Did Keith Gill Profit? What Were His Gains?

Keith Gill, also known as "Roaring Kitty" on YouTube and "DeepFuckingValue" on Reddit, became a central figure in the GameStop saga of early 2021. His story is one of calculated risk, deep conviction, and ultimately, significant, albeit complex and controversial, financial gains. Determining the precise figures of his profits is challenging due to the privacy surrounding individual investment portfolios and the fluctuations inherent in the stock market. However, we can analyze the publicly available information and his documented positions to estimate his gains and understand the strategies that contributed to his success.

Gill's initial investment in GameStop began long before the stock became a meme. He started purchasing shares in 2019 when the company's stock was trading in the single digits. He believed, contrary to the prevailing Wall Street narrative, that GameStop was undervalued. His argument was based on his analysis of the company's balance sheet, its potential for adaptation in the gaming market, and the short interest surrounding the stock. He diligently documented his investment journey on Reddit's WallStreetBets forum and his YouTube channel, sharing his research and reasoning with a growing audience. This transparency and analytical approach distinguished him from many other investors on the platform.

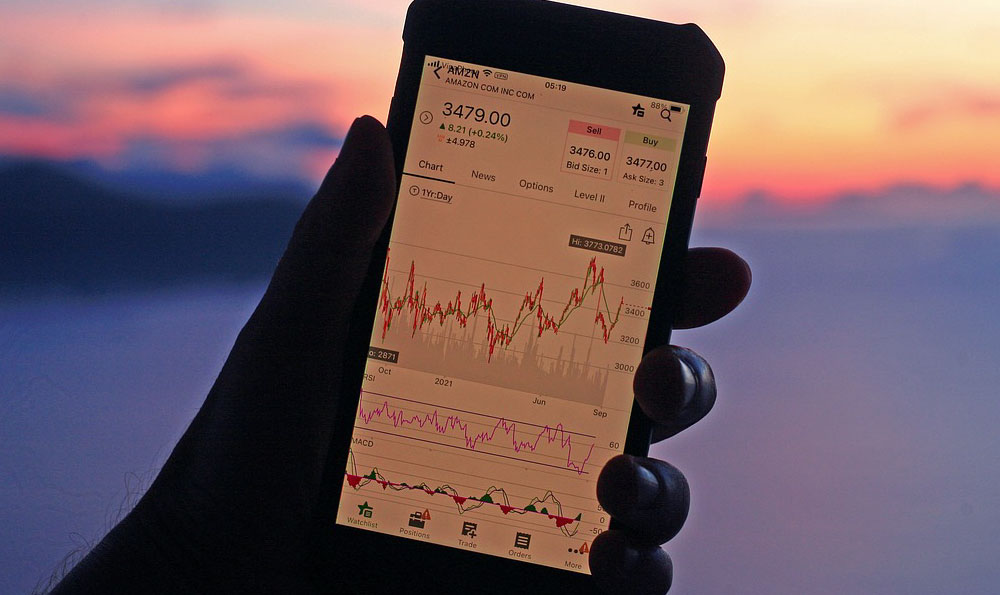

As GameStop's stock began its meteoric rise in January 2021, fueled by a short squeeze orchestrated by retail investors coordinating through WallStreetBets, Gill's portfolio exploded in value. He consistently updated his positions, often posting screenshots of his brokerage account. At one point, his portfolio was estimated to be worth nearly $50 million, representing a staggering return on his initial investment, which was reported to be around $53,000. This significant increase in value brought him both fame and scrutiny.

However, it's crucial to understand that the paper gains represented at the peak were not necessarily realized gains. The stock price of GameStop was extremely volatile, and the value of Gill's portfolio fluctuated wildly. To realize a profit, he would have needed to sell his shares at a favorable price. While he did exercise some of his call options, which would have resulted in purchasing additional shares at a predetermined price, the extent to which he sold his existing holdings remains largely private.

Publicly available information, including congressional testimony and reports, suggests that Gill did realize substantial profits from his GameStop investment. Estimates place his gains in the millions of dollars, likely in the tens of millions, though a precise figure is difficult to ascertain. The actual amount would depend on the specific timing and volume of his sales, which remain undisclosed.

Beyond the stock price appreciation, Gill also profited from options trading. His strategy involved purchasing call options on GameStop, which gave him the right, but not the obligation, to buy shares at a specific price before a certain date. As the stock price soared, these call options became incredibly valuable, allowing him to either exercise them and purchase shares at a lower price or sell them for a profit.

The controversy surrounding Gill's gains stems from the perception that his actions may have influenced the market and potentially misled other investors. He was investigated by regulators to determine whether he violated any securities laws. The core question was whether his online posts constituted investment advice and whether he had manipulated the market. While investigations did not result in criminal charges, they did raise questions about the role of social media in investment and the responsibilities of individuals with a large online following.

Furthermore, the aftermath of the GameStop surge saw many retail investors who had jumped in late suffer significant losses as the stock price eventually plummeted. This highlighted the risks associated with following investment trends driven by social media hype and the importance of conducting thorough research before investing.

In summary, while the exact amount of Keith Gill's profits from the GameStop saga remains private, it is clear that he realized substantial gains, likely in the millions of dollars. His success was a result of his early investment, deep understanding of the company, effective options trading strategy, and the unprecedented short squeeze that propelled GameStop's stock price to unprecedented heights. However, his story also serves as a cautionary tale about the risks associated with volatile investments and the importance of responsible investing practices. The GameStop episode shone a spotlight on the power of retail investors and the potential for social media to influence the market, but it also underscored the need for careful analysis, risk management, and a healthy dose of skepticism when navigating the world of investing. The lasting impact of Keith Gill's journey extends beyond his personal gains; it reshaped the landscape of retail investing and sparked a broader conversation about market regulation and investor protection.