How to make great money? What are the most effective strategies for earning?

Here's an article tailored to your requirements:

Unlocking Financial Freedom: Effective Strategies for Earning More

In the pursuit of financial security and the freedom to pursue passions, the question, "How to make great money?" resonates with many. While there's no magic formula, a combination of strategic planning, disciplined execution, and adaptability is key to significantly increasing your earnings. This guide explores some of the most effective strategies for boosting your income, delving into both conventional and less conventional approaches.

Diversifying Your Income Streams: The Foundation of Financial Stability

Relying solely on one source of income can leave you vulnerable to economic downturns, job loss, or industry shifts. Diversification is the cornerstone of a robust financial strategy. Think of it as building a financial safety net woven from multiple strands.

- The Power of Side Hustles: Consider pursuing a side hustle aligned with your skills and interests. This could involve freelancing (writing, graphic design, web development), online tutoring, offering consulting services, or creating and selling online courses. The digital age has democratized opportunities, making it easier than ever to monetize your talents.

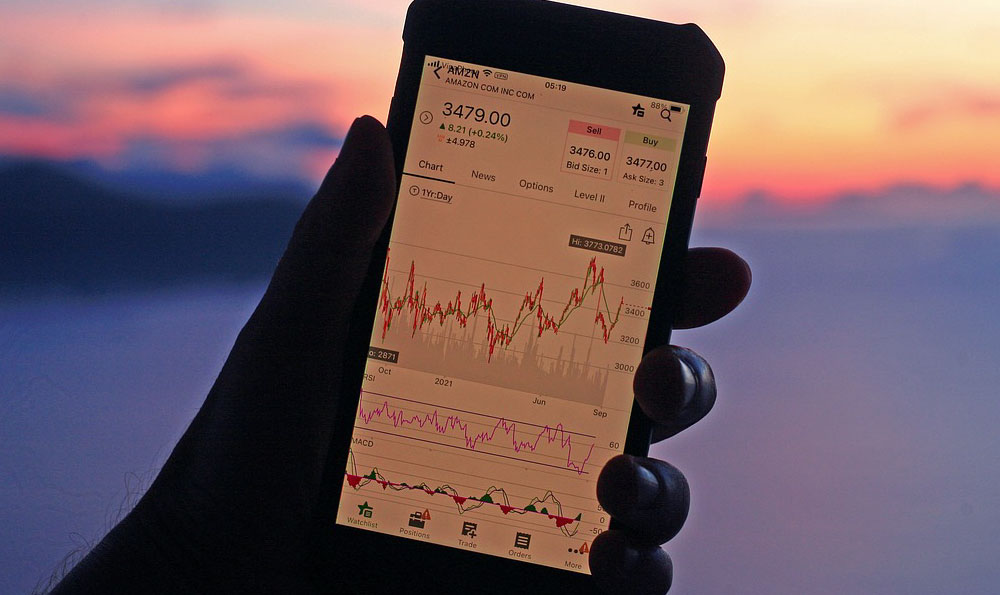

- Investing in Assets That Generate Passive Income: Passive income, as the name suggests, requires minimal ongoing effort. Real estate investing (rental properties), dividend-paying stocks, peer-to-peer lending, and creating digital products (e-books, software) are all examples of assets that can generate passive income streams.

- Exploring Royalty-Based Income: If you have creative talents, consider pursuing royalty-based income opportunities. This could involve writing a book, composing music, licensing photographs, or inventing a product. While it may take time to build a substantial royalty stream, the potential for long-term income is significant.

Honing Your Skills and Expertise: Investing in Yourself

In today's competitive job market, continuous learning is essential for career advancement and higher earning potential. Investing in yourself is arguably the most valuable investment you can make.

- Acquiring In-Demand Skills: Identify skills that are highly sought after in your industry or in emerging fields. This could involve learning a new programming language, mastering data analytics, becoming proficient in digital marketing, or obtaining certifications in project management.

- Pursuing Advanced Education: Consider pursuing a higher degree or professional certification to enhance your expertise and increase your earning potential. While this may involve a significant upfront investment, the long-term return on investment can be substantial.

- Networking and Building Relationships: Attend industry events, join professional organizations, and connect with individuals in your field. Networking can open doors to new opportunities, collaborations, and valuable insights.

Leveraging the Power of the Internet: Online Business Opportunities

The internet has revolutionized the way we work and earn money. It has created a plethora of opportunities for individuals to start their own businesses and generate income online.

- E-commerce Ventures: Consider starting an e-commerce store to sell products online. You can either create your own products or dropship products from suppliers. Platforms like Shopify and Etsy make it easy to set up and manage an online store.

- Affiliate Marketing: Promote other people's products or services and earn a commission for each sale. This can be a lucrative way to generate income, especially if you have a large online following or a niche website.

- Content Creation and Monetization: Create engaging content (blog posts, videos, podcasts) and monetize it through advertising, sponsorships, or selling merchandise. Building a loyal audience is key to success in this area.

Strategic Financial Planning: Maximizing Your Earnings

Earning more money is only half the battle. Effective financial planning is crucial for maximizing your wealth and achieving your financial goals.

- Budgeting and Expense Tracking: Create a budget to track your income and expenses. This will help you identify areas where you can cut back and save more money.

- Debt Management: Develop a plan to pay off high-interest debt, such as credit card debt. Reducing your debt burden will free up more cash flow for investing and other financial goals.

- Investing for the Future: Invest your money wisely in a diversified portfolio of stocks, bonds, and other assets. Consider consulting with a financial advisor to develop an investment strategy that aligns with your risk tolerance and financial goals.

Thinking Outside the Box: Unconventional Strategies

Beyond the traditional avenues, several less conventional strategies can contribute to significant earnings.

- Intellectual Property Exploitation: If you possess unique knowledge, consider packaging it into a course, book, or consulting service. The demand for specialized expertise is high, and the internet allows you to reach a global audience.

- Problem Solving for Businesses: Identify problems faced by businesses in your area or industry and develop solutions. This could involve streamlining processes, improving customer service, or creating innovative products.

- Niche Market Domination: Instead of trying to compete in a crowded market, focus on a niche market with unmet needs. By becoming a specialist in a specific area, you can command higher prices and attract a loyal customer base.

Cultivating a Growth Mindset: The Key to Long-Term Success

Ultimately, making great money requires a growth mindset – a belief that your abilities and intelligence can be developed through dedication and hard work. Embrace challenges, learn from failures, and continuously seek opportunities for growth.

- Embracing Calculated Risks: Stepping outside your comfort zone and taking calculated risks is often necessary to achieve significant financial gains. However, it's important to carefully assess the potential risks and rewards before making any major decisions.

- Persistence and Resilience: The path to financial success is rarely smooth. Be prepared for setbacks and challenges along the way. Persistence and resilience are essential qualities for overcoming obstacles and achieving your goals.

- Continuous Learning and Adaptation: The world is constantly changing, so it's important to stay informed and adapt to new trends and technologies. Embrace lifelong learning and be willing to adapt your strategies as needed.

Earning more money is a journey, not a destination. By implementing these strategies and cultivating a growth mindset, you can unlock your financial potential and achieve your dreams. Remember to prioritize financial literacy, seek professional advice when needed, and stay committed to your financial goals. The path to financial freedom is within your reach.