Investing: Where to Begin? What's the Initial Step?

Investing: A Beginner's Guide to Taking the Plunge

Many people find the prospect of investing intimidating. The world of finance can seem like a confusing maze of jargon, complex strategies, and potential pitfalls. However, investing doesn't have to be overwhelming. With a bit of knowledge, careful planning, and a disciplined approach, anyone can begin building a portfolio that helps them achieve their financial goals. The most important thing is to take that first step.

Laying the Foundation: Understanding Your Financial Landscape

Before diving into specific investments, it's crucial to assess your current financial situation. This involves understanding your income, expenses, debts, and assets.

- Calculate Your Net Worth: Determine your net worth by subtracting your liabilities (debts) from your assets (possessions of value). This provides a snapshot of your overall financial health.

- Track Your Spending: Monitor your income and expenses for a month or two to identify areas where you can save money. Even small savings can add up over time and be channeled into investments.

- Create a Budget: A budget is a roadmap for your finances. It helps you allocate your income to various expenses and savings goals, including investments.

- Address High-Interest Debt: Paying down high-interest debt, such as credit card debt, should be a priority before investing. The interest you pay on debt can easily outweigh the returns you earn on investments.

Defining Your Investment Goals and Risk Tolerance

Once you have a clear picture of your financial situation, you need to define your investment goals and risk tolerance. These factors will guide your investment decisions.

- What are your Goals? Determine what you're hoping to achieve through investing. Are you saving for retirement, a down payment on a house, your children's education, or something else entirely? The timeframe for your goals will influence the types of investments you choose. Short-term goals require more conservative investments, while long-term goals can accommodate more risk.

- Assess Your Risk Tolerance: Risk tolerance refers to your ability to withstand potential losses in your investments. Are you comfortable with the possibility of losing a portion of your investment in exchange for the potential for higher returns, or are you more risk-averse and prefer to preserve your capital? Understanding your risk tolerance will help you select investments that align with your comfort level. Consider taking a risk tolerance questionnaire online to gain a better understanding of your own preferences.

Opening an Investment Account: Your Gateway to the Market

To begin investing, you'll need to open an investment account. Several types of accounts are available, each with its own advantages and disadvantages.

- Brokerage Accounts: Brokerage accounts allow you to buy and sell a wide range of investments, including stocks, bonds, mutual funds, and ETFs (Exchange-Traded Funds). Full-service brokerages offer personalized advice and research, while discount brokerages provide a more self-directed experience at a lower cost.

- Retirement Accounts: Retirement accounts, such as 401(k)s and IRAs (Individual Retirement Accounts), offer tax advantages for long-term savings. Contributions to traditional 401(k)s and IRAs are tax-deductible, while earnings grow tax-deferred. Roth 401(k)s and Roth IRAs offer tax-free withdrawals in retirement.

- Robo-Advisors: Robo-advisors are automated investment platforms that use algorithms to build and manage portfolios based on your goals and risk tolerance. They typically charge lower fees than traditional financial advisors.

Choosing Your Investments: Building a Diversified Portfolio

Diversification is a key principle of investing. It involves spreading your investments across a variety of asset classes to reduce risk.

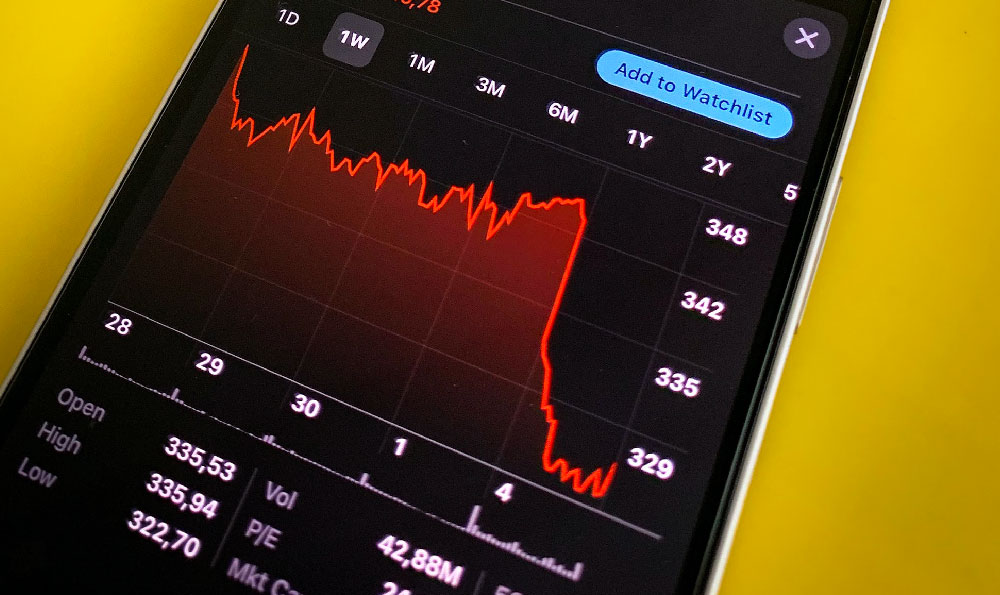

- Stocks: Stocks represent ownership in a company. They offer the potential for high returns but also carry a higher level of risk.

- Bonds: Bonds are loans made to governments or corporations. They offer lower returns than stocks but are generally considered less risky.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- ETFs (Exchange-Traded Funds): ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks. They offer diversification and low expense ratios.

- Real Estate: Investing in real estate can provide rental income and potential appreciation in value. However, it also requires significant capital and involves property management responsibilities.

The Importance of Continuous Learning and Monitoring

Investing is an ongoing process. It's essential to stay informed about market trends, economic conditions, and changes in your own financial situation.

- Read Financial News and Research: Stay up-to-date on market news and economic developments. Read reputable financial publications and research investment opportunities carefully.

- Regularly Review Your Portfolio: Review your portfolio at least once a year to ensure it still aligns with your goals and risk tolerance. Rebalance your portfolio as needed to maintain your desired asset allocation.

- Seek Professional Advice: If you're unsure about any aspect of investing, consider seeking advice from a qualified financial advisor.

Starting Small and Staying Consistent

You don't need a large sum of money to begin investing. Start small and gradually increase your contributions over time. Consistency is key to building wealth over the long term. Even small, regular investments can add up significantly over time due to the power of compounding.

Don't Let Fear Hold You Back

Many people avoid investing because they're afraid of losing money. While losses are possible, the potential rewards of investing far outweigh the risks over the long term. By educating yourself, developing a solid plan, and staying disciplined, you can minimize your risk and increase your chances of success. The most important step is simply to begin. Take the plunge, start small, and watch your investments grow over time. Remember, the journey of a thousand miles begins with a single step. Similarly, your journey to financial security begins with your first investment.