Is Investing in Gold via the Share Market Possible? And How?

Yes, investing in gold via the share market is absolutely possible, and in fact, it's a common and relatively accessible way for investors to gain exposure to the gold market without physically owning the precious metal. There are several avenues available, each with its own nuances and risk profiles. Understanding these options is crucial for making informed investment decisions.

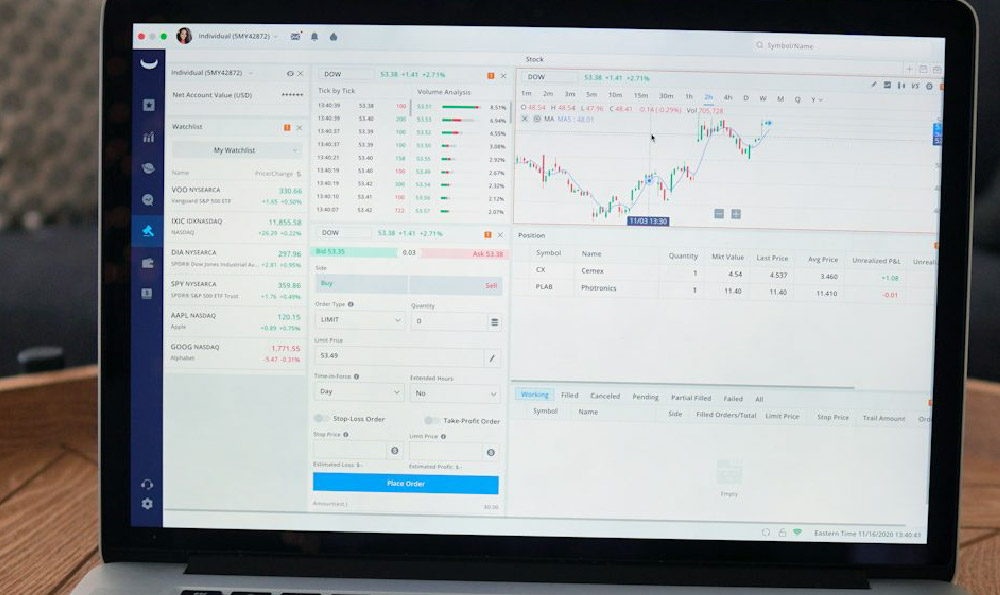

One of the most popular methods is investing in gold mining companies. These are publicly traded companies that are involved in the exploration, extraction, and processing of gold. By purchasing shares in these companies, you are essentially betting on their ability to profitably extract gold from the earth. The performance of these stocks is often correlated with the price of gold, meaning they tend to rise when gold prices increase and fall when gold prices decrease. However, it's important to recognize that gold mining stocks are not a direct proxy for the price of gold. Their performance is also influenced by factors specific to the company, such as its management team, operational efficiency, production costs, and geopolitical risks related to its mining locations. For instance, a company operating in a politically unstable region might face production disruptions, negatively impacting its stock price regardless of how high the price of gold is. Therefore, thorough research into the specific company is paramount before investing. Analyze their financial statements, understand their mining reserves and production capabilities, and assess the overall risk factors associated with their operations.

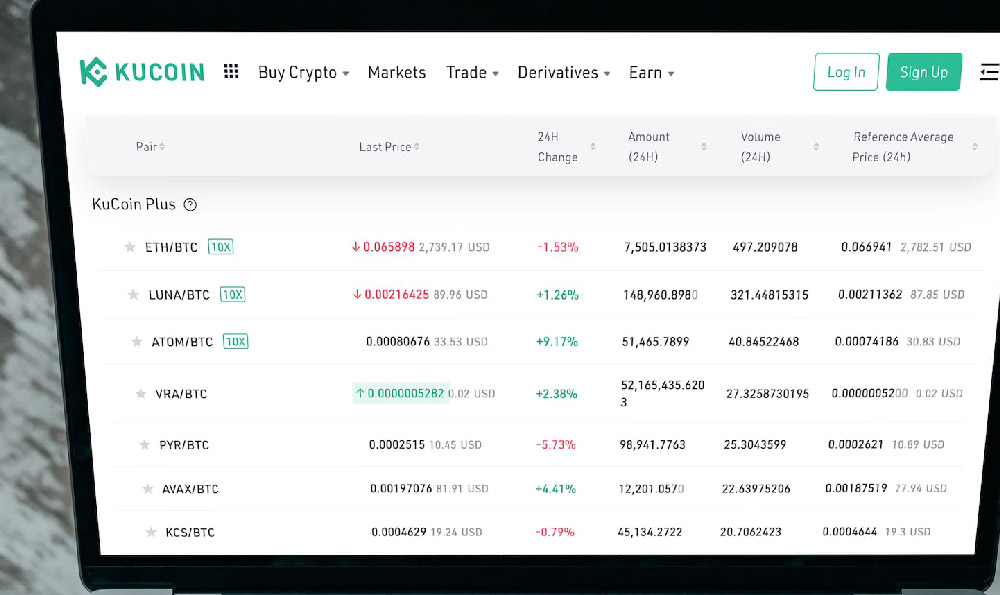

Another common route is through gold exchange-traded funds (ETFs). These are investment funds that trade on stock exchanges and are designed to track the price of gold. The most common type of gold ETF physically holds gold bullion in vaults, providing investors with direct exposure to the price of gold. When you buy shares of a gold ETF, you are essentially buying a fractional ownership of the gold bullion held by the fund. Gold ETFs offer several advantages. They are highly liquid, meaning you can easily buy and sell shares on the stock exchange. They are also relatively low-cost compared to physically owning gold, as you avoid storage and insurance costs. Furthermore, they offer diversification benefits, as you can gain exposure to the gold market with a relatively small investment. However, it's crucial to understand the ETF's structure and expenses. Some gold ETFs might use derivatives, such as futures contracts, to track the price of gold. While this can potentially enhance returns, it also introduces additional risks. Pay attention to the fund's expense ratio, which is the annual fee charged by the ETF to cover its operating expenses. Lower expense ratios are generally preferable, as they eat less into your potential returns.

A third option, albeit less common, involves investing in gold streaming and royalty companies. These companies provide upfront financing to mining companies in exchange for a percentage of the gold produced from the mine, or a royalty on the revenue generated. Gold streaming and royalty companies offer a different way to gain exposure to the gold market. Their revenue is typically tied to the production of gold from the mines they finance, rather than the overall price of gold. This can provide a more stable revenue stream compared to traditional mining companies, as they are less exposed to the fluctuations in operating costs and capital expenditures. However, their performance is still influenced by the success of the mines they finance. It's essential to assess the quality of their streaming and royalty agreements, the diversity of their portfolio of mines, and the overall creditworthiness of the mining companies they partner with.

When considering investing in gold via the share market, it's crucial to understand your own investment goals and risk tolerance. Gold is often considered a safe-haven asset, meaning it tends to perform well during times of economic uncertainty or market volatility. It can serve as a hedge against inflation and currency devaluation. However, gold prices can be volatile in the short term. Therefore, it's generally recommended to have a long-term investment horizon when investing in gold. Consider your overall portfolio allocation and determine what percentage of your portfolio you want to allocate to gold. A diversified portfolio should include a mix of different asset classes, such as stocks, bonds, and real estate, in addition to gold.

Before making any investment decisions, conduct thorough research and consult with a qualified financial advisor. Understand the risks and potential rewards associated with each investment option. Diversify your investments across different gold-related assets to mitigate risk. Monitor your investments regularly and adjust your portfolio as needed based on your investment goals and market conditions. Remember that past performance is not indicative of future results. The gold market can be influenced by a variety of factors, including global economic conditions, geopolitical events, and interest rate changes. Stay informed about these factors and their potential impact on gold prices.

In conclusion, investing in gold via the share market is a viable option for investors seeking exposure to the precious metal. Whether through gold mining stocks, gold ETFs, or gold streaming and royalty companies, there are various avenues available to participate in the gold market. However, it's crucial to understand the specific risks and rewards associated with each option and to conduct thorough research before making any investment decisions. By carefully considering your investment goals, risk tolerance, and overall portfolio allocation, you can make informed investment decisions and potentially benefit from the diversification and safe-haven characteristics that gold can offer.