Turning Pages into Paychecks: Is Reading Books a Viable Way to Make Money, and How?

In the realm of cryptocurrency investment, transforming knowledge into profit is not merely a catchy phrase; it's a fundamental principle. Reading books, particularly those focused on blockchain technology, market analysis, and financial strategies, can indeed be a viable path to generating income in this volatile yet potentially lucrative landscape. However, success hinges on more than just passively absorbing information. It requires a strategic approach, critical thinking, and a dedication to continuous learning.

The inherent volatility of the cryptocurrency market necessitates a deep understanding of its underlying mechanisms. Books providing a solid foundation in blockchain technology are invaluable. Titles that delve into the intricacies of cryptography, distributed ledger systems, and smart contracts provide the necessary intellectual framework to analyze the technical merits of different cryptocurrencies. This understanding allows for a more informed assessment of a project's potential and its long-term viability, moving beyond mere speculation driven by hype. Instead of relying solely on social media trends or influencer endorsements, the informed investor can discern the projects with genuine technological innovation and a solid roadmap for future development.

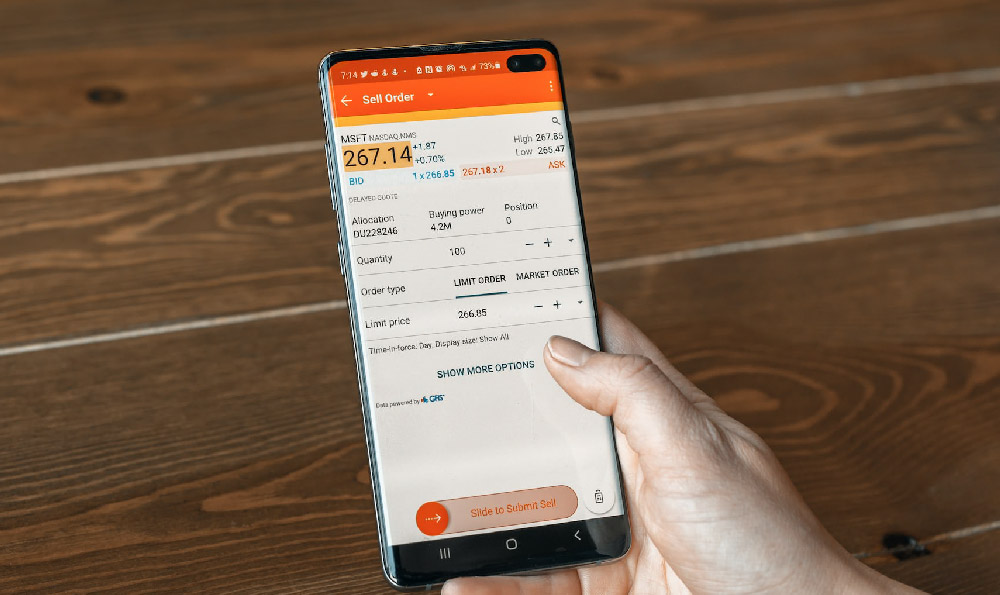

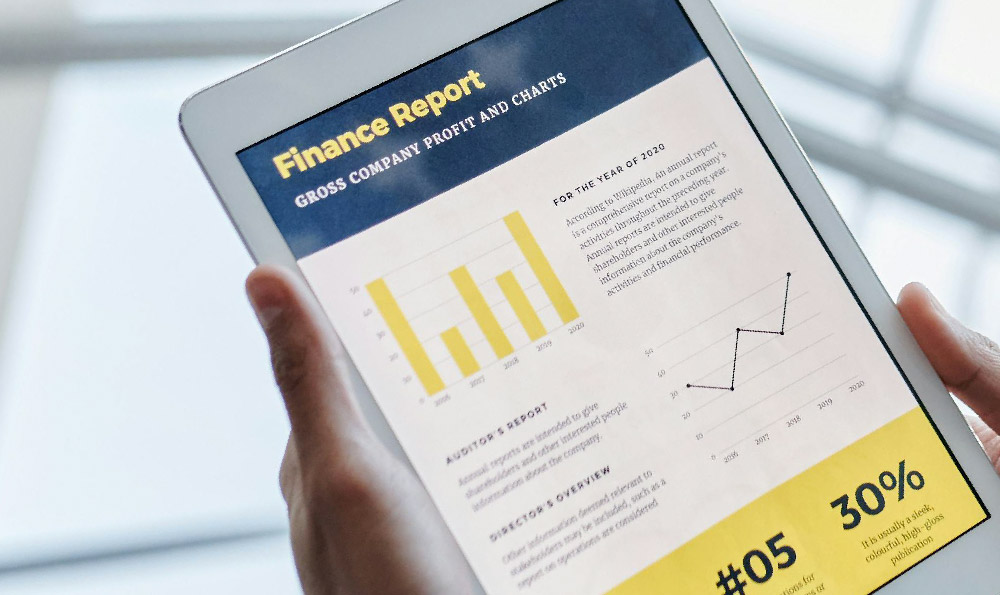

Beyond the technical aspects, a strong grasp of market dynamics is crucial. Books on fundamental analysis and technical analysis are essential tools in this regard. Fundamental analysis involves scrutinizing the underlying factors that influence a cryptocurrency's price, such as its adoption rate, network activity, and the strength of its development team. Technical analysis, on the other hand, focuses on identifying patterns and trends in price charts to predict future movements. Mastering both these approaches allows investors to make more informed decisions about when to buy, sell, or hold a particular cryptocurrency. It's important to acknowledge that past performance is not indicative of future results, but understanding historical price movements and market cycles can provide valuable context and help manage risk.

Moreover, delving into books that offer insights into risk management and portfolio diversification is paramount. The cryptocurrency market is notoriously unpredictable, and even the most well-researched investment can suffer significant losses. Therefore, it is crucial to understand how to mitigate risk through strategies such as diversifying investments across multiple cryptocurrencies, setting stop-loss orders, and allocating only a portion of one's overall portfolio to cryptocurrency investments. Books that explore different investment strategies, such as dollar-cost averaging and swing trading, can also provide valuable tools for navigating market volatility and maximizing returns.

Furthermore, the cryptocurrency landscape is constantly evolving, with new technologies and regulatory developments emerging at a rapid pace. Therefore, continuous learning is essential for staying ahead of the curve. Reading books should not be a one-time activity but rather an ongoing process of self-education. Subscribing to industry newsletters, following reputable analysts on social media, and participating in online forums can also help investors stay informed about the latest developments and trends. However, it is crucial to be discerning about the information one consumes, as the cryptocurrency space is rife with scams and misinformation. Always verify information from multiple sources and be wary of promises of guaranteed returns.

The active application of knowledge gleaned from books is also critical. Theoretical understanding must be translated into practical strategies. This involves actively engaging in the market, making small investments, and tracking the results. Learning from mistakes is an integral part of the process, and it is important to analyze both successes and failures to refine one's investment approach. Paper trading, where one simulates trading without risking real money, can also be a valuable tool for practicing strategies and developing confidence before committing significant capital.

However, simply reading books does not guarantee success. It's essential to cultivate a critical and skeptical mindset. The cryptocurrency space is full of hype and misleading information, and it's easy to get caught up in the excitement. Therefore, it's crucial to always do your own research and not blindly follow the advice of others. Approach every investment opportunity with a healthy dose of skepticism and be prepared to walk away if it doesn't meet your risk tolerance or investment criteria.

Crucially, one must be aware of the common pitfalls that plague cryptocurrency investors. These include falling prey to pump-and-dump schemes, investing in fraudulent ICOs (Initial Coin Offerings), and neglecting security measures. Books dedicated to security best practices, such as using strong passwords, enabling two-factor authentication, and storing cryptocurrencies in cold storage wallets, are essential for protecting one's assets. Never share private keys or seed phrases with anyone, and be wary of phishing scams that attempt to steal your login credentials.

Finally, patience and discipline are essential virtues for successful cryptocurrency investing. The market can be highly volatile, and it's easy to get caught up in the fear and greed that often drive price movements. It's important to stick to your investment strategy, avoid impulsive decisions, and be prepared to weather periods of market downturn. Remember that cryptocurrency investing is a long-term game, and it's crucial to have a clear understanding of your investment goals and risk tolerance.

In conclusion, reading books can be a valuable tool for generating income in the cryptocurrency market. However, it's not a passive activity but rather an active process of learning, analyzing, and applying knowledge. By combining a solid understanding of blockchain technology, market dynamics, and risk management with a critical mindset and a commitment to continuous learning, investors can significantly increase their chances of success in this exciting and rapidly evolving landscape. Remember to always prioritize security, be wary of scams, and invest only what you can afford to lose. The path from pages to paychecks is paved with knowledge, diligence, and a healthy dose of caution.