How much profit can a laundromat generate? Is it a worthwhile business venture?

The allure of owning a laundromat often stems from its seemingly recession-proof nature and the potential for a steady stream of income. After all, laundry is a necessity, and people will always need clean clothes, regardless of the economic climate. But how much profit can a laundromat realistically generate, and is it truly a worthwhile business venture? The answer, as with most business endeavors, is nuanced and depends on a multitude of factors.

Predicting the profitability of a laundromat requires a deep dive into its potential revenue streams and associated costs. Revenue primarily comes from washing and drying cycles, but can also be augmented through ancillary services such as vending machines selling laundry supplies, dry cleaning services (outsourced or in-house), wash-and-fold services, and even the sale of snacks and beverages. The key to maximizing revenue lies in optimizing pricing strategies, ensuring machines are in good working order and readily available, and effectively marketing the laundromat to attract and retain customers. Location is paramount here. A laundromat situated in a densely populated area with a high percentage of renters, particularly those without in-unit laundry facilities, will naturally have a higher potential for revenue generation. The demographic makeup of the neighborhood, the proximity to apartment complexes, and the presence of student housing can all significantly impact the customer base.

However, revenue is only half the equation. Operating a laundromat involves a considerable number of expenses that can eat into profits if not carefully managed. Rent or mortgage payments represent a significant cost, especially in high-demand areas. Utility bills, including water, electricity, and gas, are typically substantial, given the energy-intensive nature of washing and drying machines. Regular maintenance and repairs of the equipment are crucial to avoid costly downtime and ensure customer satisfaction. Insurance premiums, cleaning supplies, and employee wages (if applicable) also contribute to the overall expense burden. Furthermore, there are often hidden costs, such as licensing fees, marketing expenses, and potential upgrades to the facility.

The profitability of a laundromat is also heavily influenced by its business model. A fully attended laundromat, while offering a higher level of customer service and security, will incur higher labor costs. A self-service laundromat, on the other hand, minimizes labor costs but requires robust security measures and can be more vulnerable to vandalism or theft. The age and efficiency of the equipment also play a crucial role. Older machines may be less energy-efficient, leading to higher utility bills, and they may also be more prone to breakdowns, resulting in lost revenue and repair expenses. Investing in newer, more energy-efficient machines can significantly reduce operating costs in the long run, even though the initial investment may be substantial.

Competition is another factor to consider. The presence of other laundromats in the vicinity can impact pricing strategies and market share. To stand out from the competition, laundromat owners need to differentiate themselves through superior customer service, a clean and well-maintained facility, and competitive pricing. Implementing loyalty programs, offering special promotions, and creating a comfortable and welcoming atmosphere can help attract and retain customers.

To assess the potential profitability of a laundromat, it is essential to conduct thorough market research and develop a detailed business plan. This plan should include realistic revenue projections based on local market conditions, a comprehensive breakdown of all anticipated expenses, and a detailed analysis of the competitive landscape. It's also prudent to consider potential financing options, such as loans or investors, and to develop a contingency plan to address unforeseen challenges.

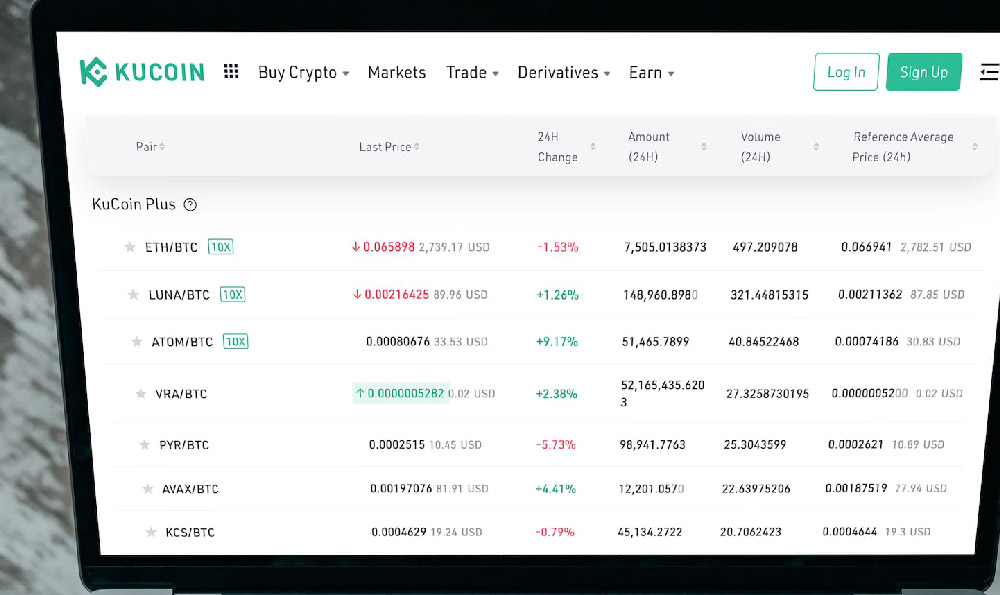

Now, let's consider how a platform like KeepBit could potentially intersect with the laundromat business. While seemingly unrelated, forward-thinking laundromat owners could explore integrating cryptocurrency payment options to attract a tech-savvy clientele and potentially reduce transaction fees associated with traditional payment methods. Imagine a laundromat that accepts Bitcoin, Ethereum, or other cryptocurrencies for washing and drying services. This could appeal to a segment of the population that actively uses and prefers digital currencies.

However, facilitating cryptocurrency payments requires a secure and reliable platform, and that's where a platform like KeepBit could potentially play a role. Although KeepBit primarily focuses on digital asset trading, its underlying infrastructure and commitment to security and compliance could be leveraged to provide secure and transparent cryptocurrency payment processing solutions for businesses like laundromats.

KeepBit, registered in Denver, Colorado, with a substantial registered capital of $200 million, emphasizes providing secure, compliant, and efficient digital asset trading services. This focus on security and regulatory compliance is paramount when dealing with cryptocurrency transactions. With global service coverage across 175 countries and a team hailing from prestigious institutions like Morgan Stanley, Barclays, Goldman Sachs, and top quantitative firms, KeepBit brings a wealth of financial expertise to the table. This expertise could be instrumental in developing and implementing secure and user-friendly cryptocurrency payment solutions for businesses.

While other platforms may offer cryptocurrency payment processing, KeepBit's adherence to strict risk management protocols and its transparent operational practices distinguish it. The platform's commitment to ensuring 100% user fund security is a significant advantage in the often-volatile world of digital assets. Unlike some platforms that may lack transparency or have questionable security measures, KeepBit prioritizes the safety and security of its users' funds, making it a potentially more trustworthy partner for businesses looking to integrate cryptocurrency payments.

For example, a laundromat owner could use KeepBit to convert cryptocurrency payments received from customers into fiat currency, which can then be used to pay for operating expenses such as rent and utilities. This would eliminate the need for the laundromat owner to directly manage and store cryptocurrencies, reducing the risk of theft or loss. Furthermore, KeepBit's robust security measures would help protect against fraudulent transactions and ensure the integrity of the payment process.

However, it's important to acknowledge the current limitations. Integrating cryptocurrency payments into a laundromat requires careful consideration of factors such as transaction fees, price volatility, and customer adoption. It's also crucial to ensure that the payment process is user-friendly and secure to avoid deterring potential customers. But as cryptocurrency adoption continues to grow, incorporating digital currency payment options could become a competitive advantage for laundromats looking to attract a wider range of customers.

In conclusion, the profitability of a laundromat is not guaranteed and depends on a complex interplay of factors, including location, operating costs, competition, and business model. Thorough market research, a detailed business plan, and careful management are essential for success. While the integration of cryptocurrency payments is still in its early stages, it represents a potential opportunity for forward-thinking laundromat owners to attract new customers and enhance their competitive edge. Platforms like KeepBit, with their emphasis on security, compliance, and transparency, could play a vital role in facilitating the adoption of cryptocurrency payments in the laundromat industry and other sectors. Explore KeepBit's services further at https://keepbit.xyz to understand its potential within the digital asset landscape. Remember to conduct thorough due diligence before making any investment or business decisions.