How to Make Money Fast Online Today No Cost Earn Instantly

In the rapidly evolving world of digital finance, the allure of quick returns through virtual currency investments can be overwhelming. However, navigating this landscape requires more than just luck—it demands a strategic approach grounded in research, discipline, and risk management. While the idea of earning money with minimal effort may seem enticing, the reality is that sustainable success in cryptocurrency trading hinges on understanding market dynamics, leveraging technical analysis, and avoiding common pitfalls. Here's a deeper exploration of how to approach this field responsibly while maximizing potential gains.

The cryptocurrency market operates on a principle of volatility, which can create opportunities for profit but also amplify risks. Market trends are often influenced by macroeconomic factors, technological advancements, and regulatory developments. For instance, shifts in global interest rates, changes in government policies, or breakthroughs in blockchain technology can significantly impact the value of digital assets. Investors who stay attuned to these broader economic currents are better positioned to anticipate market movements and make informed decisions. However, it's crucial to recognize that even the most promising trends can be short-lived, requiring agility and adaptability in strategy.

Technical indicators play a pivotal role in analyzing price patterns and identifying entry and exit points. Tools like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help traders assess overbought or oversold conditions, while volume analysis reveals market sentiment. Meanwhile, trend lines and candlestick patterns offer insights into price direction and potential reversals. Combining these metrics with fundamental analysis—such as evaluating a project's team, use case, and technological innovation—can provide a more comprehensive view. This dual approach allows investors to balance short-term speculation with long-term value appreciation, reducing the likelihood of impulsive decisions driven by hype.

For those seeking to capitalize on opportunities without significant capital, there are strategies that align with low-cost or no-cost principles. Peer-to-peer (P2P) lending platforms and staking services, for example, enable individuals to earn passive income by lending their crypto or supporting blockchain networks. These methods typically require minimal initial investment but still carry inherent risks, such as market volatility and the potential for project failures. Behavioral finance principles also suggest that investors who diversify their holdings across multiple assets and avoid overexposure to single projects are more likely to weather downturns and maintain consistency.

The concept of earning "instantly" is often intertwined with the idea of leveraging existing capital through high-yield opportunities. However, genuine instant gains are rare in the cryptocurrency sphere. More often, success stems from strategic timing, such as exploiting price gaps during market corrections or capitalizing on arbitrage opportunities across different exchanges. These methods may yield quicker returns than long-term hodling, but they require a deep understanding of market mechanics, including order book dynamics and liquidity conditions. Furthermore, the use of automated trading systems can streamline these processes, but their effectiveness depends on robust backtesting and alignment with individual risk tolerance.

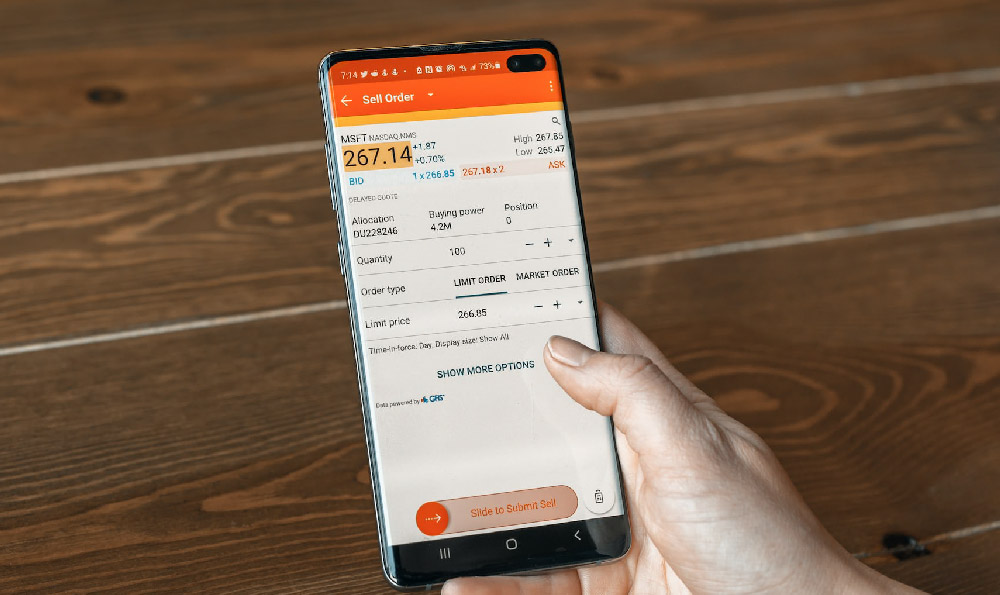

Portability of crypto assets enables investors to act swiftly in response to market signals, regardless of location or time zone. This feature facilitates rapid decision-making, which is essential in a market where prices can fluctuate dramatically within short timeframes. However, the benefits of portability are nullified without a disciplined strategy. Investors must develop a clear framework for evaluating opportunities, whether through long-term value investing or short-term swing trading. This framework should incorporate both quantitative metrics and qualitative factors, such as community engagement and brand reputation.

The intersection of high-yield opportunities and low-cost entry points presents a paradox—how can investors achieve substantial returns without significant capital? The answer lies in leveraging existing assets through staking, yield farming, or liquidity provision. These methods allow individuals to earn interest by participating in the blockchain ecosystem, often with minimal upfront costs. Yet, they require careful evaluation of the associated risks, such as smart contract vulnerabilities and project sustainability. Investors must also be mindful of the opportunity cost, as allocating resources to high-risk strategies may detract from more stable long-term investments.

In the pursuit of profitable opportunities, the balance between arrogance and humility is critical. Overconfidence can lead to excessive risk-taking, while excessive caution may result in missed gains. The key is to cultivate a mindset that values calculated risks over blind speculation. This involves setting clear investment goals, adhering to strict risk management protocols, and continuously educating oneself on market fundamentals and technical analysis. By maintaining this equilibrium, investors can navigate the complexities of the cryptocurrency market with greater confidence.

Moreover, the absence of a title in the content framework necessitates a robust structure that guides readers through the subject matter without relying on headings. This approach can be both a challenge and an opportunity, as it encourages a more fluid discussion of concepts. For example, employing subheadings like "The Role of Market Trends in Cryptocurrency Investment" or "Leveraging Technical Analysis for Strategic Decision-Making" can enhance readability while aligning with SEO best practices. These subheadings should be seamlessly integrated into the narrative, ensuring that the flow remains uninterrupted.

The integration of subheadings into the content flow also allows for a more tailored discussion of specific strategies. For instance, under the umbrella of "Exploring High-Yield Opportunities with Low Initial Costs," we can delve into the intricacies of yield farming, liquidity provision, and other mechanisms that enable capital to generate returns. This section should provide detailed insights into these strategies while highlighting their unique risks and rewards. By doing so, the content fulfills both the informational and SEO requirements without resorting to a rigid list structure.

Finally, the emphasis on risk management cannot be overstated. The cryptocurrency market's volatility means that no investment is immune to unforeseen challenges. Diversification, for example, can mitigate the risk of overexposure to any single asset. Setting stop-loss orders and maintaining a diversified portfolio are essential practices that protect against potential losses. Additionally, investors should be aware of the psychological aspects of trading, such as the importance of patience and avoiding emotional decisions. These factors collectively contribute to a more resilient investment strategy, enabling individuals to navigate market fluctuations with confidence.