How to Make Money with Artificial Intelligence

Artificial intelligence has rapidly transformed the financial landscape, offering innovative avenues for generating wealth in ways that were once the realm of science fiction. As the technology matures, investors and entrepreneurs are increasingly leveraging AI to optimize strategies, identify opportunities, and navigate complex markets. The integration of machine learning, neural networks, and data analytics into financial systems has not only improved efficiency but also opened doors to new income streams. Understanding how to harness these tools effectively requires a nuanced approach that combines technical knowledge with strategic thinking.

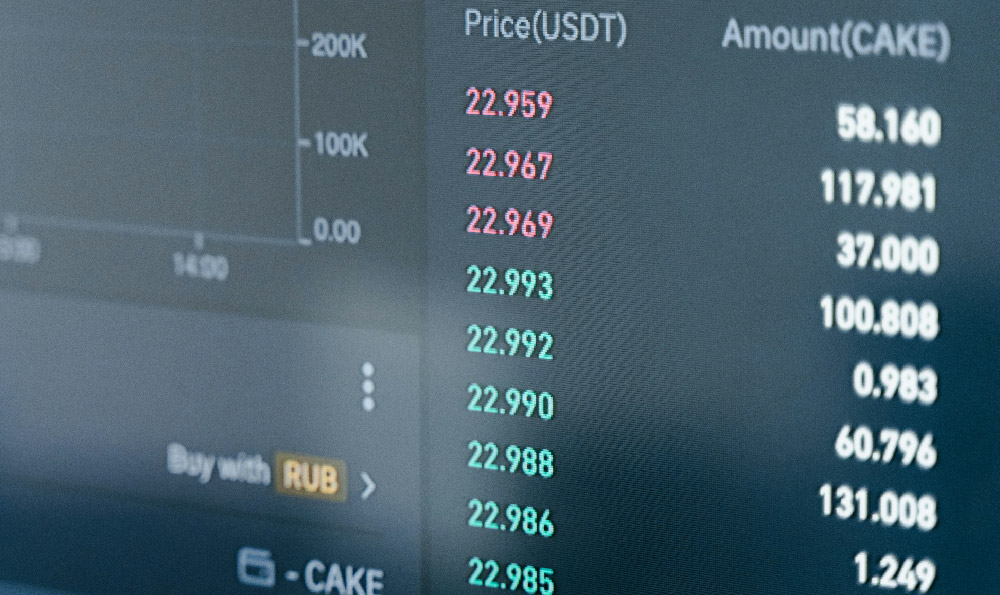

One of the most prominent applications of AI in finance is algorithmic trading, which uses predictive models to analyze vast amounts of market data and execute trades at optimal times. By processing historical trends, news sentiment, and real-time indicators, AI-driven platforms can detect patterns that human traders might miss. This capability allows for more accurate forecasting of price movements and enables investors to capitalize on opportunities with minimal latency. For example, hedge funds and institutional investors have adopted AI to automate trading decisions, reducing emotional biases and improving returns. The ability of AI to handle complex calculations swiftly also makes it a powerful tool for arbitrage opportunities, where it can identify discrepancies across different markets and execute trades to profit from them.

Beyond trading, AI has revolutionized the way individuals and businesses approach financial planning and investment management. Automated investment platforms, often referred to as Robo-Advisors, use AI algorithms to provide personalized portfolio recommendations based on user goals, risk tolerance, and market conditions. These platforms eliminate the need for manual oversight, making it easier for retail investors to access sophisticated strategies. By continuously learning from market behavior and user preferences, AI can adapt and refine investment approaches over time, ensuring that portfolios remain aligned with evolving financial objectives. This adaptability is particularly valuable in volatile markets, where traditional methods may struggle to keep pace.

Another key area where AI drives profitability is in risk management. Financial institutions and investors are using AI to assess creditworthiness, predict market downturns, and mitigate exposure to potential losses. By analyzing large datasets, AI can identify subtle risk factors that might be overlooked by traditional models. For instance, banks are employing AI to evaluate loan applications more efficiently, reducing default rates and improving underwriting accuracy. Similarly, investors can leverage AI-powered tools to monitor their portfolios in real-time, adjusting positions based on market changes and emerging trends. This proactive approach to risk assessment ensures that financial decisions are made with greater foresight, enhancing overall stability and returns.

AI’s ability to process and analyze unstructured data has also given rise to new opportunities in financial services. Natural language processing (NLP) models can parse through news articles, social media, and earnings reports to gauge market sentiment and predict stock price movements. This insight allows investors to make more informed decisions, potentially outperforming traditional analysis methods. Additionally, AI-powered chatbots and virtual assistants are being used to provide personalized financial advice, streamline customer interactions, and reduce operational costs. These tools enhance user experience while also increasing the scalability of financial services, making it possible for businesses to offer tailored solutions at a lower cost.

The integration of AI into financial systems is not limited to trading and risk management. It also extends to the development of innovative products and services that cater to niche markets. For example, AI-driven robo-advisors are gaining popularity among younger investors who prioritize convenience and low fees. These platforms use algorithms to create and manage investment portfolios, adjusting strategies based on market conditions and user behavior. The rise of AI in this space reflects a growing demand for accessible and efficient financial solutions, particularly in an era where digital transformation is reshaping the industry.

Moreover, AI has enabled the creation of data-centric investment strategies that rely on predictive analytics and pattern recognition. By analyzing millions of data points, AI can uncover correlations that are not immediately apparent, helping investors make decisions based on empirical evidence rather than intuition. This approach has been particularly effective in asset allocation, where AI can optimize the mix of stocks, bonds, and other investments to maximize returns while minimizing risk. The use of AI in this context also allows for continuous refinement of strategies, ensuring that they evolve alongside market dynamics.

The potential of AI to generate wealth also lies in its ability to disrupt traditional financial models and create new business opportunities. For instance, cryptocurrency exchanges are using AI to enhance transaction security, detect fraudulent activities, and improve user experience. Similarly, fintech startups are developing AI-powered tools to streamline financial processes, such as fraud detection, loan approval, and customer onboarding. These innovations not only improve operational efficiency but also create additional revenue streams for businesses that adopt them.

As AI continues to advance, its impact on financial markets is expected to grow exponentially. The technology has already demonstrated its ability to outperform traditional methods in many areas, and its potential for further disruption is immense. However, the success of AI-driven strategies depends on a clear understanding of the underlying principles, as well as the ability to integrate the technology into a well-defined business model. For investors and entrepreneurs, the key to harnessing AI lies in combining technical expertise with strategic foresight, ensuring that they can adapt and thrive in an increasingly digital world.

In conclusion, the intersection of artificial intelligence and financial markets offers a wealth of opportunities for individuals and organizations alike. Whether through algorithmic trading, automated investment platforms, risk management, or data analytics, AI provides tools that can enhance decision-making and improve returns. As the technology continues to evolve, its role in the financial sector will only become more prominent, making it an essential component of modern investment strategies. By embracing AI and understanding its capabilities, investors can position themselves to capitalize on the future of finance.