How to Invest $1000: Where Should I Start?

Investing $1000 can seem daunting, especially if you're just starting. However, it's a fantastic opportunity to learn the ropes and begin building a foundation for your financial future. The key is to approach it strategically, considering your risk tolerance, time horizon, and financial goals. Here's a comprehensive guide to help you navigate your investment options:

Before diving into specific investments, it’s crucial to lay some foundational groundwork. This involves defining your investment goals. Are you saving for retirement, a down payment on a house, or simply trying to grow your wealth over time? Your goals will heavily influence your investment choices. Next, honestly assess your risk tolerance. Are you comfortable with the possibility of losing some of your initial investment in exchange for potentially higher returns, or do you prefer more conservative options with lower potential gains? Understanding your risk tolerance is paramount, as it will prevent you from making impulsive decisions based on market fluctuations. Also, determine your investment timeline. Are you looking for short-term gains or long-term growth? Short-term investments may require different strategies than long-term ones. Once you have a clear understanding of these factors, you can move on to choosing your investment options.

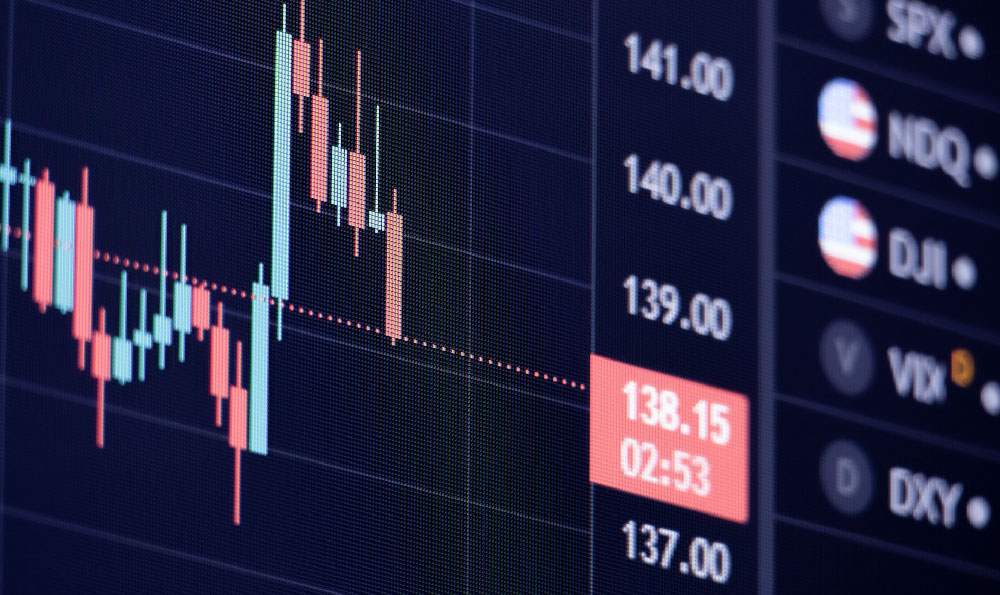

One of the most accessible and practical starting points is investing in Exchange-Traded Funds (ETFs). ETFs are essentially baskets of stocks or bonds that track a specific index, sector, or investment strategy. They offer instant diversification, meaning you're not putting all your eggs in one basket. For example, an S&P 500 ETF (like SPY, IVV, or VOO) tracks the performance of the 500 largest publicly traded companies in the United States. Investing in such an ETF provides broad exposure to the overall market. Other ETFs focus on specific sectors like technology (XLK), healthcare (XLV), or renewable energy (ICLN). Choose ETFs that align with your investment goals and risk tolerance. The low expense ratios associated with most ETFs are another attractive feature, as they minimize the cost of investing. With $1000, you could easily purchase shares in one or more ETFs, creating a diversified portfolio.

Another option, especially for beginners, is to invest in fractional shares of stocks. Many brokerage platforms now allow you to buy a portion of a share of stock, even if you don't have enough money to buy a whole share. This is particularly useful for investing in high-priced stocks like Amazon, Google, or Tesla. Fractional shares allow you to participate in the growth of these companies without needing to invest thousands of dollars upfront. When selecting stocks, it's important to do your research. Look for companies with strong financials, a competitive advantage, and growth potential. Read analyst reports, follow industry news, and understand the company's business model before investing. Starting with a small allocation of your $1000 to a few carefully selected stocks can be a good way to learn about individual company analysis.

If you have a longer time horizon and a slightly higher risk tolerance, consider investing in a Roth IRA. A Roth IRA is a retirement account that offers tax advantages. Contributions are made with after-tax dollars, but your investments grow tax-free, and withdrawals in retirement are also tax-free. The contribution limit for Roth IRAs changes annually, but even a small contribution of $1000 can make a significant difference over time, thanks to the power of compounding. You can invest your Roth IRA funds in various assets, including stocks, bonds, ETFs, and mutual funds. This allows you to customize your retirement portfolio to suit your individual needs. Contributing to a Roth IRA is a great way to simultaneously save for retirement and learn about investing.

For those seeking a lower-risk option, consider high-yield savings accounts or certificates of deposit (CDs). High-yield savings accounts offer significantly higher interest rates than traditional savings accounts, allowing your money to grow at a faster pace. CDs are a type of savings account that holds a fixed amount of money for a fixed period of time, typically ranging from a few months to several years. In exchange for keeping your money locked up, you receive a higher interest rate than you would with a regular savings account. While the returns from these options are typically lower than those of stocks or ETFs, they provide a safe and secure way to grow your money, especially in the short term. These options are particularly suitable if you have a short-term savings goal or a low-risk tolerance.

Investing in yourself is arguably the best investment you can make. Consider using a portion of your $1000 to acquire new skills or knowledge that can increase your earning potential. This could involve taking online courses, attending workshops, or pursuing certifications in your field. Investing in your education or skills can lead to higher income, greater job security, and increased opportunities for advancement. These benefits can far outweigh the returns from traditional investments. For example, learning a new software program or developing a valuable skill set can open doors to higher-paying jobs or freelance opportunities.

No matter which investment option you choose, it's important to remember the principles of dollar-cost averaging. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market conditions. This strategy helps to reduce the risk of buying high and selling low. For example, instead of investing your entire $1000 at once, you could invest $100 each month for ten months. This allows you to average out your purchase price over time, potentially leading to better returns. Consistency is key to successful investing. Even small, regular investments can add up significantly over the long term.

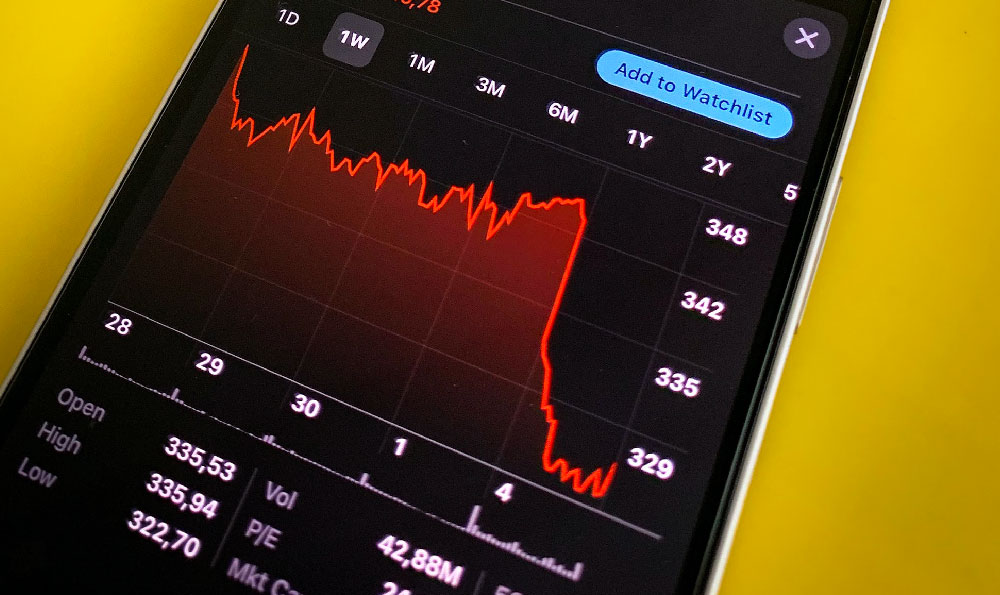

Finally, remember that investing is a marathon, not a sprint. Don't expect to get rich overnight. It's important to stay disciplined, patient, and focused on your long-term goals. Avoid making emotional decisions based on short-term market fluctuations. Regularly review your portfolio, rebalance your investments as needed, and stay informed about market trends. Seek guidance from a qualified financial advisor if you need help making investment decisions. With careful planning and consistent effort, you can achieve your financial goals and build a secure financial future, starting with that initial $1000. Starting early, even with a small amount, can make a significant difference in the long run due to the power of compounding.