How to Make Extra Money Online Quickly with Simple Tips and Strategies

In today's digital age, the internet has become a powerful tool for generating additional income, offering opportunities that transcend traditional financial boundaries. While the idea of earning money quickly online may seem enticing, it’s essential to approach it with a balanced perspective, recognizing that sustainable wealth creation often requires patience, strategy, and a willingness to learn. By leveraging existing skills, exploring low-cost investment options, and utilizing automation, individuals can find ways to bolster their finances without significant time investment, though it’s important to remain wary of schemes that promise unrealistic returns. Let's delve into some practical and accessible methods that blend simplicity with profitability.

One of the most straightforward approaches is to monetize existing skills through platforms that connect talent with demand. Freelancing, for instance, allows professionals to offer their expertise in fields such as writing, graphic design, programming, or digital marketing. Websites like Upwork and Fiverr act as marketplaces where individuals can list their services, set competitive rates, and secure projects from a global client base. Alternatively, those with a passion for content creation can turn their hobbies into a revenue stream by producing videos, podcasts, or written articles on platforms like YouTube, TikTok, or Medium. While content creation requires consistent effort, it can offer passive income through advertising, sponsorships, or affiliate marketing once a following is established. The key here is to identify skills that align with current market trends and to build a niche that stands out among competitors.

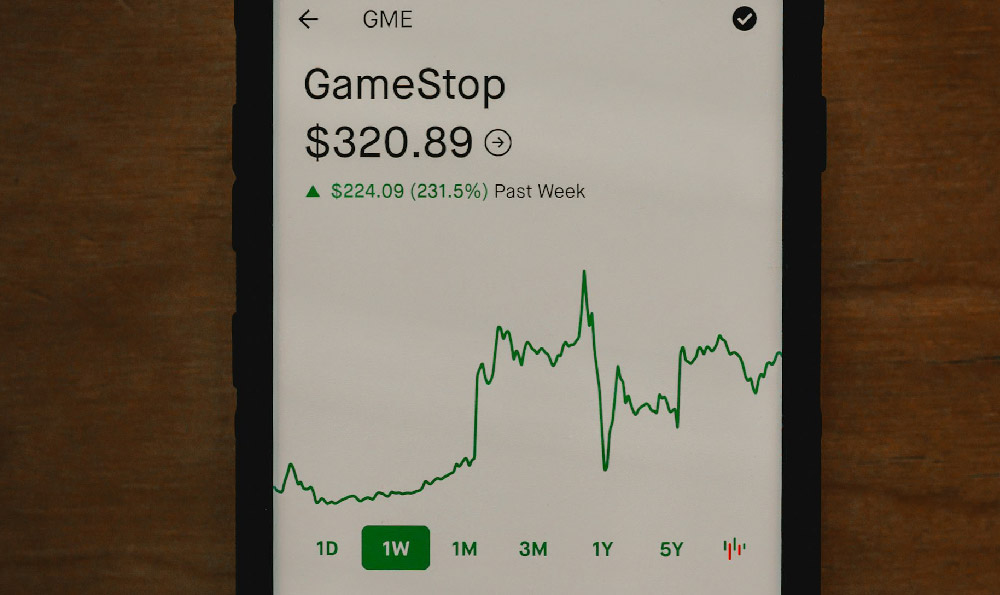

Another avenue for quick financial gains lies in the realm of low-cost or no-cost investments. For example, robo-advisors like Betterment or Wealthfront provide automated portfolio management services with minimal fees, allowing investors to diversify their assets without needing to understand complex financial instruments. Similarly, investing in exchange-traded funds (ETFs) or real estate investment trusts (REITs) can offer exposure to multiple assets with a single transaction, reducing the risk associated with individual stock picking. These strategies are particularly appealing to those with limited capital, as they enable participation in markets that might otherwise be inaccessible. However, it’s crucial to remember that all investments come with inherent risks, and short-term gains should not come at the expense of long-term stability. Diversification, thorough research, and a disciplined approach are necessary to mitigate potential losses.

Automation is a powerful ally for those seeking to streamline their financial pursuits. Online platforms that offer task-based income, such as Swagbucks or Amazon Mechanical Turk, let users complete surveys, watch videos, or perform small digital tasks to earn cash rewards. These activities are typically time-efficient and can be integrated into daily routines, making them accessible even for those with busy schedules. Additionally, creating automated content or products, such as downloadable guides, e-books, or templates, can provide recurring income once the initial creation is done. Tools like Canva or Adobe InDesign simplify the design process, while platforms like Gumroad or Etsy offer easy avenues for selling digital goods. The secret to success here is to focus on creating value that others are willing to pay for, rather than chasing quick clicks or views.

For individuals with a more entrepreneurial mindset, online marketplaces provide a direct path to profit. Selling unused items on eBay or Facebook Marketplace can be a simple way to generate cash without significant effort, as these platforms handle the logistics of transactions. Similarly, dropshipping allows entrepreneurs to sell products online without needing to manage inventory, as suppliers handle the shipping process. This model eliminates the need for upfront capital and reduces the risk of overstocking, though it does require careful selection of suppliers and products to ensure quality and competitiveness. The beauty of these strategies is that they can be scaled over time, allowing for increased earnings as experience and reputation grow.

Lastly, it's vital to consider the broader implications of online income generation. While these methods can offer immediate financial benefits, they also require time, effort, and sometimes a learning curve. For instance, mastering SEO techniques or learning a new digital skill may take weeks or months to become proficient. The key to long-term success is to approach these endeavors with a growth mindset, understanding that small, consistent efforts often yield better results than attempting to achieve rapid success. It's also important to maintain financial discipline, ensuring that any additional income is reinvested or saved rather than spent on impulsive purchases. By combining these strategies with a commitment to continuous learning, individuals can create a diversified income stream that enhances their financial security without compromising their well-being.