Investing in India Stocks: A Smart Move? What's the Best Way?

Investing in the Indian stock market presents both significant opportunities and inherent risks. Whether it's a smart move depends heavily on an individual investor's circumstances, risk tolerance, investment goals, and time horizon. To navigate this dynamic landscape effectively, a thorough understanding of the Indian economy, market structure, and various investment avenues is crucial.

India, with its burgeoning middle class, rapidly growing economy, and youthful demographic, offers compelling reasons for investment. The country is undergoing significant structural reforms, including improvements in infrastructure, digitalization, and regulatory frameworks. These reforms are aimed at fostering economic growth and attracting foreign investment. Furthermore, India's robust domestic demand provides a buffer against global economic headwinds. Sectors like technology, pharmaceuticals, consumer goods, and financial services are experiencing rapid growth and offer promising investment prospects.

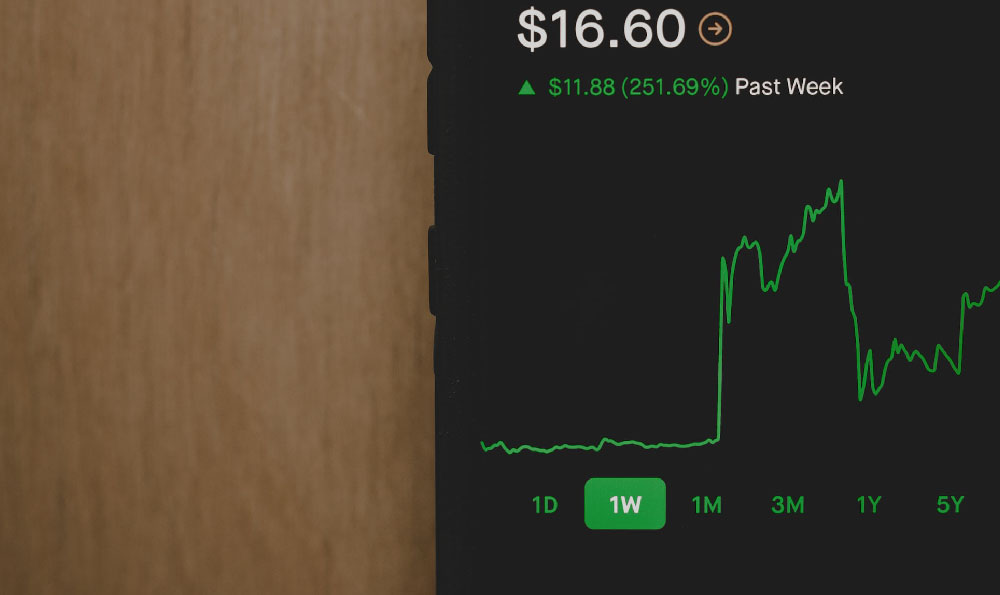

However, it's important to acknowledge the risks. The Indian stock market can be volatile, influenced by factors such as global economic conditions, commodity price fluctuations, political instability, and changes in government policies. Regulatory hurdles, bureaucratic inefficiencies, and corporate governance issues can also pose challenges. Moreover, the Indian Rupee is susceptible to fluctuations, which can impact returns for foreign investors.

Having considered the opportunities and risks, let's explore the best ways to invest in Indian stocks. There are several avenues available, each with its own advantages and disadvantages:

Direct Equity Investment: This involves buying shares of individual Indian companies directly through a brokerage account. This approach offers the potential for high returns but requires significant research and due diligence to identify undervalued companies with strong growth potential. Investors need to analyze financial statements, understand industry dynamics, and monitor market trends. This method is best suited for experienced investors with a high level of financial literacy and a tolerance for risk. Furthermore, it is important to consider the transaction costs and taxes associated with direct equity investment.

Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of Indian stocks. This option is suitable for investors who lack the time, expertise, or inclination to conduct in-depth research on individual companies. Mutual funds are managed by professional fund managers who have the expertise to analyze market trends and make informed investment decisions. There are various types of mutual funds available, including equity funds, debt funds, and hybrid funds. Equity funds invest primarily in stocks, while debt funds invest in bonds and other fixed-income securities. Hybrid funds invest in a mix of stocks and bonds. Investors should carefully consider their risk tolerance and investment goals when choosing a mutual fund. It's also essential to evaluate the fund's expense ratio, past performance, and investment strategy.

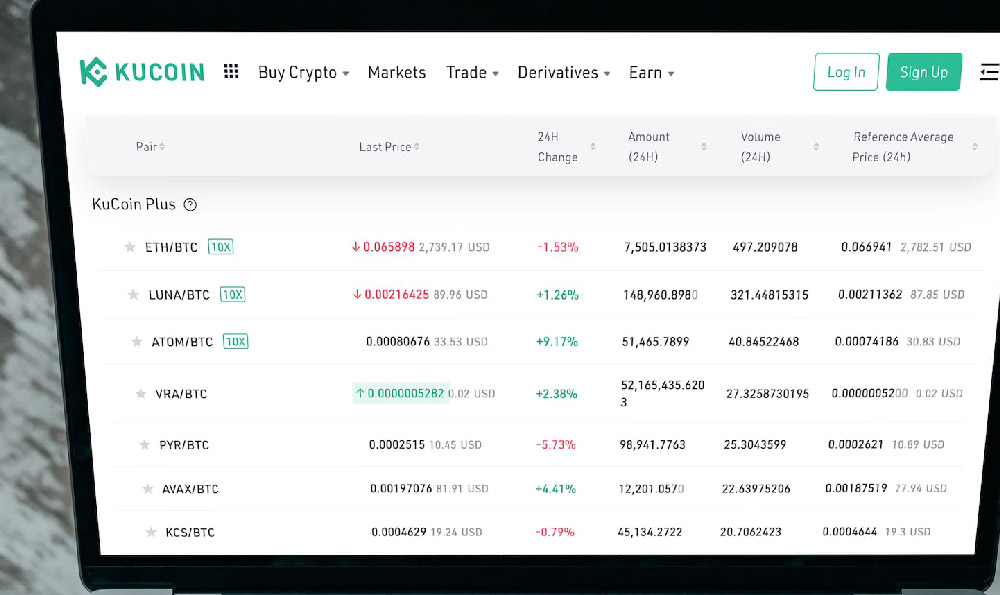

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer a convenient and cost-effective way to gain exposure to a broad range of Indian stocks. ETFs typically track a specific market index, such as the Nifty 50 or the Sensex. This provides instant diversification and eliminates the need for individual stock selection. ETFs are generally more liquid and have lower expense ratios than mutual funds. However, investors should be aware of the tracking error, which is the difference between the ETF's performance and the performance of the underlying index.

American Depositary Receipts (ADRs): ADRs are certificates that represent shares of foreign companies traded on U.S. stock exchanges. This allows U.S. investors to invest in Indian companies without having to open a brokerage account in India. ADRs are denominated in U.S. dollars, which eliminates the currency risk for U.S. investors. However, not all Indian companies have ADRs listed on U.S. exchanges. Furthermore, the liquidity of ADRs can vary, and transaction costs may be higher than for U.S. stocks.

Investing through International Brokerage Accounts: Some international brokerage firms offer access to the Indian stock market, allowing investors to buy and sell Indian stocks directly. This option can provide greater flexibility and control over investment decisions. However, it requires a thorough understanding of Indian regulations and tax laws. Investors may also need to deal with currency conversion and international transfer fees.

Before investing in Indian stocks, it's crucial to conduct thorough research and due diligence. This includes analyzing the Indian economy, understanding market trends, and evaluating the financial performance of individual companies or the investment strategy of mutual funds and ETFs. It's also important to consider the impact of currency fluctuations, political risks, and regulatory changes. Diversification is key to mitigating risk. Investors should consider diversifying their portfolio across different sectors, industries, and asset classes. This can help to reduce the impact of any single investment on overall portfolio performance.

Furthermore, it is essential to have a long-term investment horizon. The Indian stock market can be volatile in the short term, but it has historically delivered strong returns over the long term. Investors should be prepared to weather market fluctuations and avoid making emotional decisions based on short-term market movements.

Finally, it's advisable to consult with a qualified financial advisor who can provide personalized investment advice based on individual circumstances and risk tolerance. A financial advisor can help to develop a comprehensive financial plan, assess investment options, and monitor portfolio performance.

In conclusion, investing in Indian stocks can be a smart move for investors seeking long-term growth and diversification. However, it's essential to understand the risks involved and to choose the right investment approach based on individual circumstances and goals. Thorough research, diversification, a long-term investment horizon, and professional advice are crucial for success in the Indian stock market.