How to Make Money? What Are the Best Strategies?

Okay, I understand. Here's an article addressing the question of "How to Make Money? What Are the Best Strategies?" written in English, meeting your specified requirements.

Unlocking Financial Potential: A Comprehensive Guide to Wealth Generation

The age-old question of "how to make money" continues to resonate, especially in a world characterized by rapid technological advancements and fluctuating economic landscapes. There's no single magic formula, but rather a collection of diverse strategies and approaches that, when intelligently applied, can unlock your financial potential. It requires a combination of proactive planning, continuous learning, and a willingness to adapt to changing circumstances.

One fundamental pathway to wealth creation lies in acquiring high-demand skills. Investing in your education and professional development is paramount. This can involve formal education, like a college degree in a field with strong job prospects, or informal learning through online courses, workshops, and certifications. The key is to identify skills that are valuable in the current and future job markets. Think about areas like technology (artificial intelligence, data science, cybersecurity), healthcare, finance, and renewable energy. By mastering these skills, you increase your earning potential and open doors to higher-paying jobs. Remember that the learning process is continuous, and you should be actively seeking opportunities to upgrade your skillset.

Beyond traditional employment, entrepreneurship offers a powerful avenue for generating wealth. Starting your own business, whether it's a small online store, a consulting service, or a technology startup, provides the opportunity to create something of value and capture a significant share of the profits. This path requires dedication, resilience, and a willingness to take risks. Thorough market research is crucial to identify unmet needs or underserved markets. Developing a solid business plan that outlines your goals, strategies, and financial projections is essential. Securing funding, whether through bootstrapping, angel investors, or venture capital, is often necessary to get your business off the ground. While the path of entrepreneurship can be challenging, the potential rewards are substantial. You have the freedom to control your own destiny, build a valuable asset, and create jobs for others.

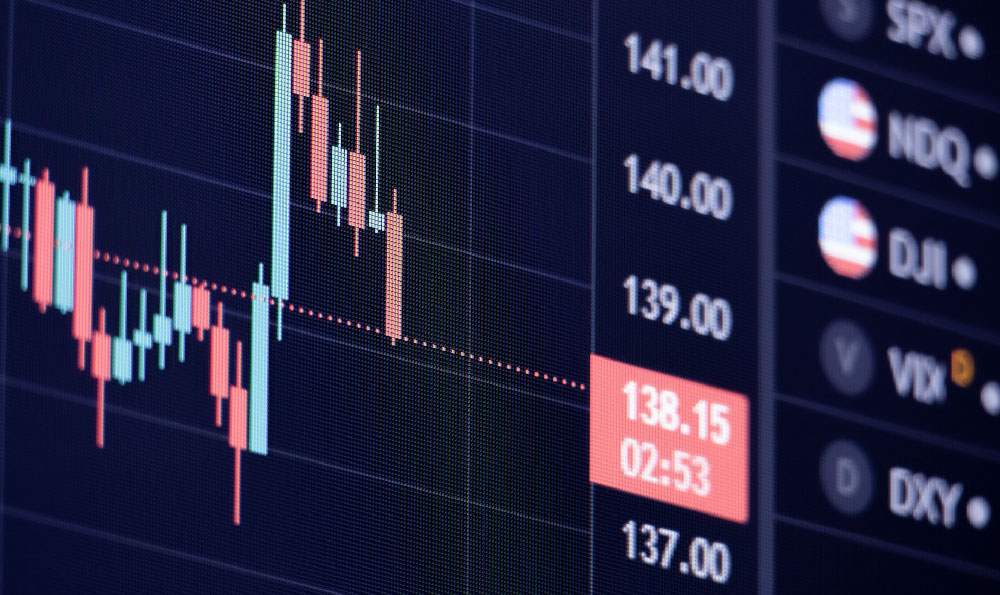

Investing is another critical component of building long-term wealth. It's the process of allocating capital with the expectation of generating future income or profits. There are many different types of investments, each with its own risk profile and potential return. Stocks represent ownership in a company and can provide significant capital appreciation over time, but they also carry the risk of market volatility. Bonds are debt instruments that offer a more stable income stream but typically have lower returns than stocks. Real estate can provide both rental income and capital appreciation, but it requires significant capital investment and involves ongoing management responsibilities. Diversification is key to managing risk in your investment portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of any single investment performing poorly. Furthermore, understanding your own risk tolerance and investment goals is vital for constructing an investment portfolio that aligns with your individual circumstances. Regularly reviewing and rebalancing your portfolio is also essential to ensure it remains aligned with your objectives.

Creating multiple streams of income is another powerful strategy for increasing your financial security and accelerating wealth accumulation. This can involve generating income from sources other than your primary job, such as freelance work, rental properties, online businesses, or investments. Side hustles, like offering your skills as a consultant or selling products online, can provide additional income and help you diversify your income sources. Building passive income streams, such as royalties from a book or income from a dividend-paying stock portfolio, can provide a steady flow of income with minimal ongoing effort. The more income streams you have, the less reliant you are on any single source, and the more resilient you are to economic shocks.

Furthermore, developing a strong financial foundation is crucial. This involves creating a budget to track your income and expenses, paying down high-interest debt, and building an emergency fund. A budget helps you understand where your money is going and identify areas where you can cut back on spending. Paying down high-interest debt, such as credit card debt, frees up cash flow and reduces your overall financial burden. An emergency fund provides a financial cushion to cover unexpected expenses, such as job loss or medical bills. Building a solid financial foundation provides a stable base for your wealth-building efforts.

Moreover, remember that making money is not just about accumulating wealth, but also about using it responsibly. Consider giving back to your community through charitable donations or volunteer work. Think about how you can use your resources to make a positive impact on the world. Financial success should be viewed as a tool for achieving your personal goals and contributing to the well-being of others.

Ultimately, the best strategies for making money are those that align with your skills, interests, and values. There is no one-size-fits-all approach. It requires a combination of hard work, smart decision-making, and a willingness to adapt to changing circumstances. By investing in yourself, exploring entrepreneurial opportunities, diversifying your income streams, and building a strong financial foundation, you can unlock your financial potential and achieve your financial goals. The journey towards financial freedom is a marathon, not a sprint. Persistence, patience, and a commitment to continuous learning are essential for long-term success.