What is an Investment Bank, and Why Should You Care?

Investment banks are financial institutions that act as intermediaries between companies and investors. Understanding their role and function is crucial for anyone involved in or considering participation in financial markets, particularly those interested in investments like cryptocurrencies, as the principles and strategies employed by investment banks often permeate the broader financial landscape.

At their core, investment banks facilitate capital raising for corporations, governments, and other entities. They achieve this through various methods, primarily through underwriting and advisory services. Underwriting involves the purchase of newly issued securities (stocks, bonds, etc.) from the issuer with the intent of reselling them to the public or institutional investors. This process can take several forms, including firm commitment underwriting, where the investment bank guarantees the sale of the entire issue, assuming the risk if the market demand is insufficient. Alternatively, they may employ best efforts underwriting, where the bank acts as an agent, attempting to sell the securities but not guaranteeing their sale.

Beyond underwriting, investment banks provide advisory services on mergers and acquisitions (M&A), restructurings, and other strategic transactions. In the M&A realm, they act as advisors to either the buying or selling party, helping to value companies, negotiate terms, and structure deals. This requires sophisticated financial modeling, due diligence, and a deep understanding of industry dynamics. Restructuring advisory involves assisting companies facing financial distress, developing plans to reorganize their finances, renegotiate debt, and potentially avoid bankruptcy. These services are critical for the health and stability of the financial system.

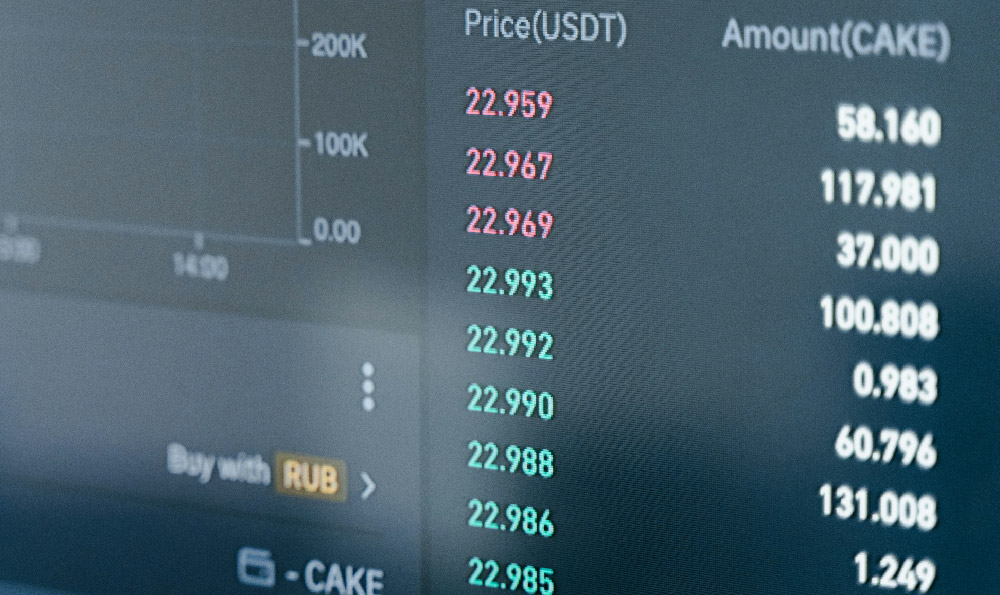

Investment banks also engage in trading activities, buying and selling securities on behalf of their clients and for their own accounts. This can include trading in stocks, bonds, currencies, commodities, and derivatives. Their trading desks provide liquidity to the market and facilitate price discovery. However, it's also where the potential for conflicts of interest and market manipulation exists, requiring stringent regulatory oversight.

So, why should you care about investment banks, even if you're primarily focused on cryptocurrency investments? The answer lies in the interconnectedness of financial markets. Investment banks play a significant role in shaping market sentiment, influencing capital flows, and driving investment trends.

Firstly, understanding the activities of investment banks can provide insights into the broader macroeconomic environment. Their underwriting activities offer a gauge of corporate confidence and investment appetite. A surge in IPOs (Initial Public Offerings) orchestrated by investment banks might signal a bullish market sentiment, while a slowdown could indicate caution. Monitoring their M&A activity can reveal trends in industry consolidation and strategic shifts. This macro-level understanding is vital for making informed investment decisions across all asset classes, including cryptocurrencies.

Secondly, investment banks often conduct research and analysis that can be valuable for investors. Their research departments employ analysts who cover various sectors, industries, and companies. These analysts provide insights into company performance, industry trends, and potential investment opportunities. While their reports may not explicitly cover cryptocurrencies in detail (though this is changing), the underlying analytical frameworks and economic perspectives are transferable. Understanding how they evaluate traditional assets can inform your approach to valuing and analyzing cryptocurrencies.

Thirdly, the regulatory environment surrounding investment banks can indirectly affect the cryptocurrency market. Regulations aimed at preventing money laundering, terrorist financing, and market manipulation in traditional financial markets can also have implications for the cryptocurrency space. As governments grapple with how to regulate cryptocurrencies, they often draw lessons and parallels from the regulation of investment banks and other financial institutions. Being aware of these regulatory trends is crucial for navigating the evolving landscape of the cryptocurrency market.

Furthermore, investment banks are increasingly exploring opportunities within the cryptocurrency ecosystem. Some are offering custody services for digital assets, while others are developing trading platforms for cryptocurrencies. This growing involvement of established financial institutions could lend legitimacy to the cryptocurrency market and attract more institutional investment. Conversely, it could also lead to increased regulatory scrutiny and potential restrictions.

However, it's also important to be aware of the potential pitfalls associated with investment banks. Their pursuit of profit can sometimes lead to unethical or even illegal behavior, such as insider trading, market manipulation, and the sale of toxic assets. The 2008 financial crisis serves as a stark reminder of the risks associated with unchecked investment banking practices. Therefore, it's essential to approach their research and recommendations with a critical eye and to conduct your own independent analysis.

In the context of cryptocurrency investment, understanding investment banking principles can help you to:

- Identify Emerging Trends: Follow the sectors investment banks are most active in, as this can signal future investment opportunities and technological advancements relevant to blockchain technology and cryptocurrencies.

- Assess Project Viability: Apply the same due diligence techniques used by investment bankers to evaluate the fundamentals of cryptocurrency projects and their underlying technology.

- Understand Market Sentiment: Analyze IPO and M&A activity to gauge overall market confidence and risk appetite, which can influence cryptocurrency prices.

- Manage Risk: Learn from past financial crises and understand the importance of diversification, risk management, and regulatory compliance.

In conclusion, while you may not directly interact with investment banks on a daily basis as a cryptocurrency investor, understanding their role, function, and influence is essential for navigating the complex and interconnected world of finance. By learning from their expertise and being aware of their potential pitfalls, you can make more informed investment decisions and protect your assets in the ever-evolving landscape of digital currencies. Understanding how traditional finance operates provides a valuable framework for analyzing and navigating the often-turbulent cryptocurrency markets.