Keepbit Implementation Guide: Coinpro - What is it, and How Does it Work?

Coinpro, as a theoretical Keepbit implementation, represents a fascinating convergence of blockchain technology, decentralized finance (DeFi), and the pursuit of enhanced financial security. It's crucial to understand that "Coinpro" in this context is a hypothetical example – a design blueprint rather than a fully functional, real-world product. Think of it as a detailed proposal for how Keepbit’s core principles could be applied to a specific DeFi scenario. Understanding the theoretical nature is paramount before exploring its workings.

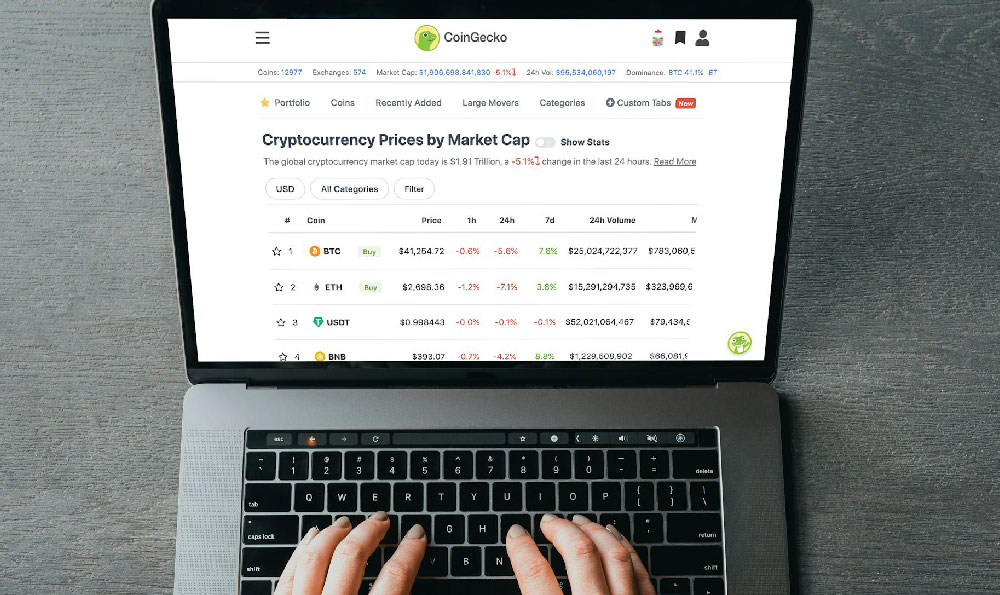

At its core, Coinpro aims to provide a safer and more reliable framework for participating in DeFi activities. The inherent volatility and risk associated with many DeFi platforms are well-documented. Smart contract vulnerabilities, impermanent loss in liquidity pools, and rug pulls are just a few of the potential pitfalls that investors face. Coinpro, through the application of Keepbit concepts, seeks to mitigate these risks.

The fundamental building blocks of Coinpro rely on several key principles. First and foremost is the concept of layered security. This involves employing multiple layers of protection to safeguard user funds and data. Instead of relying on a single security measure, Coinpro would integrate a combination of techniques, such as multi-signature wallets, cold storage solutions, and advanced encryption protocols. Multi-signature wallets require multiple approvals before any transaction can be executed, making it significantly harder for a single attacker to compromise the system. Cold storage solutions, where private keys are stored offline, drastically reduce the risk of online hacking. Encryption protocols protect sensitive data from unauthorized access.

Secondly, Coinpro would heavily emphasize smart contract auditing and formal verification. Smart contracts are the backbone of DeFi applications, and any vulnerabilities in their code can have catastrophic consequences. To address this, Coinpro would mandate rigorous auditing by independent security firms before any smart contract is deployed. Furthermore, it would employ formal verification techniques, which use mathematical methods to prove the correctness of the smart contract code and identify potential flaws that might be missed by traditional auditing methods. This proactive approach to security is critical for preventing exploits and ensuring the integrity of the platform.

Thirdly, decentralized governance would play a crucial role in Coinpro's operation. This means that the community of users and stakeholders would have a say in the platform's development and decision-making processes. Through a decentralized governance model, Coinpro can ensure that the platform is aligned with the needs of its users and that any changes or upgrades are implemented in a transparent and accountable manner. Token holders would be able to vote on proposals related to platform upgrades, security measures, and other important decisions, fostering a sense of ownership and responsibility within the community.

Fourthly, risk diversification is a key strategy within Coinpro’s conceptual design. Instead of focusing on a single asset or investment strategy, Coinpro would encourage users to diversify their portfolios across a range of different assets and DeFi protocols. This can help to reduce the overall risk of their investment portfolio and protect them from the impact of any single event or market downturn. Coinpro could offer tools and resources to help users identify and manage their risk exposure, as well as access to a diversified range of investment options.

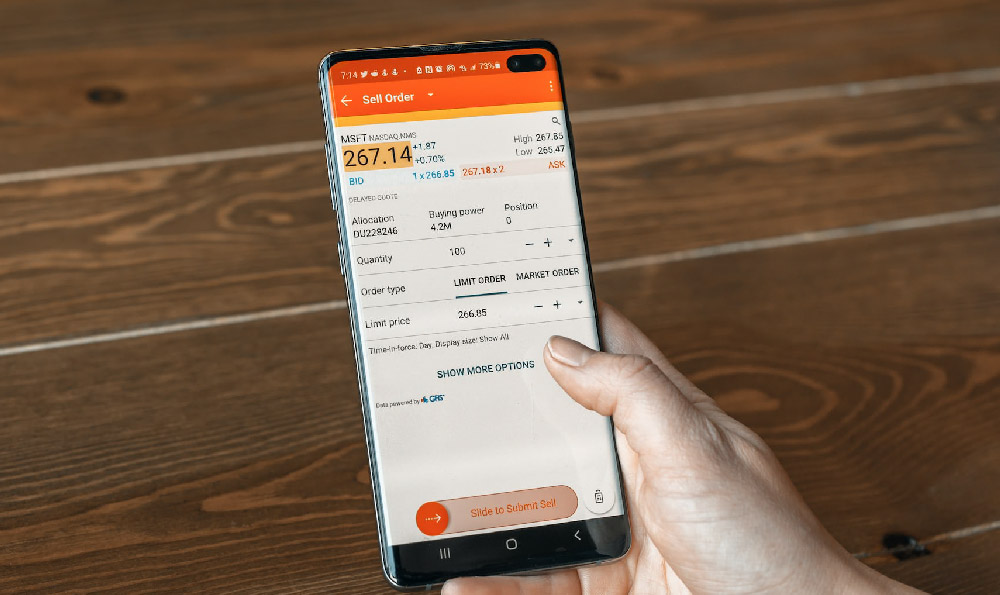

Now, let’s delve into how Coinpro might function in practice. Imagine a user wanting to participate in a decentralized lending protocol. Traditionally, they would deposit their funds directly into the lending pool, exposing themselves to the risks of smart contract vulnerabilities and impermanent loss. With Coinpro, the user would interact with a secure interface that acts as a gateway to the lending protocol. This interface would first assess the risk profile of the lending protocol, taking into account factors such as the smart contract audit history, the level of decentralization, and the historical performance of the protocol.

If the risk profile is deemed acceptable, the interface would then automatically diversify the user's funds across multiple lending protocols or liquidity pools, reducing the risk of impermanent loss and exposure to any single vulnerability. The interface would also monitor the performance of the lending protocols in real-time and automatically rebalance the user's portfolio as needed to maintain optimal risk-adjusted returns. Furthermore, any withdrawals would require multi-signature approval, adding an extra layer of security.

To incentivize participation and governance, Coinpro could introduce a native token that rewards users for providing liquidity, participating in governance decisions, and contributing to the platform's security. This token could also be used to pay for transaction fees or to access premium features on the platform. The tokenomics of the Coinpro token would be carefully designed to ensure that the token is scarce and valuable, and that it aligns the interests of all stakeholders.

The practical challenges in implementing Coinpro are substantial. Developing and maintaining secure smart contracts requires specialized expertise and rigorous testing. Decentralized governance models can be complex to implement and can be vulnerable to manipulation. Achieving true diversification across DeFi protocols can be challenging, as many protocols are correlated and subject to the same market risks. Scaling the platform to handle a large number of users and transactions is another significant hurdle. Regulatory uncertainty surrounding DeFi also poses a challenge, as new regulations could impact the way Coinpro operates.

In conclusion, Coinpro, as a hypothetical implementation of Keepbit principles, offers a promising vision for a safer and more reliable DeFi ecosystem. By focusing on layered security, smart contract auditing, decentralized governance, and risk diversification, Coinpro could potentially mitigate many of the risks associated with traditional DeFi platforms. However, the practical challenges in implementing such a platform are significant and require careful consideration. It is essential to remember that Coinpro is a theoretical model and further research and development are needed to bring it to fruition. The underlying concepts, however, provide a valuable framework for building more secure and robust DeFi applications in the future. Continuous vigilance and proactive risk management remain paramount in the ever-evolving landscape of decentralized finance.