Money Blooms: How-To Guide or Financial Folly?

The allure of "money blooms" – the promise of effortless wealth generation – is a siren song that has lured many into the treacherous waters of financial speculation. While the concept of passive income and wealth accumulation is undoubtedly appealing, approaching it with naiveté and without a solid understanding of underlying principles can lead to significant financial losses and a disillusionment with the entire investment process. Therefore, before diving headfirst into any "money blooms" strategy, a rigorous self-assessment and a comprehensive understanding of risk, diversification, and market dynamics are paramount.

At its core, the idea of money blooming suggests that money can grow independently, requiring minimal effort from the investor. This concept often hinges on investments that are perceived as generating high returns with low risk. However, it's crucial to recognize that the higher the potential return, the higher the inherent risk. There are no guaranteed shortcuts to wealth, and any investment opportunity promising otherwise should be approached with extreme skepticism. True financial growth requires a strategic approach, diligent research, and a willingness to adapt to changing market conditions.

One of the cornerstones of any successful investment strategy is diversification. Putting all your eggs in one basket, hoping for that single investment to skyrocket, is a recipe for potential disaster. Diversification involves spreading your investments across a variety of asset classes, such as stocks, bonds, real estate, and commodities. This reduces the impact of any single investment performing poorly and helps to mitigate overall risk. The specific allocation of assets will depend on your individual risk tolerance, time horizon, and financial goals. A young investor with a long time horizon might be able to tolerate a higher allocation to stocks, while an older investor approaching retirement might prefer a more conservative portfolio with a higher allocation to bonds.

Understanding your own risk tolerance is a critical step in developing a sound investment strategy. Are you comfortable with the possibility of losing a significant portion of your investment in exchange for the potential of higher returns? Or do you prefer a more conservative approach that prioritizes capital preservation over aggressive growth? Answering these questions honestly will help you determine the appropriate level of risk for your portfolio and guide your investment decisions. There are various risk tolerance questionnaires available online that can help you assess your comfort level with different investment scenarios.

Beyond diversification and risk assessment, a fundamental understanding of market dynamics is essential. This includes staying informed about economic trends, interest rate changes, and geopolitical events that can impact investment markets. Reading reputable financial news sources, consulting with a financial advisor, and conducting thorough research on individual companies and industries can provide valuable insights and help you make more informed investment decisions. Remember, investing is not a get-rich-quick scheme; it's a long-term process that requires patience, discipline, and a commitment to continuous learning.

Another important aspect to consider is the fees associated with different investment products. High fees can significantly erode your returns over time, so it's crucial to understand the fee structure before investing in any product. For example, actively managed mutual funds typically have higher fees than passively managed index funds. While active management may offer the potential for higher returns, it's not always guaranteed, and the higher fees can offset any potential gains. Consider low-cost investment options such as exchange-traded funds (ETFs) or robo-advisors, which can provide diversified exposure to the market at a lower cost.

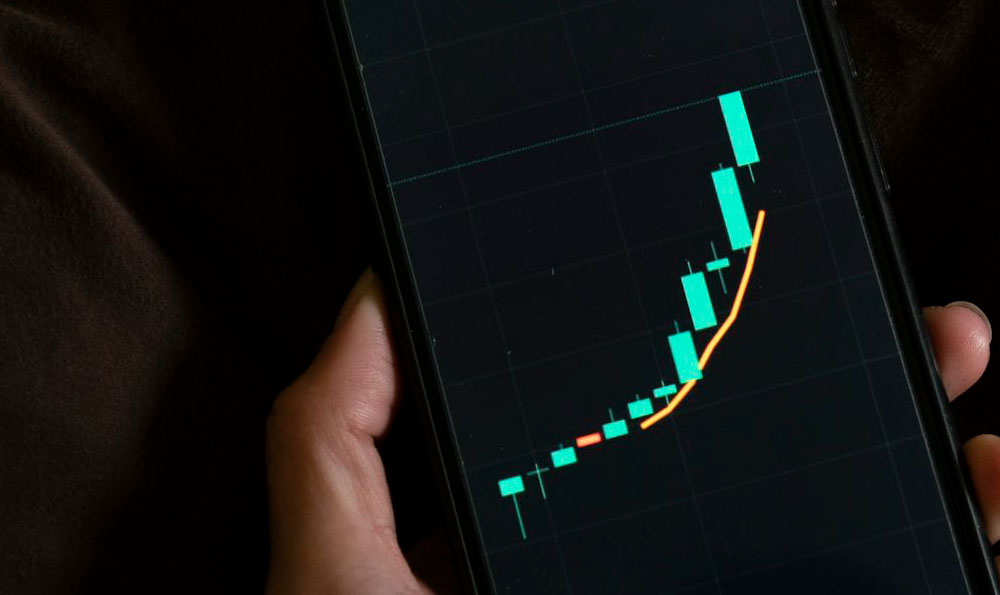

Furthermore, avoid falling prey to emotional investing. Fear and greed can drive irrational decisions that lead to significant losses. During market downturns, it's tempting to sell your investments out of fear, locking in losses. Conversely, during market booms, it's easy to get caught up in the hype and invest in overvalued assets. A well-defined investment strategy and a long-term perspective can help you stay disciplined and avoid making impulsive decisions based on emotions.

Finally, remember that seeking professional advice can be invaluable. A qualified financial advisor can help you develop a personalized financial plan, assess your risk tolerance, recommend appropriate investments, and provide ongoing support. While there are costs associated with professional advice, the benefits of having a knowledgeable and objective partner can outweigh the costs. Choose an advisor who is fee-based and acts as a fiduciary, meaning they are legally obligated to act in your best interests.

In conclusion, the promise of "money blooms" should be approached with caution and a healthy dose of skepticism. True financial growth requires a strategic approach, diligent research, a commitment to diversification, and a thorough understanding of risk. By avoiding shortcuts, staying informed, and seeking professional advice when needed, you can cultivate a financial garden that yields sustainable and long-term growth, transforming the initial allure into a genuine path towards financial well-being, instead of a financial folly.