Can Ledger Nano S Store BTC? Is Keepbit a Good Platform?

Here's an SEO-optimized article answering the question "Can Ledger Nano S Store BTC? Is Keepbit a Good Platform?" with a focus on providing comprehensive information and user-friendly content.

Can Ledger Nano S Secure Your Bitcoin? A Deep Dive

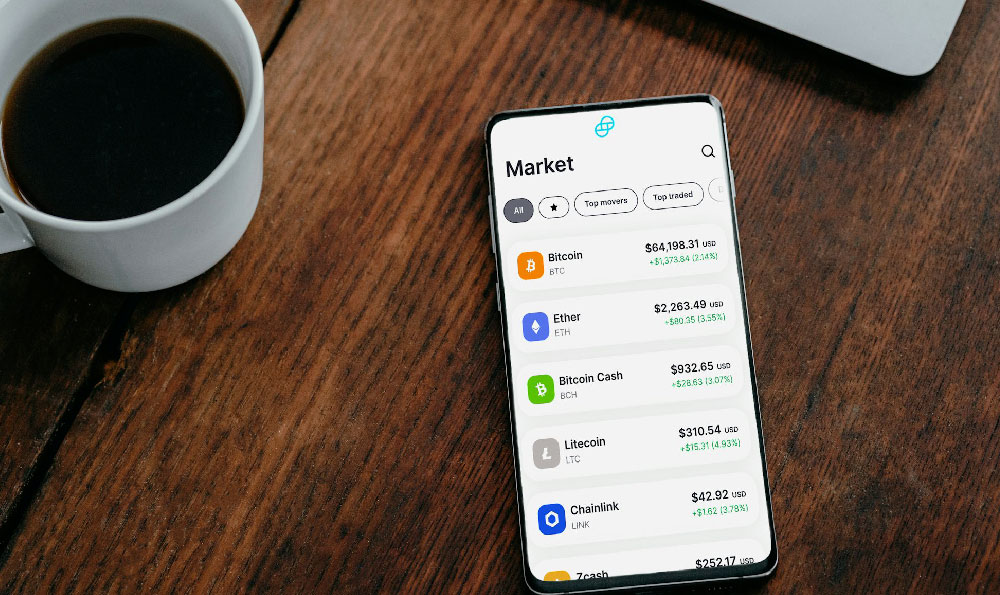

Cryptocurrency, particularly Bitcoin (BTC), has surged in popularity, attracting both seasoned investors and newcomers. As the value of digital assets increases, so does the importance of secure storage. Hardware wallets, like the Ledger Nano S, have emerged as a popular solution. Let’s examine if the Ledger Nano S can effectively store BTC and how it compares to other options.

Understanding the Ledger Nano S

The Ledger Nano S is a hardware wallet, a physical device designed to store your private keys offline. Private keys are essential for accessing and managing your cryptocurrency holdings. Unlike software wallets or exchanges, which store keys online (making them vulnerable to hacking), hardware wallets keep them isolated from internet-connected devices. This offline storage significantly reduces the risk of unauthorized access.

Ledger Nano S and Bitcoin Compatibility

The answer is a resounding yes! The Ledger Nano S is fully compatible with Bitcoin. It supports BTC storage through the Ledger Live application or via compatible third-party wallets. This means you can securely send, receive, and manage your Bitcoin using the Ledger Nano S device.

How it Works: Securing Your BTC with Ledger Nano S

The process of using the Ledger Nano S to store Bitcoin is straightforward:

-

Initialization: You’ll need to initialize your Ledger Nano S by setting up a PIN code and recording your 24-word recovery phrase. This recovery phrase is crucial; it's your backup in case your device is lost, stolen, or damaged.

-

Installing the Bitcoin App: Using Ledger Live, install the Bitcoin (BTC) app on your Ledger Nano S. This app allows the device to interact with the Bitcoin blockchain.

-

Generating Bitcoin Addresses: Within the Ledger Live app (or a compatible wallet connected to your Ledger Nano S), you can generate Bitcoin addresses. These addresses are used to receive BTC.

-

Transaction Signing: When you want to send Bitcoin, you initiate the transaction through Ledger Live or a connected wallet. The Ledger Nano S will then prompt you to verify the transaction details and approve it using the physical buttons on the device. This physical confirmation adds an extra layer of security, preventing unauthorized transactions even if your computer is compromised.

The Advantages of Using Ledger Nano S for BTC Storage

- Offline Storage: Your private keys are stored offline, shielded from online threats.

- PIN Protection: The device requires a PIN code to access, adding a layer of physical security.

- Recovery Phrase: The 24-word recovery phrase allows you to restore your Bitcoin in case of device loss.

- Transaction Verification: You must physically verify and approve transactions on the device, preventing remote hacking.

- Multi-Currency Support: The Ledger Nano S supports multiple cryptocurrencies, allowing you to manage various assets with a single device.

Are There Any Drawbacks?

- Cost: Hardware wallets require an upfront investment, unlike free software wallets.

- Learning Curve: While user-friendly, there's a slight learning curve associated with setting up and using a hardware wallet.

- Physical Security: You need to protect the physical device and your recovery phrase from theft or loss.

Keepbit: A Critical Assessment of the Platform

Now, let's shift our focus to Keepbit, a platform mentioned in the original question. Determining whether Keepbit is a "good" platform requires a comprehensive assessment of its features, security, reputation, and user experience. Without specific details about Keepbit's functionality (e.g., exchange, lending platform, information aggregator), a definitive recommendation is impossible. However, here's a general framework for evaluating any crypto platform, which you can use to assess Keepbit if you have more information:

Key Factors to Consider When Evaluating a Crypto Platform

-

Security: This is paramount. Investigate the platform's security measures:

- Two-Factor Authentication (2FA): Does it offer 2FA for account logins?

- Cold Storage: Does the platform store a significant portion of its assets in cold storage (offline)?

- Audits: Has the platform undergone security audits by reputable firms? Are the results publicly available?

- Insurance: Does the platform have insurance coverage to protect against losses due to hacks or other security breaches?

- Past Security Incidents: Research if the platform has experienced any security breaches in the past. If so, how were they handled?

-

Reputation and Trustworthiness:

-

Reviews and Ratings: Check online reviews and ratings from reputable sources (e.g., Trustpilot, Reddit, Bitcoin forums).

- Transparency: Is the platform transparent about its operations, fees, and security practices?

- Regulatory Compliance: Does the platform comply with relevant regulations in its jurisdiction? Is it registered with the appropriate authorities?

- Team and Background: Research the team behind the platform. Are they experienced and reputable in the cryptocurrency industry?

-

Features and Functionality:

-

Trading Options: What cryptocurrencies are supported? What trading pairs are available?

- Fees: What are the trading fees, withdrawal fees, and other fees associated with using the platform? Compare these fees to other platforms.

- User Interface: Is the platform easy to use and navigate? Is it suitable for both beginners and experienced users?

- Customer Support: Does the platform offer responsive and helpful customer support? What channels are available (e.g., email, chat, phone)?

- Staking/Lending Options: If the platform offers staking or lending opportunities, what are the risks and rewards involved? Are the interest rates competitive?

-

Liquidity:

-

Trading Volume: Does the platform have sufficient trading volume to ensure that you can buy and sell cryptocurrencies easily without significant price slippage?

-

Risks Associated with Using Crypto Platforms:

-

Volatility: Cryptocurrencies are inherently volatile, and their prices can fluctuate significantly.

- Regulatory Risk: The regulatory landscape for cryptocurrencies is constantly evolving, and there is a risk that new regulations could negatively impact the value of your holdings or the operations of the platform.

- Counterparty Risk: When you use a crypto platform, you are entrusting your assets to a third party. There is a risk that the platform could become insolvent or experience other problems that could result in the loss of your funds.

General Recommendation

Before using any crypto platform, including Keepbit (if you have more information about its specific features), conduct thorough research. Read reviews, compare fees, and assess the platform's security measures. Consider using a hardware wallet like the Ledger Nano S to store your Bitcoin and other cryptocurrencies for added security, especially for long-term holdings. Never invest more than you can afford to lose, and always be aware of the risks involved in cryptocurrency investing.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Cryptocurrency investments are risky and can result in losses. Always do your own research before investing.