Can You Make Money Investing in Stocks?

Investing in stocks has long been a topic of fascination for individuals seeking to grow their wealth. While the stock market is often touted as a place where fortunes can be made, it is equally important to recognize the risks involved. For those contemplating this path, the key lies in understanding that success is neither guaranteed nor consistent, but rather dependent on a combination of factors including strategic planning, market conditions, and emotional control. The market’s fluctuation makes it a complex arena, yet its potential for long-term appreciation remains undeniable. By examining real-world examples and analyzing the mechanisms at play, it becomes clearer how individuals can navigate this landscape to make money through stock investments.

The stock market operates as a dynamic system where the value of shares can rise or fall based on company performance, investor sentiment, and broader economic trends. Historically, stocks have outperformed other investment vehicles over extended periods, with the S&P 500 index returning approximately 10% annually since 1926. This figure, while impressive, does not account for the volatility that accompanies such growth. Investors who are prepared to weather short-term fluctuations and focus on long-term goals may find that the compounding effect of earnings contributes significantly to their overall returns. For instance, consistent reinvestment of dividends can transform initial capital into substantial wealth over decades, even if individual stock prices experience temporary downturns.

However, the path to profitability is not straightforward. Market conditions, such as interest rates and geopolitical tensions, can impact investor returns in unpredictable ways. During 2020, for example, the global pandemic caused a sharp decline in stock prices, but those who remained invested saw a dramatic rebound by the end of the year. This illustrates the importance of patience in stock market investments, as timing the market often leads to missed opportunities. Instead of attempting to predict short-term movements, investors should focus on the fundamental strengths of companies and the broader economic environment. A firm with strong financials, innovative products, and a resilient business model is more likely to deliver consistent returns over the long haul.

The individual’s approach to investing also plays a critical role in determining success. Diversification is a foundational strategy, as concentrating investments in a single stock or sector increases exposure to risk. By spreading capital across various industries and geographic regions, investors can mitigate the impact of a poor-performing asset. For example, a portfolio containing both technology and energy stocks may weather a downturn in one sector by benefiting from growth in another. Similarly, allocating resources to different market caps—such as large-cap, mid-cap, and small-cap stocks—can balance stability with higher growth potential. This approach ensures that even if one segment of the market declines, others may offset those losses.

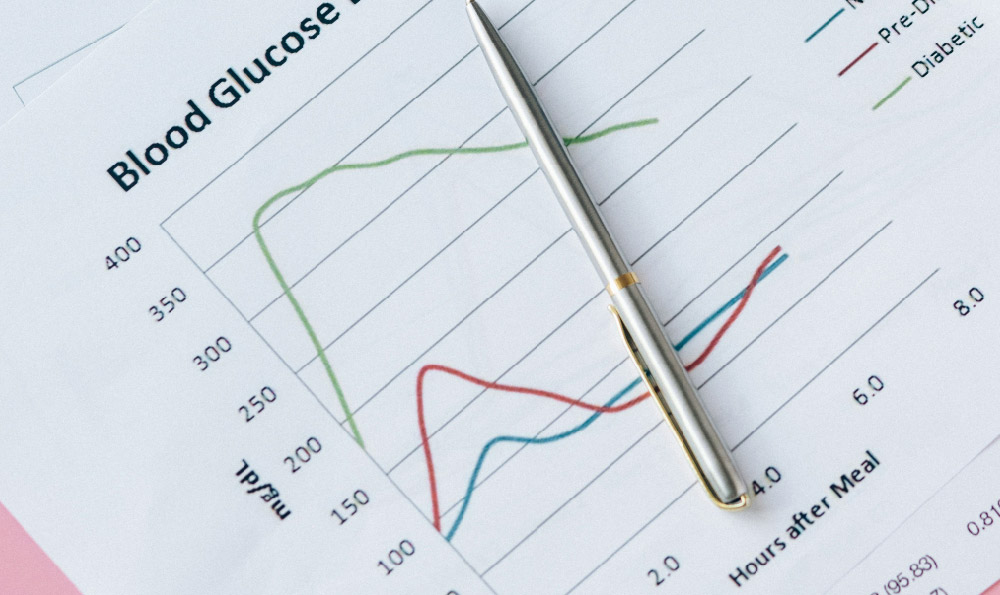

Technical and fundamental analysis serve as two complementary methods for evaluating stocks. Technical analysis examines price trends and trading volume to identify potential entry and exit points, while fundamental analysis delves into a company’s financial health, management quality, and market position. Many successful investors combine these approaches, using fundamental analysis to select stocks with strong long-term prospects and technical analysis to time their trades. For instance, an investor might use fundamental analysis to identify a company with sustainable growth and then apply technical indicators, such as moving averages or relative strength, to determine the optimal moment to purchase shares.

Emotional discipline is another essential component of effective stock market participation. The market’s volatility can trigger emotional responses, such as panic selling during downturns or overconfidence during bullish phases. These behaviors often undermine long-term gains, as selling at a loss or buying at a high can erode profitability. Maintaining a long-term perspective and avoiding impulsive decisions is crucial. For example, an investor who holds onto stocks during economic recessions may benefit from their rebound in subsequent years, whereas those who react with fear may miss out on significant opportunities.

The compounding effect further enhances the potential for profitability in stock investments. By reinvesting earnings, investors allow their capital to grow exponentially over time. Consider an investor who invests $10,000 in a stock yielding a 5% annual return. After 20 years, assuming consistent reinvestment, the total value would surpass $26,500. This demonstrates how even modest returns can accumulate into substantial gains when compounded over the long term. Additionally, leveraging low-cost index funds and ETFs can provide broader exposure without the need for individual stock selection, making it an accessible option for many.

While the stock market offers opportunities for wealth creation, it is not a guaranteed path. The returns depend on factors such as market timing, risk tolerance, and investment approach. Those who prioritize long-term growth, diversify their portfolios, and maintain emotional discipline are more likely to achieve consistent results. Furthermore, understanding the mechanisms behind market fluctuations and aligning investments with personal goals can help individuals navigate this complex environment. In essence, yes, you can make money investing in stocks, but the process requires careful planning, continuous learning, and a commitment to long-term strategy.