How To Start Real Estate Investing? Where to Begin Investing in Real Estate?

Here's a comprehensive guide on how to start real estate investing, covering various aspects and adhering to SEO best practices.

Real estate investing, a tangible asset class, has long been considered a cornerstone of wealth creation. Unlike stocks or bonds, real estate offers the potential for both income generation and long-term appreciation. However, diving into the world of real estate can feel daunting, especially for beginners. This guide provides a roadmap for aspiring investors, answering the crucial question: "Where do I begin investing in real estate?"

Understanding the Fundamentals: Laying the Groundwork for Success

Before venturing into any investment, a solid understanding of the fundamentals is essential. This involves self-assessment, financial preparation, and market research.

1. Self-Assessment: Defining Your Investment Goals and Risk Tolerance

The first step is to define your personal investment goals. Are you seeking passive income, long-term capital appreciation, or a combination of both? What is your desired timeline for seeing returns? Your goals will influence the type of real estate investments you pursue.

Equally important is understanding your risk tolerance. Real estate investing carries inherent risks, including market fluctuations, vacancy periods, and property maintenance costs. Are you comfortable with these risks, or do you prefer a more conservative approach? A lower risk tolerance might lead you towards safer investments like REITs (Real Estate Investment Trusts), while a higher tolerance could open doors to more lucrative but riskier opportunities like fix-and-flips.

2. Financial Preparation: Assessing Your Resources and Securing Financing

Real estate investing requires capital. Assess your current financial situation, including your savings, income, and debt. Determine how much you can realistically allocate to real estate investments without jeopardizing your financial stability.

Consider your financing options. Will you be using cash, securing a mortgage, or exploring alternative financing methods like private lenders or hard money loans? Getting pre-approved for a mortgage can give you a competitive edge when making offers and provides a clear understanding of your borrowing power. Understand the different types of mortgages available, including fixed-rate, adjustable-rate, and interest-only loans, and choose the option that best suits your financial circumstances.

3. Market Research: Identifying Promising Investment Locations

Thorough market research is paramount to successful real estate investing. Identify areas with strong economic growth, job creation, and population increases. Look for neighborhoods with low vacancy rates, rising rents, and a diverse range of amenities.

Analyze local market trends, including median home prices, average rents, and property taxes. Utilize online resources like Zillow, Redfin, and Realtor.com to gather data and compare properties. Networking with local real estate agents and attending industry events can provide valuable insights and access to off-market deals.

Exploring Different Real Estate Investment Strategies

Once you've established a solid foundation, it's time to explore different real estate investment strategies and choose the one that aligns with your goals and resources.

1. Rental Properties: Generating Passive Income

Investing in rental properties is a popular strategy for generating passive income. You purchase a property and rent it out to tenants, collecting monthly rent that covers your mortgage payments, property taxes, insurance, and maintenance costs.

Consider the type of rental property that best suits your needs. Single-family homes, apartments, and multi-family units each have their own advantages and disadvantages. Research local rental rates and vacancy rates to determine the potential profitability of rental properties in your target market.

2. Fix-and-Flips: Capitalizing on Quick Profits

Fix-and-flips involve purchasing undervalued properties, renovating them, and selling them for a profit. This strategy requires strong project management skills, construction knowledge, and access to reliable contractors.

Thoroughly assess the potential renovation costs before purchasing a property. Factor in unexpected expenses and delays. Develop a realistic budget and timeline for the renovation project.

3. Real Estate Investment Trusts (REITs): Investing in Real Estate Without Direct Ownership

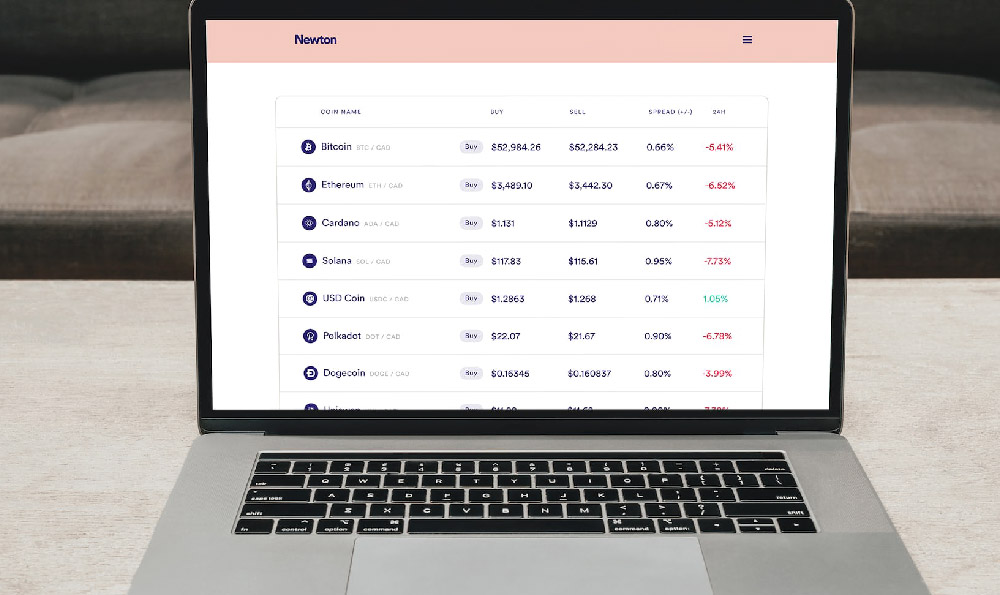

REITs are companies that own and operate income-producing real estate, such as office buildings, shopping malls, and apartment complexes. Investing in REITs allows you to participate in the real estate market without directly owning or managing properties.

REITs offer diversification and liquidity. They are traded on major stock exchanges, making them easy to buy and sell. Research different types of REITs and choose those that align with your investment goals.

4. Wholesaling: A Low-Capital Entry Point

Wholesaling involves finding distressed properties, securing a contract to purchase them, and then assigning that contract to another buyer for a fee. Wholesalers typically don't actually purchase the property themselves, making it a low-capital entry point to real estate investing.

This strategy relies heavily on networking and marketing to find motivated sellers and potential buyers. It requires strong negotiation skills and a deep understanding of real estate contracts.

Key Steps to Take After Choosing Your Strategy

Once you have decided on a strategy, there are a few vital steps you must make to move forward.

1. Build Your Network

No one succeeds in real estate alone. Building a strong network of professionals is crucial. This includes real estate agents, mortgage brokers, attorneys, contractors, and other investors.

2. Due Diligence

Whether you're buying a rental property or flipping a house, due diligence is non-negotiable. This involves thoroughly inspecting the property, reviewing title reports, and conducting environmental assessments.

3. Manage Your Properties Effectively

If you're investing in rental properties, property management is key to success. You can either manage the properties yourself or hire a property management company.

Continual Learning and Adaptation

The real estate market is constantly evolving. Stay informed about market trends, new regulations, and innovative investment strategies. Continuously refine your investment approach based on your experiences and the changing market conditions. Attend industry conferences, read real estate publications, and network with other investors to stay ahead of the curve.

The Journey Begins Now

Starting real estate investing can seem complex, but by following these steps, you can lay a solid foundation for success. Remember to do your research, understand your risk tolerance, and build a strong network of professionals. With dedication and perseverance, you can achieve your financial goals through real estate investing. By starting with a strong foundation and adaptable mindset, anyone can invest in real estate.