How to Invest & Make My Money Work for Me?

Okay, I understand. Here's an article based on the title "How to Invest & Make My Money Work for Me?", written in a style that aims for comprehensiveness and detail, avoiding a point-by-point structure and numbered lists.

Investing isn't about getting rich quick; it's about building wealth over time through informed decisions and a commitment to long-term growth. It's about understanding that your money, if strategically placed, can work just as hard as you do, generating returns while you sleep, allowing you to achieve financial independence and security. The initial step, arguably the most crucial, is self-assessment. You need a clear picture of your financial landscape. What are your current assets and liabilities? What is your monthly income and expenditure? Building a budget is fundamental; it's your roadmap to financial clarity. Knowing where your money goes is the first step in redirecting it towards investments. Beyond the budget, consider your risk tolerance. Are you comfortable with the possibility of losing a portion of your investment in exchange for potentially higher returns, or do you prefer a more conservative approach that prioritizes capital preservation? This understanding will significantly influence the types of investments you consider. Finally, define your financial goals. Are you saving for retirement, a down payment on a house, your children's education, or simply building a financial safety net? Each goal has a different timeline and risk profile, impacting your investment strategy.

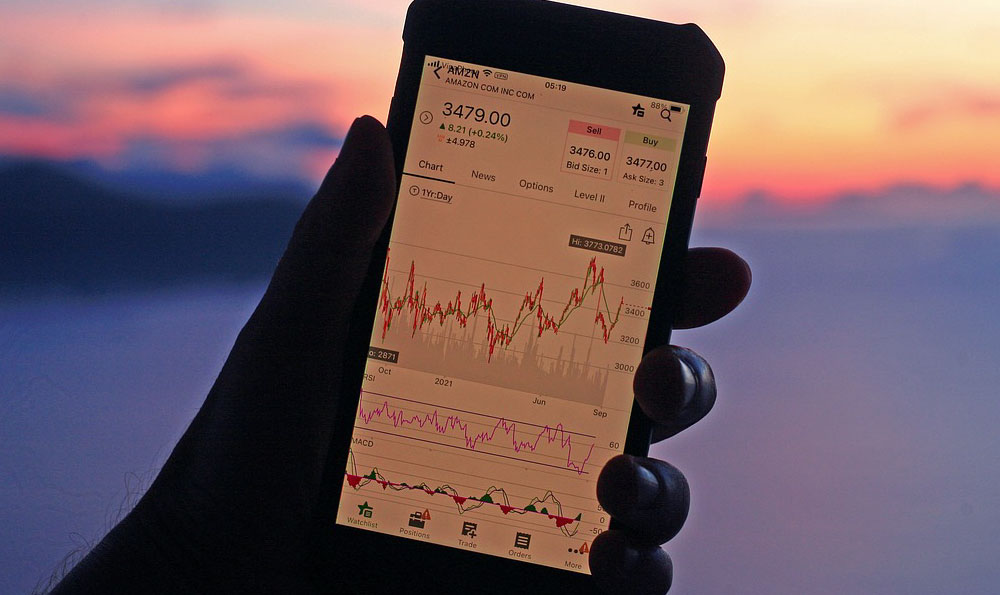

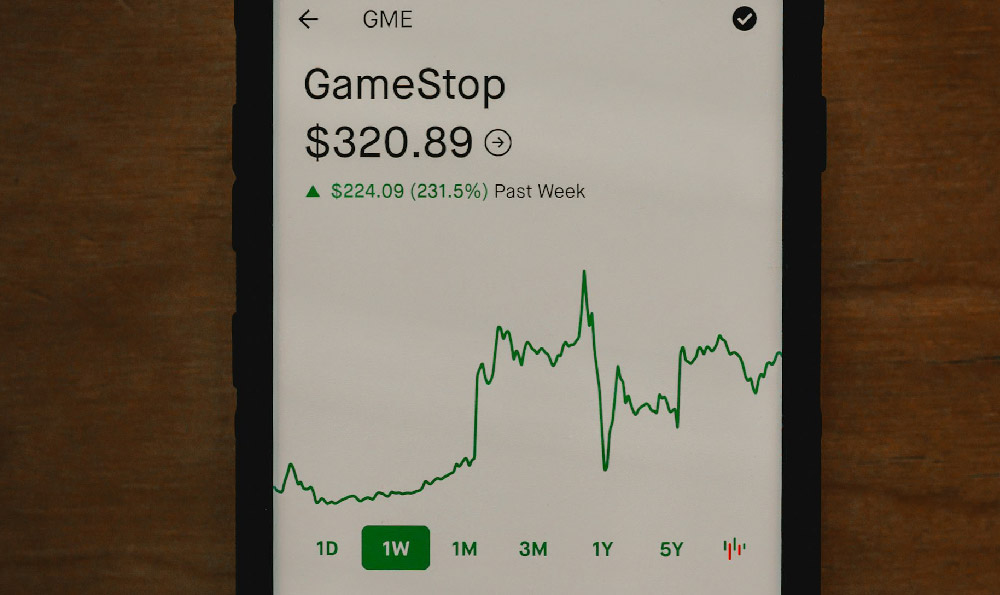

With a solid understanding of your financial situation, risk tolerance, and goals, you can delve into the diverse world of investment options. A common starting point for many is the stock market, which offers the potential for significant growth, but also carries inherent risks. Investing in individual stocks can be exciting, but it requires careful research and analysis of the companies you're considering. You need to understand their business model, competitive landscape, financial health, and growth prospects. A safer and often more effective alternative is investing in stock market index funds or Exchange Traded Funds (ETFs). These funds pool money from multiple investors to purchase a diversified portfolio of stocks, mirroring the performance of a specific market index, such as the S&P 500. This diversification reduces your risk, as your investment isn't tied to the performance of a single company.

Beyond stocks, bonds offer a different risk-reward profile. Bonds are essentially loans you make to a government or corporation, who in return, promise to pay you back with interest over a specified period. They are generally considered less risky than stocks, offering more stable returns, but their potential for growth is also lower. Bonds can be a valuable addition to a diversified portfolio, providing a cushion during periods of stock market volatility. Different types of bonds exist, including government bonds, corporate bonds, and municipal bonds, each with varying levels of risk and return.

Real estate is another asset class that can offer both income and appreciation. Investing in rental properties can provide a steady stream of income, while the property itself can increase in value over time. However, real estate investment also requires significant capital and involves responsibilities such as property management and maintenance. Real Estate Investment Trusts (REITs) offer an alternative way to invest in real estate without the direct ownership and management responsibilities. REITs are companies that own and operate income-producing real estate, such as office buildings, shopping malls, and apartment complexes.

Other investment options include commodities like gold, silver, and oil, which can serve as a hedge against inflation, and alternative investments like private equity and venture capital, which offer the potential for high returns but are also highly illiquid and risky, and generally suitable for sophisticated investors. Cryptocurrency has emerged as a significant, albeit volatile, investment, with potential for high growth but also substantial risk of loss.

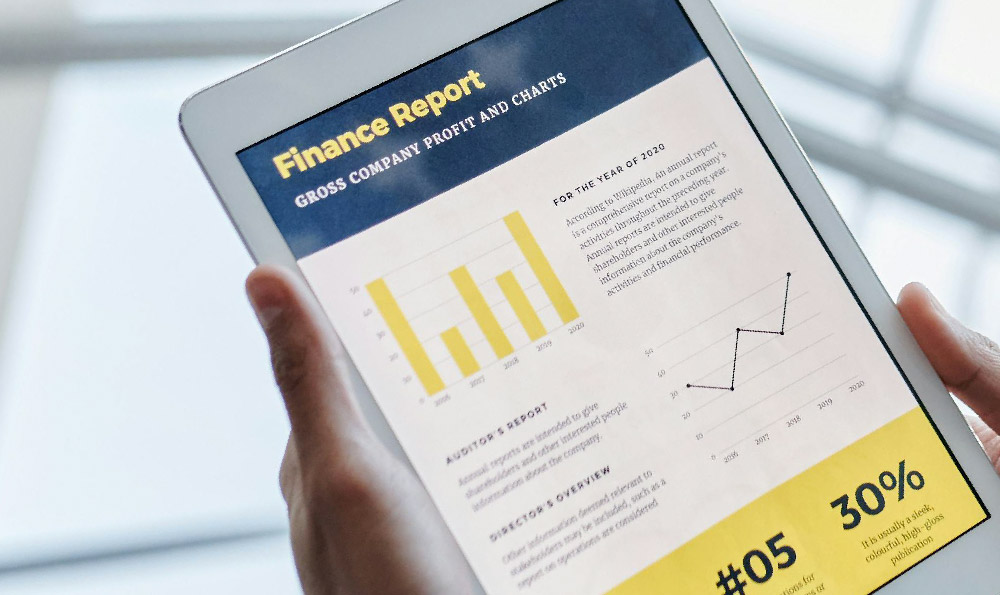

Crafting a well-balanced portfolio that aligns with your risk tolerance and investment goals is crucial. Diversification is key to mitigating risk. Don't put all your eggs in one basket. Spread your investments across different asset classes, industries, and geographic regions. This ensures that if one investment performs poorly, the impact on your overall portfolio is minimized. Regularly review and rebalance your portfolio to maintain your desired asset allocation. As your investment grows and your financial goals evolve, you may need to adjust your portfolio to stay on track.

It's also important to remember the power of compounding. Albert Einstein famously called compounding the "eighth wonder of the world." It's the process of earning returns not only on your initial investment but also on the accumulated interest or gains. The earlier you start investing, the more time your money has to grow through compounding.

Finally, it's vital to continuously educate yourself about investing. The financial markets are constantly changing, and new investment opportunities emerge regularly. Stay informed about market trends, economic developments, and investment strategies. Read books, articles, and financial publications. Attend seminars and workshops. Consider consulting with a qualified financial advisor who can provide personalized guidance and help you make informed investment decisions. Avoid chasing short-term gains or falling prey to get-rich-quick schemes. Successful investing is a marathon, not a sprint. It requires patience, discipline, and a long-term perspective. By following these principles, you can harness the power of investing and make your money work for you, achieving your financial goals and securing your financial future. Remember that understanding the tax implications of your investments is also very important, and seeking tax advice could benefit you in the long run.