What Will My Investment Be Worth? & How Can I Maximize Its Value?

Predicting the future value of an investment and strategizing to maximize its worth are fundamental concepts in financial planning. It's a question every investor asks, whether they're just starting out or managing a substantial portfolio. The answer, however, is rarely straightforward, as it involves understanding various factors, making informed assumptions, and implementing smart investment strategies. Let's delve into the components that contribute to an investment's potential value and how to optimize its growth trajectory.

Several key elements play a crucial role in determining the future value of your investment. The principal amount, which is the initial sum you invest, serves as the foundation upon which all future gains are built. Naturally, a larger principal generally yields a greater return, all else being equal. The rate of return, expressed as a percentage, represents the profitability of your investment over a specific period, typically a year. This rate is not fixed; it fluctuates based on market conditions, the type of investment, and the overall economic climate. It’s important to distinguish between nominal and real rate of return. The nominal rate is the stated rate without considering inflation, while the real rate adjusts for inflation, providing a more accurate picture of your investment's purchasing power over time. Time horizon, the duration for which you plan to keep your money invested, is another significant factor. The longer your investment horizon, the more opportunities you have to benefit from compounding, which is the snowball effect of earning returns on your initial investment as well as on the accumulated interest or gains.

Compounding is arguably one of the most powerful forces in investing. It’s the process of earning returns not only on the original principal but also on the accumulated interest or profits. Consider two scenarios: one where interest is withdrawn each year and another where it is reinvested. Over the long term, the reinvested interest will generate significantly higher returns due to the compounding effect. The frequency of compounding also matters. Interest compounded daily will generate slightly higher returns than interest compounded annually. While the difference may seem negligible in the short term, it can become substantial over decades.

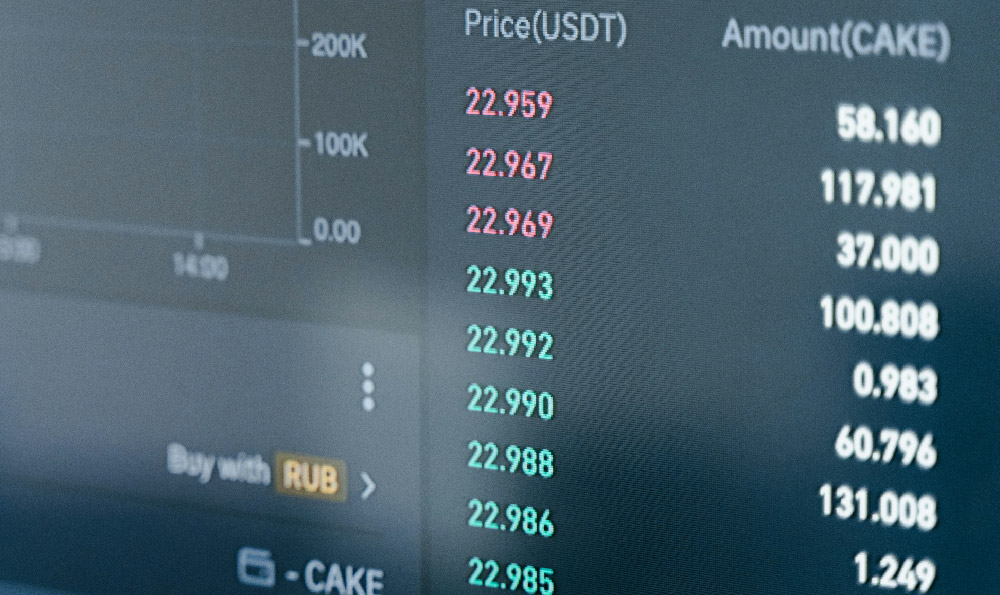

Several types of financial instruments can be used for investment, each with its own inherent risk and potential return profile. Stocks, representing ownership in a company, have historically offered higher returns but also come with greater volatility. Bonds, essentially loans to governments or corporations, tend to be less volatile but offer lower returns. Mutual funds and Exchange-Traded Funds (ETFs) provide diversification by pooling money from multiple investors and investing in a basket of assets, reducing individual security risk. Real estate can provide both income through rental properties and appreciation in value, but it requires more active management and can be less liquid. Alternative investments, such as hedge funds, private equity, and commodities, can offer diversification and potentially high returns, but they are typically less liquid and carry higher risks. Understanding the risk-return trade-off associated with each asset class is crucial for making informed investment decisions. Generally, higher potential returns come with higher risks, and vice versa.

To maximize the value of your investments, several strategies can be implemented. Asset allocation involves strategically distributing your investments across different asset classes based on your risk tolerance, investment goals, and time horizon. A well-diversified portfolio can help mitigate risk and enhance returns. Diversification means spreading your investments across various asset classes, industries, and geographic regions. This reduces the impact of any single investment on your overall portfolio. For example, instead of investing solely in technology stocks, you might allocate a portion of your portfolio to bonds, real estate, and international equities. Rebalancing your portfolio periodically is essential to maintain your desired asset allocation. Over time, certain assets may outperform others, causing your portfolio to drift away from its original allocation. Rebalancing involves selling some of the overperforming assets and buying underperforming ones to restore your target allocation.

Dollar-cost averaging is a strategy of investing a fixed amount of money at regular intervals, regardless of market fluctuations. This helps to smooth out the impact of market volatility and reduces the risk of investing a large sum at the peak of the market. Timing the market, attempting to predict short-term market movements, is notoriously difficult and often leads to lower returns. Sticking to a long-term investment strategy and avoiding impulsive decisions based on market noise is generally a more prudent approach. Minimizing investment costs is another crucial aspect of maximizing returns. High fees can significantly erode your profits over time. Opt for low-cost investment options, such as index funds and ETFs, and be mindful of brokerage fees, management fees, and transaction costs.

Tax efficiency is an often overlooked but essential component of investment management. Certain investments, such as municipal bonds, are tax-exempt, while others may be tax-deferred or taxed at lower rates, such as long-term capital gains. Utilizing tax-advantaged accounts, such as 401(k)s and IRAs, can help you reduce your tax burden and maximize your after-tax returns. Regularly reviewing and adjusting your investment strategy is crucial to ensure it remains aligned with your goals and risk tolerance. Life circumstances change, and so too should your investment approach. Major life events, such as marriage, children, job changes, or retirement, may require adjustments to your asset allocation and investment strategy. Staying informed about market trends, economic developments, and changes in tax laws is essential for making informed investment decisions. Consider consulting with a qualified financial advisor who can provide personalized advice and guidance based on your specific circumstances.

Ultimately, predicting the exact future value of an investment is impossible due to inherent market uncertainties. However, by understanding the key factors that influence investment growth, implementing sound investment strategies, and staying disciplined and informed, you can significantly increase your chances of achieving your financial goals and maximizing the value of your investments over the long term. Remember that investing is a marathon, not a sprint, and patience, perseverance, and a well-thought-out plan are essential for success.