with information spreading rapidly and competitors capitalizing on opportunities swiftly.

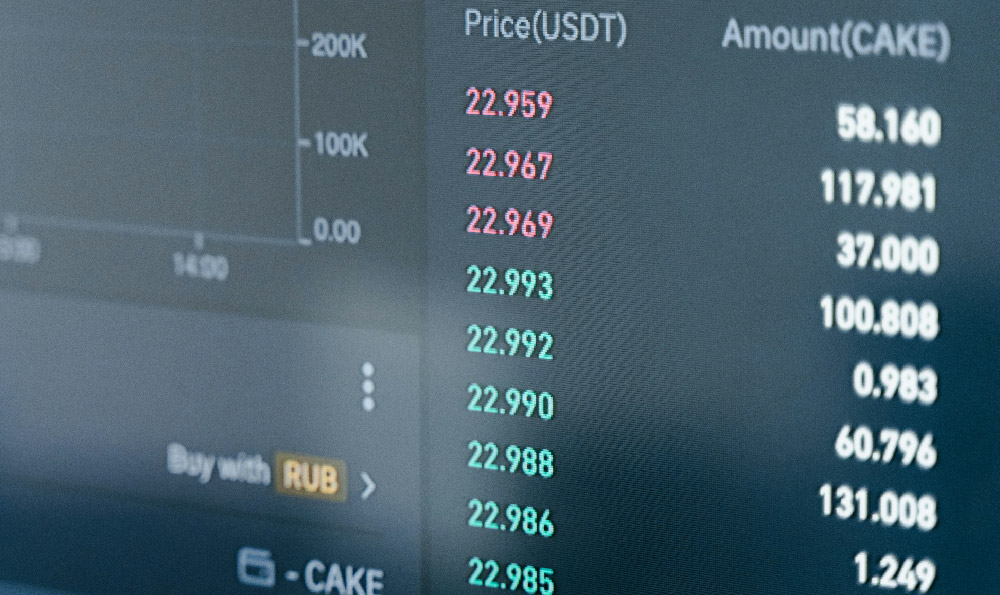

Another common fallacy is the assumption that high-risk investments or speculative activities offer a guaranteed path to rapid wealth. While certain assets, such as cryptocurrencies or leveraged trading instruments, can generate substantial returns in short periods, they also carry an equally high risk of significant losses. The volatility of these markets means that a single adverse event—whether a regulatory change, a technological disruption, or a macroeconomic shift—can erase years of accumulated gains. Furthermore, the psychological toll of managing such risks can lead to poor decision-making, as investors may be tempted to take on excessive leverage or ignore fundamental analysis in pursuit of quick profits. This creates a precarious balance where the potential for gain is matched only by the probability of ruin.

A more constructive approach to wealth accumulation lies in leveraging compounding, diversification, and incremental progress. Compounding, often referred to as the "eighth wonder of the world," is a powerful force that allows returns to generate additional returns over time. By investing consistently and allowing capital to grow through compound interest, individuals can achieve substantial wealth even with modest initial sums. For instance, a $10,000 investment earning an annual return of 7% would grow to over $170,000 in 20 years, assuming no withdrawals or market disruptions. This demonstrates the importance of patience and the power of time as a multiplier for wealth.

Diversification is another cornerstone of effective wealth management. By spreading investments across different asset classes, sectors, and geographic regions, individuals can mitigate risk while maintaining the potential for growth. A well-diversified portfolio is less susceptible to the failure of a single investment, as losses in one area may be offset by gains in another. This principle is particularly relevant in volatile markets, where the performance of individual assets can fluctuate dramatically. However, diversification should not be confused with reckless allocation; it requires careful analysis of correlations, liquidity, and risk profiles to ensure that the overall exposure remains balanced.

Incremental progress, often overlooked in the pursuit of instant results, is a more reliable pathway to wealth. Rather than focusing on monumental gains, individuals can build wealth through consistent, manageable steps such as regular savings, prudent spending, and strategic investing. For example, setting aside a portion of income each month, reinvesting dividends, and gradually increasing investment contributions over time can create a compounding effect that outpaces the outcomes of sporadic, high-risk bets. This method aligns with the principles of behavioral economics, which suggest that small, habitual actions are more sustainable than large, impulsive decisions.

In essence, the pursuit of rapid wealth is a double-edged sword. While it is possible to achieve overnight success through extraordinary circumstances, these are exceptions rather than the rule. For most individuals, the path to financial prosperity requires a combination of education, discipline, and patience. Understanding the risks associated with speculative activities, embracing the power of compounding, and committing to incremental progress are the keys to building wealth over time. By focusing on these principles, rather than chasing illusory shortcuts, investors can create a more stable, sustainable foundation for long-term financial success.