Can you earn money on social security? How much can you make then?

Earning Money While Receiving Social Security: Navigating the Landscape

Social Security, a cornerstone of retirement income for millions, often sparks the question: Can I supplement my benefits with earnings without impacting them? The answer, while nuanced, is generally yes. Understanding the rules and potential limitations is crucial for maximizing your income during retirement or while receiving disability benefits.

Understanding Social Security's Earning Rules

The Social Security Administration (SSA) allows beneficiaries to work and earn income while receiving benefits. However, for those receiving benefits before their full retirement age (FRA), there are earnings limits. Exceeding these limits can temporarily reduce your Social Security payments.

The specifics of these earnings limits are crucial. For 2024, the earnings limit for those under FRA for the entire year is \$22,320. If your earnings exceed this amount, SSA will deduct \$1 from your benefits for every \$2 you earn above the limit.

For those reaching FRA in 2024, a different, more generous rule applies. For the months leading up to the month you reach FRA, the earnings limit is \$59,520, and SSA deducts \$1 from your benefits for every \$3 you earn above this limit. Once you reach FRA, there is no earnings limit. You can earn as much as you want without affecting your Social Security benefits.

It’s important to remember that these are annual limits. SSA will review your total earnings for the year to determine any necessary adjustments to your benefits.

How Earnings Affect Social Security Benefits

When your benefits are reduced due to exceeding the earnings limit, it's not necessarily a permanent loss. The amounts withheld are used to recalculate your benefits at your full retirement age. This recalculation essentially increases your future monthly payments to account for the months you didn't receive full benefits due to working. This adjustment ensures you eventually receive the full value of your benefits, albeit spread out over a longer period.

Therefore, consider these reductions as a temporary deferral rather than a permanent reduction of your lifetime benefits.

Full Retirement Age: The Turning Point

Reaching your Full Retirement Age (FRA) marks a significant turning point. At FRA, the earnings limits disappear entirely. You can work and earn any amount of income without affecting your Social Security benefits. This provides significant flexibility for those who wish to continue working or pursue other income-generating activities in retirement.

Your FRA depends on your year of birth. It's 66 for those born between 1943 and 1954, gradually increasing to 67 for those born in 1960 or later. Knowing your FRA is critical for planning your retirement income strategy.

Types of Income That Affect Social Security

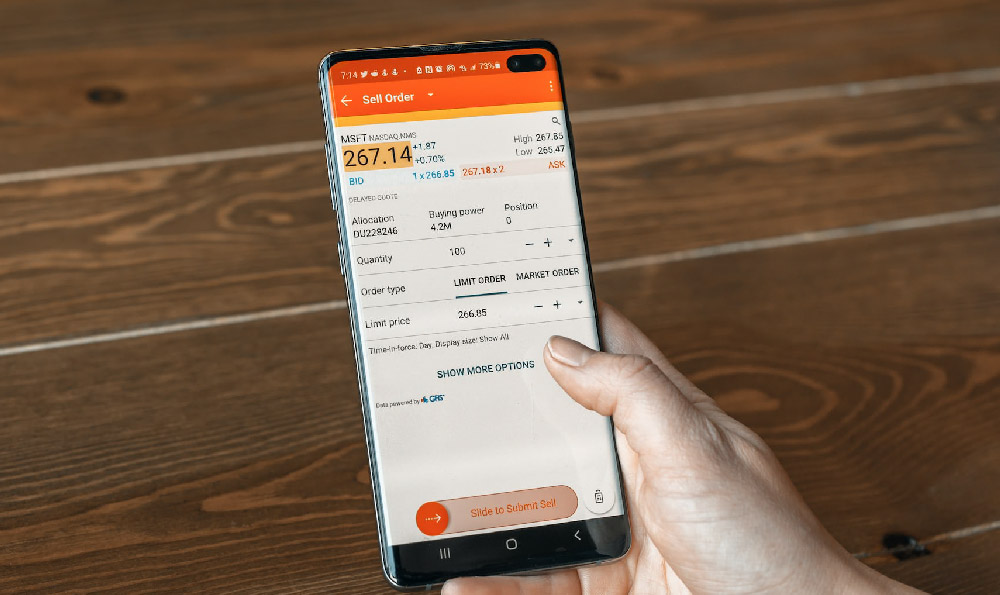

The earnings rules primarily apply to income from work – wages or self-employment income. This includes salary, commissions, bonuses, and net earnings from self-employment.

Other types of income, such as investment income (dividends, interest, capital gains), pensions, annuities, and rental income, generally do not affect your Social Security benefits, regardless of your age. Therefore, retirees can supplement their Social Security income with these sources without triggering any reductions.

Strategies for Maximizing Income

Several strategies can help you maximize your income while receiving Social Security benefits:

-

Strategic Timing of Retirement: Carefully consider your FRA when deciding when to claim Social Security. Delaying benefits until FRA or even later (up to age 70) can significantly increase your monthly payments. However, this might not be feasible for everyone, especially those with immediate financial needs.

-

Managing Earnings Below the Limit: If you are receiving benefits before FRA, carefully manage your earnings to stay below the annual limit. This might involve reducing your work hours or negotiating a different compensation structure with your employer.

-

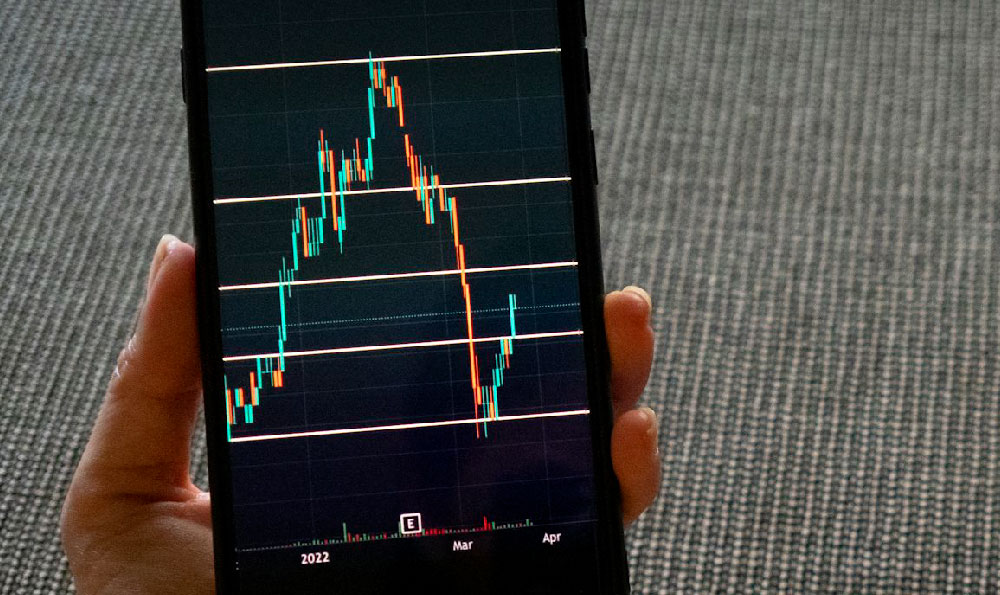

Focusing on Passive Income: Explore opportunities to generate passive income that won't affect your Social Security benefits. This could include investing in dividend-paying stocks, rental properties, or other income-generating assets.

-

Consulting with a Financial Advisor: A qualified financial advisor can help you develop a personalized retirement income strategy that takes into account your individual circumstances and goals. They can help you navigate the complexities of Social Security and make informed decisions about when to claim benefits and how to manage your income.

Disability Benefits and Working

The rules for working while receiving Social Security Disability Insurance (SSDI) benefits are different from those for retirement benefits. While SSDI recipients can work, there are stricter guidelines and income limitations.

The SSA offers programs like the Ticket to Work program and work incentives to help SSDI recipients return to work gradually without immediately losing their benefits. These programs provide support and resources to help individuals with disabilities achieve their employment goals. It is crucial to consult with SSA and explore these programs before engaging in substantial gainful activity (SGA). In 2024, SGA is defined as earning \$1,550 per month (or \$2,590 for those who are blind). Earning above this amount is generally considered evidence that you are no longer disabled and may lead to the termination of your benefits.

The Future of Social Security Earnings Rules

The Social Security system is constantly evolving, and the earnings rules may change in the future. It's essential to stay informed about any legislative updates or changes to SSA policies that could affect your benefits. Regularly check the SSA website or consult with a financial advisor to stay up-to-date.

Conclusion: Earning While Receiving Social Security

Navigating the complexities of Social Security earnings rules requires careful planning and understanding. While earning income while receiving benefits before FRA can temporarily reduce your payments, the long-term impact is often minimal due to benefit recalculations. Reaching FRA eliminates the earnings limits entirely, providing greater flexibility. By understanding the rules, exploring strategies for maximizing income, and seeking professional advice, you can effectively manage your Social Security benefits and achieve your financial goals. Furthermore, individuals on SSDI must carefully consider their work activity and income to avoid jeopardizing their benefits and explore available work incentive programs.

Remember that Social Security is a complex system. Consult the Social Security Administration directly for the most accurate and personalized information regarding your specific situation.